In ICT (Inner Circle Trader) strategies, Break of Structure (BOS) and Change of Character (CHOCH) are fundamental concepts used to analyze and anticipate market movements.

While they may seem similar, each serves a distinct purpose in identifying shifts in market structure, helping traders differentiate between continuation patterns and potential reversals.

Here’s a comprehensive breakdown of BOS and CHOCH, their applications in trading, and examples illustrating each concept.

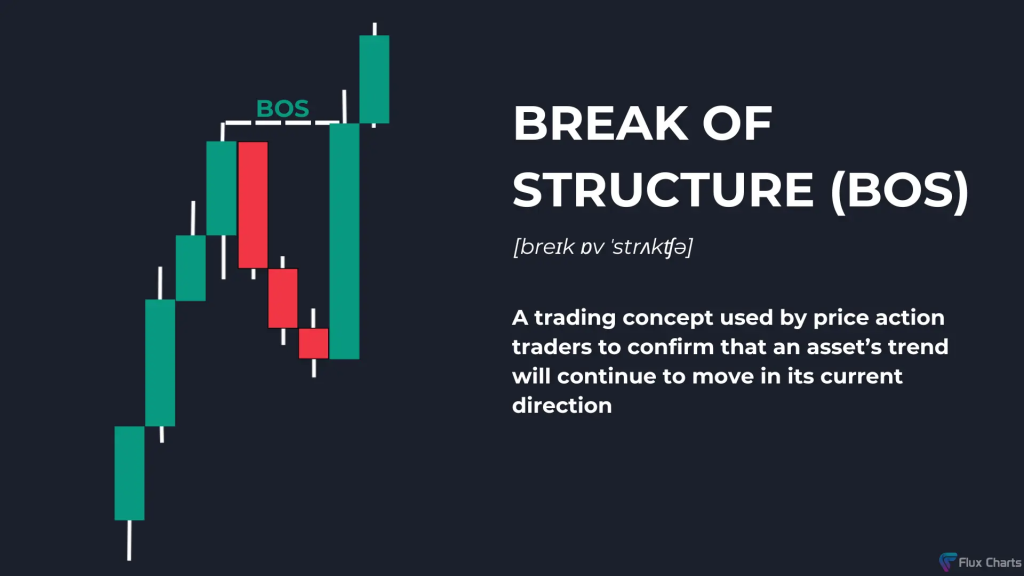

1. What is Break of Structure (BOS) in ICT?

A Break of Structure (BOS) is a movement in price that breaks a previous high or low in a way that confirms the current trend.

A BOS is typically a sign of trend continuation and indicates that the current trend is strong and likely to persist.

1. Characteristics of BOS:

- Confirms the continuation of an existing trend.

- Occurs in both uptrends (bullish BOS) and downtrends (bearish BOS).

- Highlights strength in the trend direction (e.g., breaking higher highs in an uptrend or lower lows in a downtrend).

2. Example of BOS:

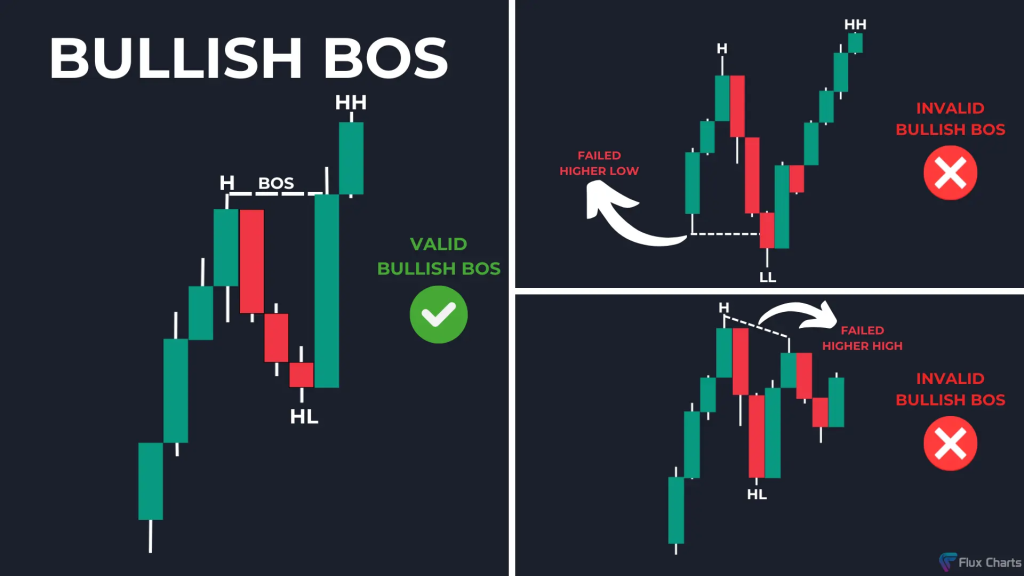

1. Bullish Break of Structure (Uptrend):

In an uptrend, if price creates a new higher high (HH) by breaking above the previous high, it signals that buyers are in control, reinforcing the bullish trend.

