The Bull Flag Pattern is a continuation pattern that indicates a temporary consolidation in an uptrend before the price resumes its upward momentum.

In ICT (Inner Circle Trader) methodologies, this pattern gains further significance when aligned with concepts like liquidity, fair value gaps (FVGs), and order blocks.

1. What is a Bull Flag Pattern in ICT?

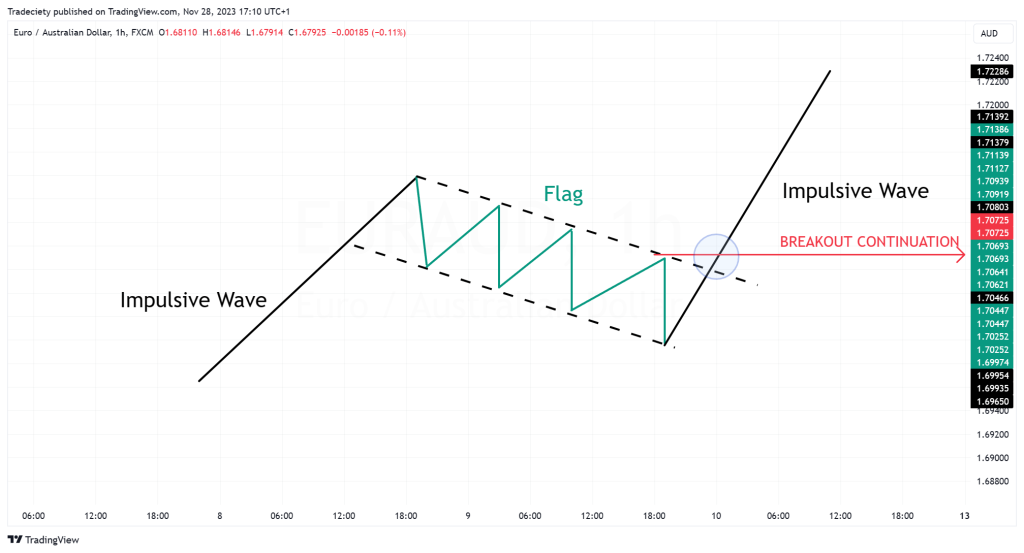

A bull flag forms during an uptrend and consists of two main components:

1. Flagpole:

The initial strong upward price movement representing bullish momentum.

2. Flag:

A consolidation phase where the price moves slightly lower or sideways in a tight range, forming a rectangle or downward-sloping channel.

Once the flag formation is complete, the price typically breaks out upward, continuing the previous trend.

2. Key Characteristics of a Bull Flag in ICT

1. Strong Upward Move:

The flagpole should represent a robust bullish rally.

2. Low Volume During Consolidation:

Indicates that the selling pressure is weak during the consolidation phase.

3. Breakout:

The price breaks out of the consolidation range, often with increased volume.

4. Continuation of Trend:

The breakout aligns with the prevailing bullish trend.

3. Bull Flag in ICT Context

In ICT trading, the bull flag can be enhanced using specific concepts:

1. Liquidity Zones:

The flag often forms near liquidity pools (e.g., buy stops above previous highs), signaling smart money’s preparation for a continuation move.

2. Fair Value Gaps (FVGs):

The breakout may occur from an area where an FVG is present, providing a high-probability entry point.

3. Order Blocks:

The flag can consolidate around a bullish order block, which serves as a foundation for the next leg up.

4. How to Trade the Bull Flag Pattern in ICT

Step 1: Identify the Pattern

- Look for a strong bullish move forming the flagpole.

- Observe a consolidation phase where the price retraces slightly but maintains higher lows.

Step 2: Use ICT Tools for Confluence

- Check if the consolidation occurs near an FVG or bullish order block.

- Identify liquidity pools near the breakout zone.

