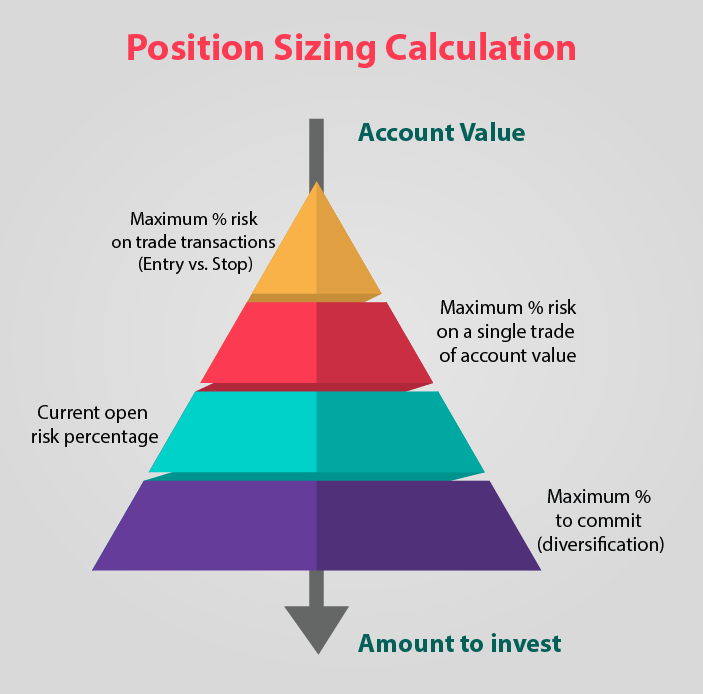

Position sizing refers to determining the appropriate amount of capital to allocate to a single trade.

It is a critical component of risk management in trading, especially when employing Inner Circle Trader (ICT) strategies.

Proper position sizing ensures that losses are controlled while allowing for sufficient exposure to profitable trades.

1. Why is Position Sizing Important in ICT?

1. Capital Preservation:

Protects your trading account from being wiped out during losing streaks.

2. Consistent Risk Management:

Maintains a steady level of risk per trade, ensuring long-term sustainability.

3. Reduced Emotional Stress:

Knowing the exact amount at risk helps traders stay disciplined and rational.

2. Key Factors in Position Sizing in ICT

1. Account Size:

The total amount of capital in your trading account.

2. Risk Per Trade:

The percentage of capital you are willing to risk on a single trade (commonly 1–2%).

3. Stop-Loss Distance:

The number of pips between the entry price and the stop-loss level.

4. Trade Setup:

The quality of the setup, based on ICT concepts like order blocks, liquidity pools, or fair value gaps.

3. How to Calculate Position Size in ICT

To calculate the position size, divide the total amount you’re willing to risk on a trade by the value of one pip movement multiplied by the number of pips you’re risking (stop-loss distance).

In simpler terms:

- Multiply your account size by the percentage of capital you’re risking.

- Divide that amount by the total risk in terms of pip value and stop-loss distance.

Example 1: Trading a Bullish Order Block

1. Scenario

You have identified a bullish order block in the EUR/USD pair at 1.1000. You plan to enter at 1.1020, with a stop-loss at 1.0980 (40 pips).

2. Details

- Account Size: $10,000

- Risk per Trade: 1% = $100

- Stop-Loss Distance: 40 pips

- Pip Value: $10 per pip for a standard lot (1 lot).

3. Position Size Calculation

- Multiply your account size by your risk percentage: $10,000 × 1% = $100.

- Divide $100 by the total pip risk: 40 pips × $10 per pip = $400.

- Your position size is 0.25 lots (2.5 mini lots).

4. Result

If the trade hits your stop-loss, you will lose exactly $100, which is 1% of your account.

Example 2: Trading a Liquidity Sweep

1. Scenario

On GBP/USD, you spot a liquidity sweep at 1.3050, indicating a potential bullish move. You enter at 1.3060 with a stop-loss at 1.3030 (30 pips).

2. Details

- Account Size: $5,000

- Risk per Trade: 2% = $100

- Stop-Loss Distance: 30 pips

- Pip Value: $10 per pip for 1 lot.

