Before we dive into internal and external range liquidity, let’s first understand what liquidity means in ICT.

In trading, liquidity = money.

And in ICT terms, liquidity is where stop losses are placed.

These stop-loss clusters are used by institutions (Smart Money) to trigger big moves by sweeping them.

So, liquidity pools = targets for Smart Money.

1. Two Main Types of Liquidity in ICT

Michael J. Huddleston (ICT) classifies liquidity into:

- Internal Range Liquidity (IRL)

- External Range Liquidity (ERL)

Understanding the difference between these two is key to planning entries and targets the way Smart Money does.

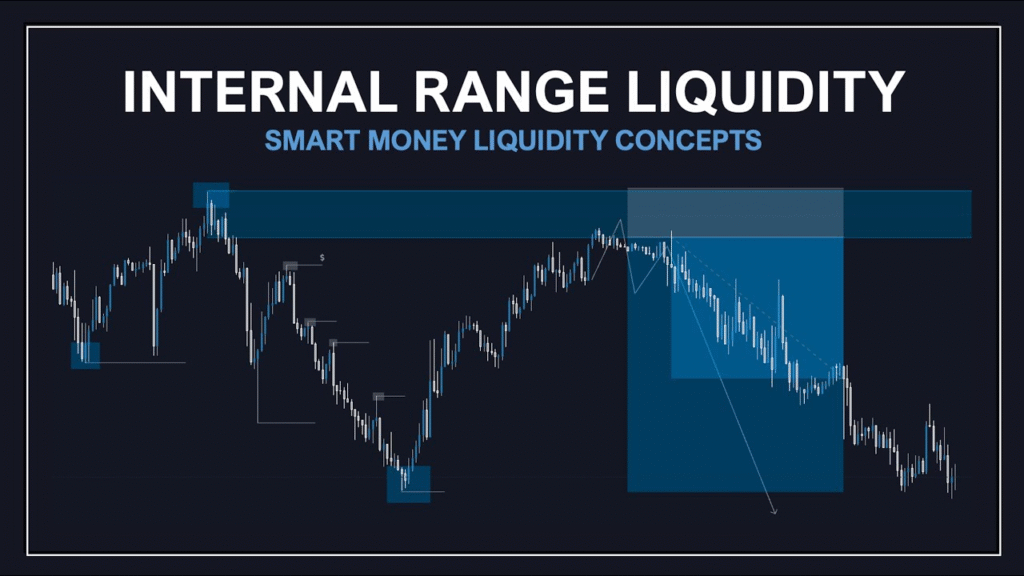

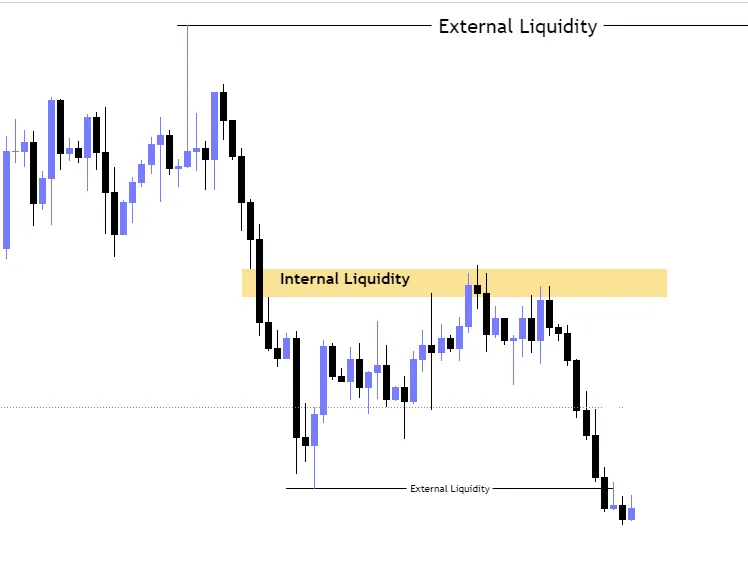

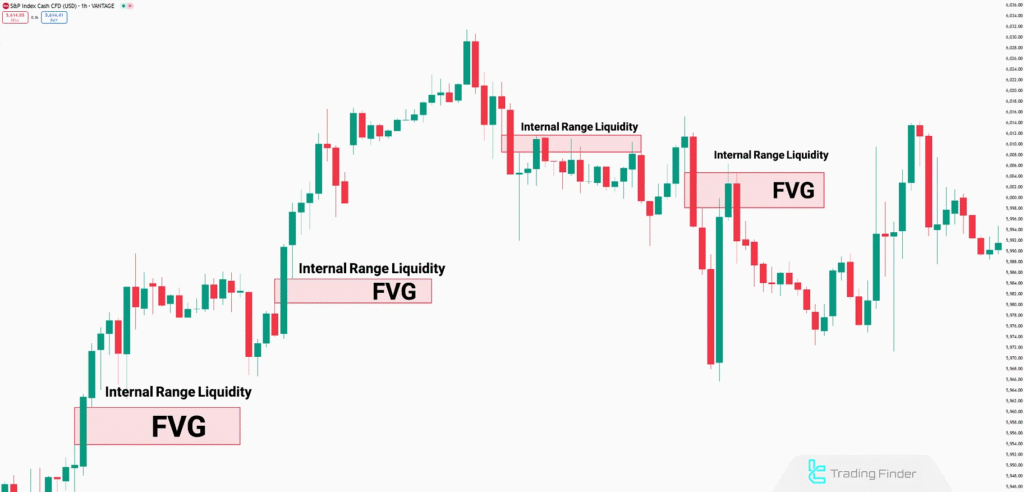

2. What is Internal Range Liquidity (IRL) in ICT?

Internal Range Liquidity is found inside the current trading range — the range between the most recent high and low.