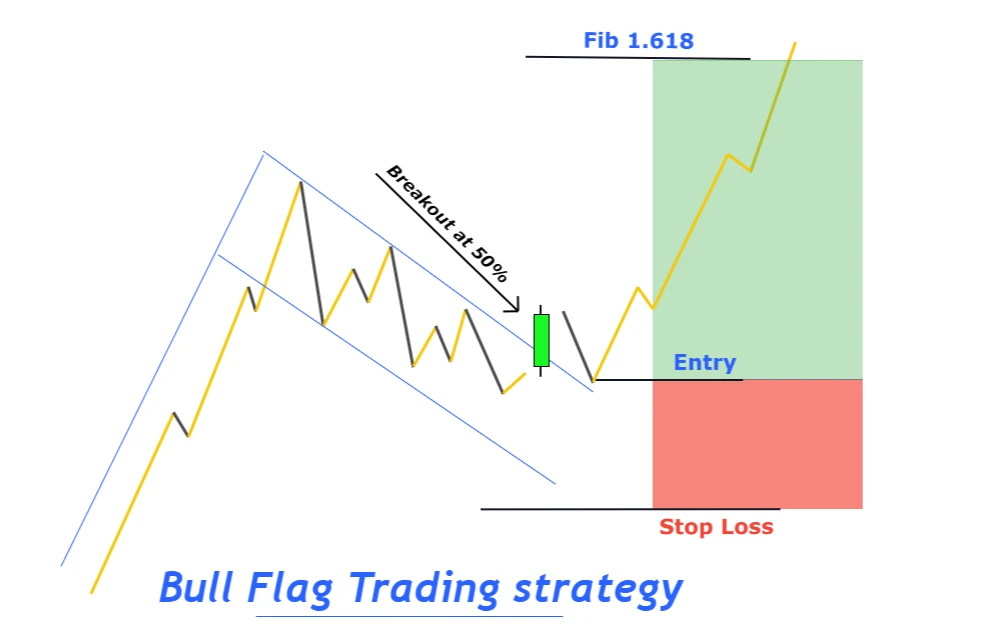

Step 3: Plan Your Entry

- Enter long when the price breaks out of the flag pattern.

- Alternatively, wait for a retracement back to the order block or FVG for a more precise entry.

Step 4: Define Stop-Loss and Target

- Place the stop-loss below the flag’s lower boundary or the order block.

- Set the profit target by projecting the flagpole’s length from the breakout point.

5. Example: Bull Flag on EUR/USD in ICT

1. Scenario

EUR/USD is in an uptrend, rallying from 1.1000 to 1.1100, forming the flagpole. The price then consolidates between 1.1080 and 1.1050, creating the flag.

2. Details

- Flagpole Length: 100 pips.

- Consolidation Range: 1.1050–1.1080.

- Breakout: Price breaks above 1.1080.

3. ICT Context

- Order Block: A bullish order block is present at 1.1040–1.1050, supporting the flag formation.

- Liquidity Pool: Buy stops are above 1.1080, where the breakout occurs.

- Fair Value Gap: An FVG is identified between 1.1065–1.1075, offering an optimal entry point.

4. Trade Setup

- Entry: Enter at 1.1085 after the breakout.

- Stop-Loss: Place at 1.1040 (below the order block).

- Take Profit: Target 1.1185 (flagpole projection from the breakout).

5. Result

The price moves to 1.1185, completing the pattern and yielding a 100-pip gain.

6. Tips for Successful Bull Flag Trading in ICT

1. Wait for Confirmation:

Ensure the breakout is supported by volume or ICT concepts like displacement.

2. Use Multiple Timeframes:

Confirm the pattern and ICT confluences on higher timeframes.

3. Combine with Killzones:

Align entries with key ICT killzones (e.g., London Open) for better timing.

4. Monitor Institutional Moves:

Look for signs of institutional accumulation before the breakout.

7. Conclusion

The bull flag pattern is a powerful continuation strategy, especially when integrated with ICT principles.

By combining this classic chart pattern with advanced ICT concepts like order blocks, liquidity pools, and fair value gaps, traders can achieve precise entries and exits with higher probabilities of success.

Leave a Reply