3. Position Size Calculation

- Multiply your account size by your risk percentage: $5,000 × 2% = $100.

- Divide $100 by the total pip risk: 30 pips × $10 per pip = $300.

- Your position size is 0.17 lots (1.7 mini lots).

4. Result

This means you will trade approximately 0.17 lots. If the stop-loss is hit, you will lose $100.

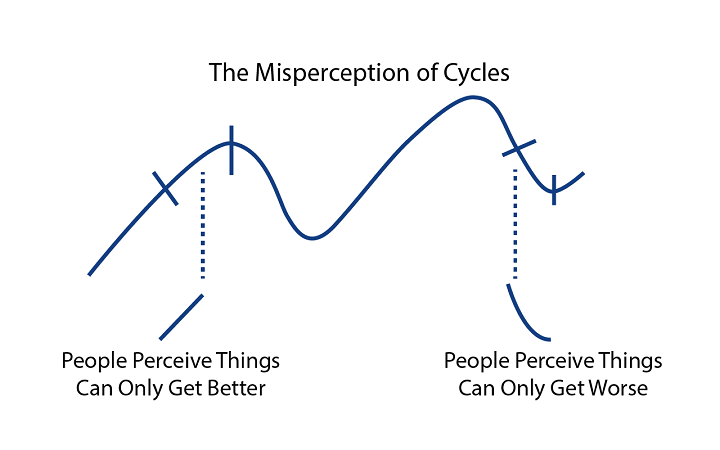

4. Adjusting Position Size for Volatility in ICT

Certain currency pairs, such as GBP/JPY, are more volatile than others, requiring smaller position sizes to manage risk effectively.

ICT traders often measure volatility using tools like the Average True Range (ATR) or by observing historical price movements.

5. Advanced Position Sizing Techniques in ICT

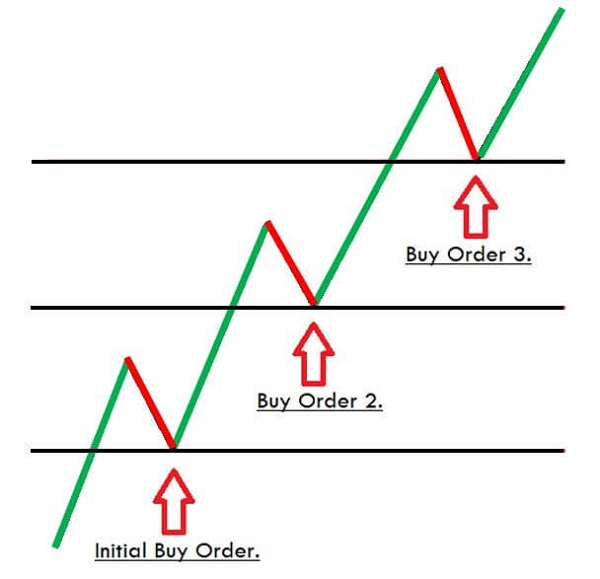

1. Scaling In and Out:

Entering or exiting positions in increments to manage risk and lock in profits.

2. Dynamic Position Sizing:

Adjusting the risk per trade based on the confidence level in a setup.

For instance, a trade aligning multiple ICT confluences (e.g., an order block and fair value gap) might warrant risking 1.5% instead of 1%.

3. Multiple Timeframe Alignment:

Use higher timeframes to identify major trends and lower timeframes for precision entries, ensuring tighter stop-losses and larger position sizes.

6. Common Mistakes in Position Sizing in ICT

1. Overleveraging:

Trading too large a position size increases the risk of significant losses.

2. Neglecting Stop-Loss Levels:

Failing to calculate the stop-loss distance accurately can lead to improper sizing.

3. Ignoring Account Growth or Shrinkage:

Position sizes should be recalibrated as the account balance changes.

7. Conclusion

Position sizing is a cornerstone of effective trading within ICT frameworks.

By understanding and applying proper calculations, traders can align their positions with their risk tolerance and trading strategies.

Coupled with ICT’s precision-based methods, disciplined position sizing ensures sustainable and profitable trading.

Leave a Reply