Example: Let’s say the EUR/USD pair is trending upwards. It has formed a higher low at 1.1000 and a higher high at 1.1100.

Price then retraces to 1.1050 before breaking above 1.1100. This new high indicates a BOS, confirming that the uptrend is intact.

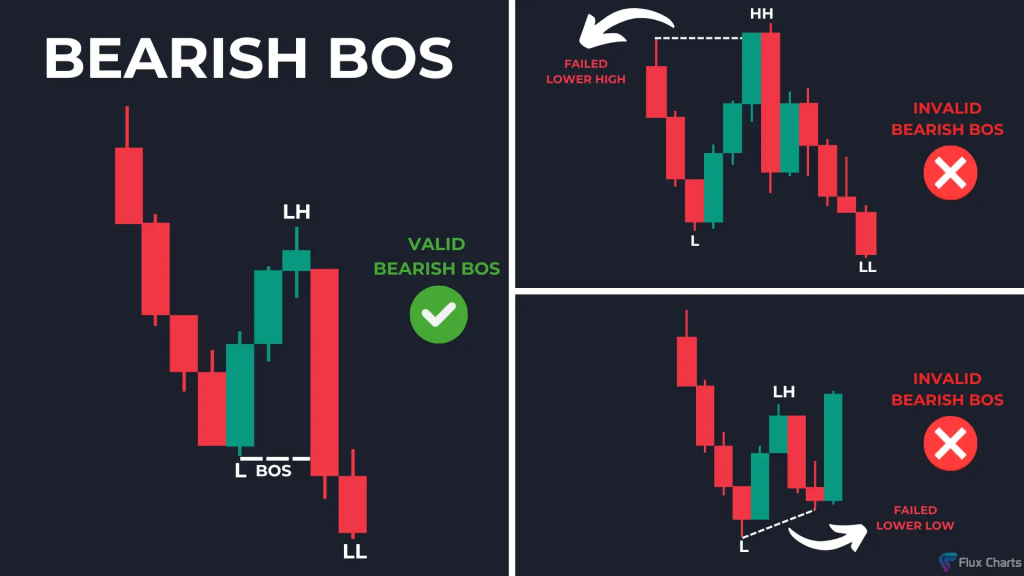

2. Bearish Break of Structure (Downtrend):

In a downtrend, if price creates a new lower low (LL) by breaking below the previous low, it confirms that sellers remain in control, suggesting the trend will likely continue lower.

Example: Assume the GBP/USD pair is in a downtrend with a lower high at 1.3000 and a lower low at 1.2900.

The price retraces to 1.2950 before breaking below 1.2900, forming a new low.

This bearish BOS confirms the continuation of the downtrend.

3. BOS Application:

Traders use BOS to enter trades in the direction of the trend after a retracement.

For example, in an uptrend, after a bullish BOS, a trader might wait for a pullback to enter long, expecting the trend to continue.

2. What is Change of Character (CHOCH) in ICT?

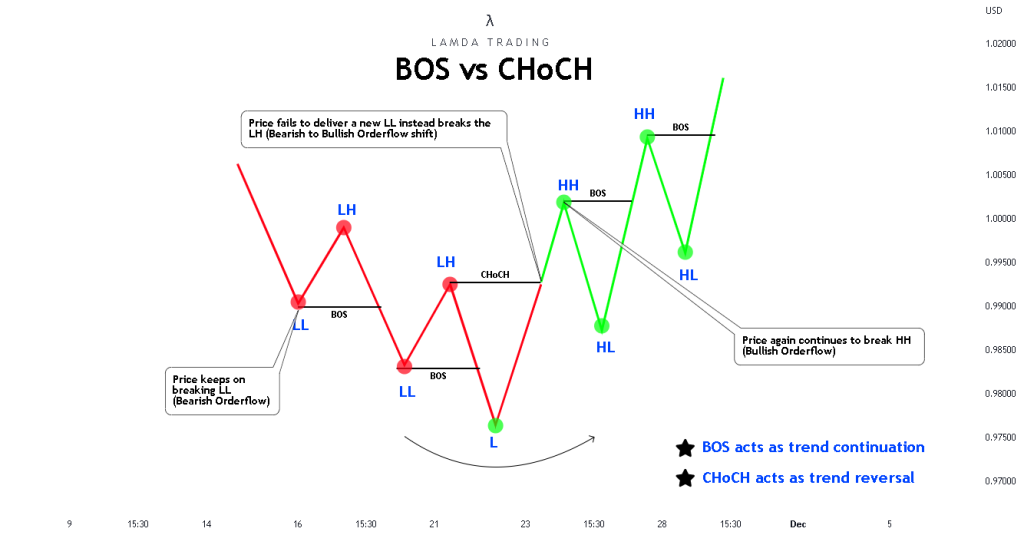

A Change of Character (CHOCH) signals a potential reversal in the market structure.