This includes:

- Equal highs/lows within the range

- Previous day’s low/high (if still inside current day’s range)

- Fair Value Gaps (FVGs) inside the range

- Internal order blocks

In simple words:

IRL = Liquidity found within the most recent swing high and swing low.

1. Example of Internal Range Liquidity

Let’s say EUR/USD has:

- A swing low at 1.0800

- A swing high at 1.0900

The current price is moving between 1.0800 and 1.0900.

Within this range, price forms equal lows at 1.0845.

This cluster becomes internal liquidity.

Smart Money might drive price below 1.0845 to collect that liquidity — before heading to external targets (like 1.0910 or 1.0780).

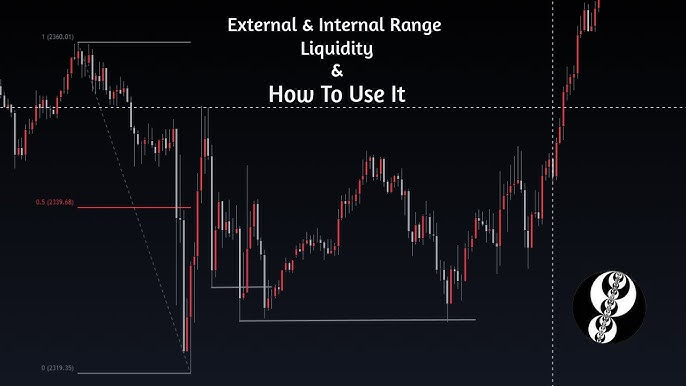

3. What is External Range Liquidity (ERL) in ICT?

External Range Liquidity lies outside the current trading range.

This includes:

- Swing highs above the current range

- Swing lows below the current range

- Liquidity pools formed beyond the previous structure

ERL = Liquidity that price needs to break out of the current range to reach.

This is often the final target for a trade based on the Smart Money narrative.

1. Example of External Range Liquidity

Let’s continue the previous example:

- Price is moving between 1.0800 (low) and 1.0900 (high)

- Above 1.0900, there’s a clean swing high at 1.0925

- Below 1.0800, there’s a swing low at 1.0770

These are external range liquidity pools — areas where Smart Money will eventually reach after clearing internal liquidity.

So, if price runs internal equal lows at 1.0845 and then reverses bullishly — it may target 1.0925 (external liquidity).

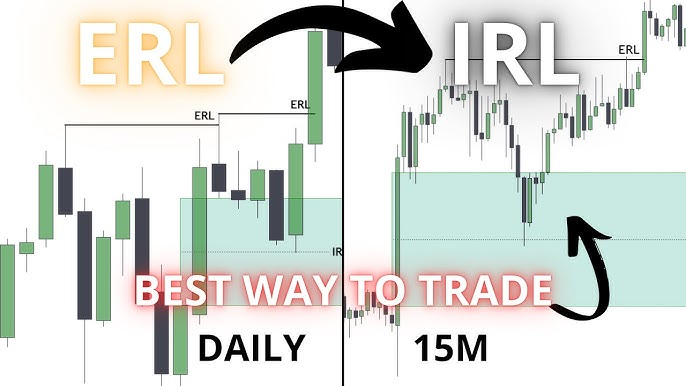

4. How Internal and External Liquidity Work Together in ICT

This is where Smart Money really shows its cards.

Here’s the general structure:

- Collect IRL (Internal Range Liquidity)

Price runs internal stops to build fuel for the real move - Displace (Break structure or BOS)

This signals a change in direction - Move toward ERL (External Range Liquidity)

Price targets major liquidity pools for Smart Money exits

1. Real-Life ICT Scenario

Let’s say price is consolidating within a range on the 1-hour chart.

- It forms equal lows (IRL) at 1.2950

- Below that is a swing low (ERL) at 1.2900

- Price runs the IRL at 1.2950, grabs liquidity, and shows bullish displacement

Now, the new external target becomes 1.3050 — a clean swing high.

→ This is a textbook example of how Smart Money sweeps IRL, shifts structure, and aims for ERL.

5. How to Use IRL and ERL in Your Trading in ICT

- Identify the Range First

Mark the most recent swing high and low - Mark IRL inside the range

Look for equal highs/lows, FVGs, and internal OBs - Mark ERL outside the range

Swing highs/lows, or major imbalance zones - Trade the Liquidity Sweep

Once IRL is taken, wait for displacement and enter toward ERL

6. Key Takeaways from ICT Internal Range & External Range Liquidity

- Internal Range Liquidity = liquidity within the current range

- External Range Liquidity = liquidity outside the current range

- Smart Money first runs internal, then targets external

- This gives you direction, entry, and target clarity

7. Final Thoughts

Mastering ICT Internal and External Range Liquidity helps you:

- Avoid traps (like entering before a sweep)

- Understand Smart Money’s step-by-step roadmap

- Time entries with better precision

Always combine liquidity concepts with CHoCH, Order Blocks, and FVGs for maximum edge.

Would you like a visual chart example showing IRL and ERL on a real setup? I can create that for you too.

Leave a Reply