The ICT Silver Bullet Strategy is a time-sensitive, intraday trading setup taught by Michael J. Huddleston (The Inner Circle Trader).

It’s designed to help traders identify precise entries during specific windows of market liquidity and volatility—typically during the New York session.

It’s one of the most effective Smart Money Concepts-based strategies and is popular for its clarity, repeatability, and low-risk/high-reward nature when executed correctly.

Let’s break it down in detail with structure, timing, logic, and examples.

1. What Is the ICT Silver Bullet Strategy?

The ICT Silver Bullet is a short-term, intraday trading setup that exploits stop hunts and liquidity imbalances typically occurring between 10:00 AM and 11:00 AM New York time (ET), after the initial volatility of the NY open.

It targets reversals or continuations by aligning with higher timeframe bias and capitalizes on liquidity raids followed by a fair value gap (FVG) or displacement.

2. When Does the ICT Silver Bullet Strategy Work?

Time is critical.

- Session: New York Session

- Entry Window: 10:00 AM to 11:00 AM New York Time (ET)

- Pairs: Major Forex pairs (like EURUSD, GBPUSD), Index futures (like NAS100), or even commodities (like Gold)

- Best Days: Tuesday to Thursday (due to cleanest liquidity profiles)

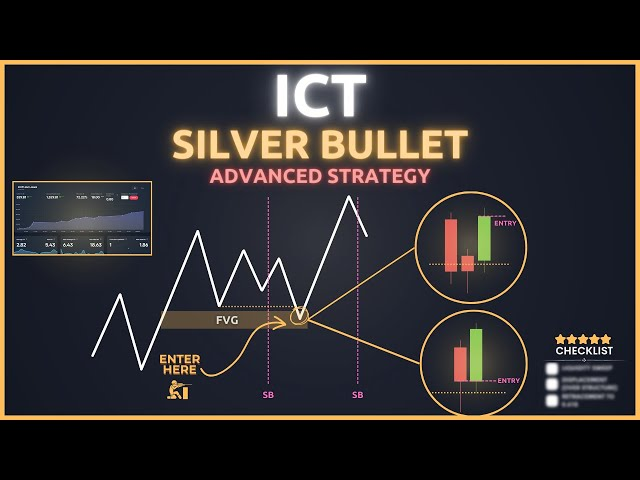

3. Key Concepts Behind the Silver Bullet Strategy in ICT

1. Liquidity Pools: Areas where stops are clustered (equal highs/lows, session highs/lows)

2. Displacement: A strong move that breaks structure and leaves a Fair Value Gap

3. FVG (Fair Value Gap): A 3-candle imbalance where price may return for an entry

4. Time Window: Waiting for setups between 10:00 and 11:00 AM ET

5. Refinement: Execution on lower timeframes (1m, 5m) after HTF bias is set

4. Step-by-Step Guide to the ICT Silver Bullet Strategy

Step 1: Define Higher Timeframe Bias

- Use the Daily or H1 chart to determine bullish or bearish bias

- Example: If price is above a bullish order block and SMT (Smart Money Tool) divergence confirms bullish intent → look for longs

Step 2: Wait for 10:00 AM ET

- Let the market build liquidity before this time

- Don’t trade before 10:00 AM; wait for price to make a run into a liquidity pool

Step 3: Identify the Liquidity Raid

- Look for price to raid previous session highs/lows or intra-session liquidity

- This raid is usually a stop hunt of retail traders

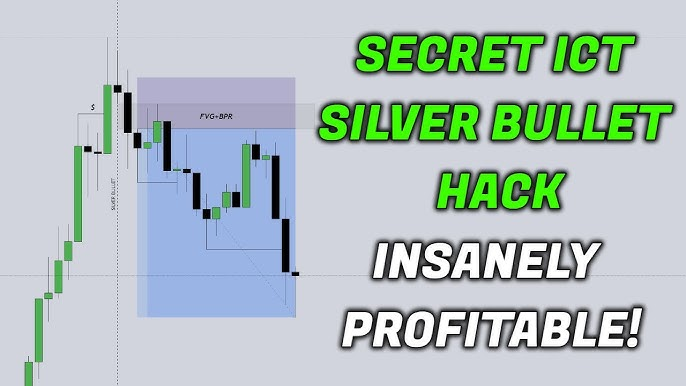

Step 4: Watch for Displacement

- A sharp move in the opposite direction after the liquidity raid

- It breaks structure and leaves a Fair Value Gap

Step 5: Entry in the Fair Value Gap

- Enter when price retraces into the FVG formed after the displacement

- Place your stop loss just beyond the raid high/low

- Target intraday liquidity (e.g., session high/low or equal highs/lows)

5. Example 1: Long Silver Bullet Setup (EURUSD) in ICT

1. Timeframe: 5-Min Chart

2. Date: Let’s say Thursday

3. Bias: Bullish (based on H1 structure and SMT divergence with DXY)

4. 10:02 AM: Price dips below the 9:30 AM low (raid of liquidity)

5. 10:05 AM: Sharp bullish displacement breaks short-term structure and leaves a 5-min FVG

6. Entry: When price revisits the FVG zone

7. Stop Loss: Below the low of the raid wick

8. Target: Intra-day high or buy-side liquidity around 11:00 AM

Result: Price rallies from the FVG and hits the target within 30–40 minutes.

6. Example 2: Short Silver Bullet Setup (NAS100) in ICT

1. Timeframe: 1-Min Chart

2. Bias: Bearish (Price under 1H bearish order block)

3. 10:07 AM: Price spikes above a local high and takes out buy stops

4. 10:10 AM: Strong bearish displacement with FVG created on 1-min chart

5. Entry: Price retraces into the FVG

6. Stop Loss: Above the liquidity raid high

7. Target: London low or next liquidity void

Result: Price drops sharply, hitting the target within 15–20 minutes.

7. Tips for Success in ICT Silver Bullet Strategy

- Stick to the 10:00–11:00 AM window strictly

- Avoid trading on Mondays and Fridays

- Always align trades with higher timeframe bias

- Confirm with SMT Divergence and market narrative

- Don’t force a setup—no raid + displacement = no trade

8. Common Mistakes to Avoid while Trading ICT Silver Bullet Strategy

- Entering before 10:00 AM ET

- Trading against higher timeframe bias

- Ignoring SMT divergence and liquidity context

- Chasing FVG entries without a clear displacement move

Leave a Reply