Unlike BOS, which confirms trend continuation, CHOCH highlights a shift in control from buyers to sellers (or vice versa), often occurring at the end of a trend or within consolidation periods.

1. Characteristics of CHOCH:

- Indicates a possible trend reversal or shift in direction.

- Shows that the current trend’s momentum is weakening.

- Occurs when the price breaks the previous swing high in a downtrend or the previous swing low in an uptrend.

2. Example of CHOCH:

1. Bullish Change of Character (Reversal to Uptrend):

In a downtrend, the price initially forms a series of lower lows and lower highs.

If the price breaks above a recent lower high, it signals a potential shift in character from bearish to bullish.

Example: Suppose the USD/JPY pair is in a downtrend, making lower highs at 150.00 and lower lows at 149.00.

After another retracement to 149.50, the price suddenly breaks above 150.00.

This break above a previous high indicates a CHOCH, suggesting a shift in market direction to bullish.

2. Bearish Change of Character (Reversal to Downtrend):

In an uptrend, the price creates higher highs and higher lows.

If the price breaks below a recent higher low, it signals a potential shift from bullish to bearish.

Example: Let’s say the AUD/USD pair is in an uptrend with higher highs at 0.7500 and higher lows at 0.7450.

After reaching 0.7500, the price suddenly breaks below 0.7450.

This break below a recent low suggests a CHOCH, hinting at a possible reversal to a downtrend.

3. CHOCH Application:

Traders often use CHOCH to identify reversals.

When a CHOCH is confirmed, traders may look to enter a position in the new direction, expecting a shift in market momentum.

For example, in a bearish CHOCH, they may look for opportunities to enter short positions.

3. Comparing BOS and CHOCH in ICT

| Aspect | Break of Structure (BOS) | Change of Character (CHOCH) |

|---|---|---|

| Indicates | Trend continuation | Potential trend reversal |

| Trend | Confirms existing trend | Signals possible shift in trend direction |

| Price Action | Breaks previous high (uptrend) or low (downtrend) | Breaks recent low (uptrend) or high (downtrend) |

| Trading Approach | Enter with trend | Look for reversal setups |

4. Using BOS and CHOCH Together in Trading in ICT

Combining BOS and CHOCH in ICT strategies enables traders to navigate both trend-following and reversal setups.

1. Trend Following with BOS:

Traders look for BOS in the direction of the trend to confirm continuation.

They might enter after a pullback following a BOS to capitalize on the momentum.

2. Trend Reversal with CHOCH:

When CHOCH appears after a sustained trend, it can signal a reversal.

Traders can wait for confirmation after a CHOCH, such as a retracement, to enter in the new direction.

3. Example Strategy:

Assume the EUR/USD is in an uptrend.

You see multiple BOS patterns, confirming the bullish trend.

You enter long after each BOS, aiming to profit from the continuation.

Later, a CHOCH occurs, breaking a recent higher low.

This alerts you that the uptrend might be ending, signaling an opportunity to exit long trades and consider short entries if a downtrend forms.

5. Examples of BOS and CHOCH in Practice in ICT

Example 1: Uptrend with BOS and CHOCH in ICT

- EUR/USD Uptrend: The pair forms higher highs and higher lows, with each new high confirming a BOS.

- After multiple BOS signals, the price forms a high at 1.2200, retraces, and fails to make a new high.

- The price breaks below the recent higher low at 1.2150. This CHOCH signals a potential reversal to bearish.

- Traders exit long positions and potentially enter short after the CHOCH confirmation.

Example 2: Downtrend with BOS and CHOCH in ICT

- GBP/USD Downtrend: The pair consistently forms lower lows and lower highs, with each low confirming a BOS.

- The price eventually breaks above a lower high at 1.2800, signaling a CHOCH and potential shift to bullish.

- After confirmation, traders may enter long positions, expecting a reversal to an uptrend.

6. Conclusion

In ICT trading, understanding the difference between BOS and CHOCH allows traders to accurately determine trend continuation and reversal points.

BOS provides insight into where the trend is likely to continue, while CHOCH highlights potential turning points.

By mastering these concepts, traders can align their entries and exits with institutional order flow, navigating markets more effectively and avoiding common retail traps.

Leave a Reply