The forex market is open 24 hours a day, five days a week.

But that doesn’t mean every hour is equally active.

Michael Huddleston (ICT) teaches that timing is everything in trading.

Price delivery isn’t random — it follows a rhythm tied to the major global trading sessions.

Knowing when each session opens and closes helps you understand when liquidity enters the market and where the best trading opportunities appear.

1. The Four Major Trading Sessions for Forex

- Sydney Session

- Opens: 10:00 PM GMT

- Closes: 7:00 AM GMT

- Marks the official start of the forex week (Monday morning in Sydney).

- Usually low volatility, especially compared to London or New York.

- ICT traders rarely take setups here unless they are studying accumulation ranges or Asian consolidations.

- Tokyo (Asian) Session

- Opens: 11:00 PM GMT

- Closes: 8:00 AM GMT

- Main session in Asia.

- Often creates a tight range (the Asian Range) which ICT traders use later in the London session.

- Example: If EUR/USD consolidates between 1.0750–1.0770 during Asia, ICT traders watch for a breakout or sweep of this range once London opens.

- London Session

- Opens: 7:00 AM GMT

- Closes: 4:00 PM GMT

- This is the most liquid session, with sharp moves and strong trends.

- ICT emphasizes the London Open Killzone (2 hours after 7:00 AM GMT) for setups. Liquidity grabs often happen here.

- Example: If GBP/USD sweeps the Asian Range low right after London opens, it may signal a reversal back higher.

- New York Session

- Opens: 12:00 PM GMT

- Closes: 9:00 PM GMT

- High volatility overlaps with London (from 12:00 PM to 4:00 PM GMT).

- ICT highlights the New York Open Killzone (12:00 PM–2:00 PM GMT) and the New York PM Session (2:00 PM–5:00 PM GMT).

- Example: During NY Open, if EUR/USD runs above a London high but fails to sustain, ICT traders may anticipate a reversal lower (a liquidity sweep).

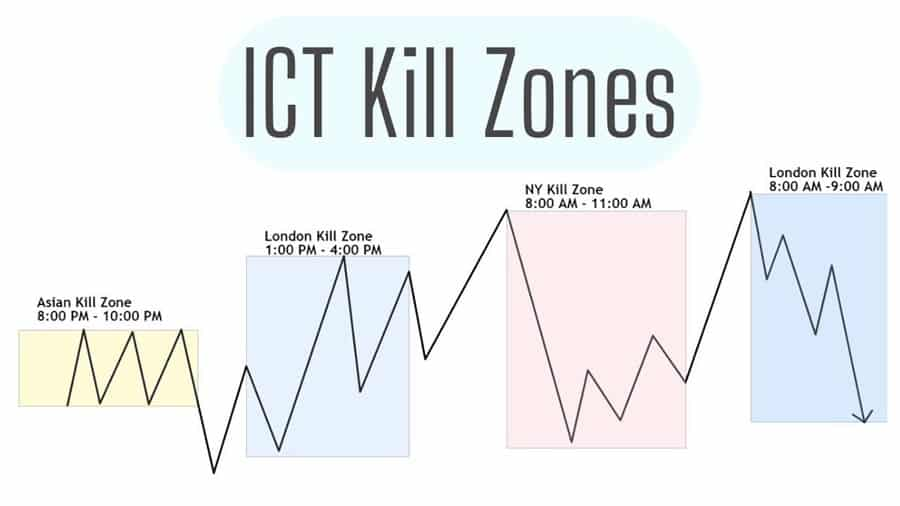

2. ICT Killzones (Prime Times to Trade)

ICT doesn’t recommend trading at every hour of the day.

Instead, he teaches Killzones — specific windows when algorithmic price delivery is most efficient.

- London Open Killzone: 7:00 AM–9:00 AM GMT

- New York Open Killzone: 12:00 PM–2:00 PM GMT

- New York PM Session: 2:00 PM–5:00 PM GMT

These are the times when banks and institutions execute orders, creating high-probability setups.

3. Example: Using Sessions in Trading (as per ICT)

Imagine EUR/USD trades quietly during the Asian session, forming a 20-pip range between 1.0800–1.0820.

- At London Open, price quickly dips below 1.0800 (stops out Asian session buyers).

- That liquidity sweep creates the low of the day (LOD).

- Price then rallies strongly back above 1.0820, continuing upward through London and into New York.

Here, the ICT trader understood that Asian Range liquidity gets targeted in London, and used timing to anticipate the move.

4. Why ICT Traders Care About Session Times for trading Forex

- Liquidity hunts usually happen at the open of London and New York.

- False breakouts often occur right before major session overlaps.

- Session highs/lows become reference points for intraday setups.

By aligning trades with session times, ICT traders avoid random entries and focus on when smart money is most active.

5. Key Takeaways from Forex Market Hours: Opening / Closing Times for Trading per ICT

The forex market never sleeps, but ICT traders only strike during prime session windows.

The London and New York Killzones are where the best setups form, while the Asian Range provides the liquidity pool that gets targeted later.

Leave a Reply