1. What is a Fair Value Gap (FVG) in ICT?

Before we dive into ICT’s 1st Presented FVG and Opening Range, let’s understand what an FVG is.

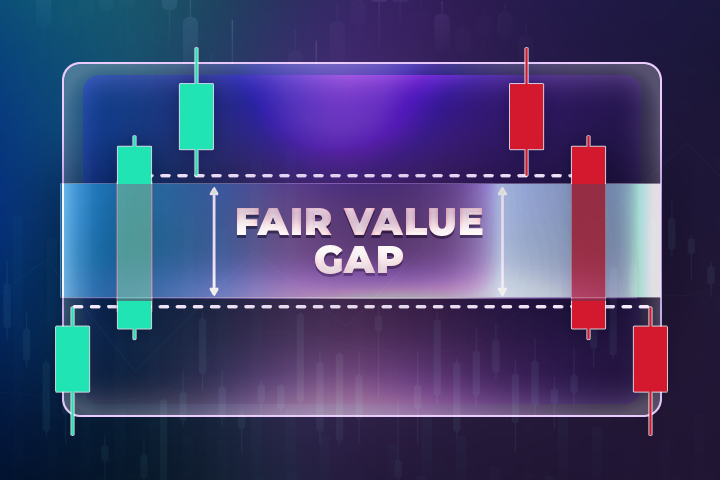

A Fair Value Gap is a price imbalance.

It happens when a candle moves so fast that the opposite side doesn’t get a chance to trade — leaving a gap between candles.

You can spot it on any timeframe using this rule:

When the low of candle 1 is higher than the high of candle 3 (with candle 2 in the middle), a Fair Value Gap is formed between them.

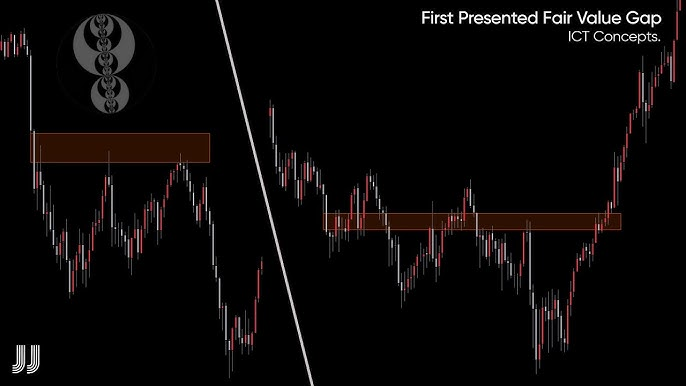

2. ICT 1st Presented Fair Value Gap

This is a high-probability setup.

It refers to the first Fair Value Gap that shows up after a market shift, also known as a Break of Structure (BOS) or Change of Character (CHoCH).

This FVG is important because:

- It’s the first sign that Smart Money is in control.

- It often acts as a re-entry point for Smart Money.

- It offers a high R:R trade opportunity.

1. Example of 1st Presented FVG:

Let’s say you’re watching GBP/USD on the 15-min chart.

- Price was making lower lows.

- Suddenly, price breaks a previous high (BOS).

- On this break, a Fair Value Gap forms between 1.2675–1.2685.

This is your 1st Presented FVG after a BOS.

Now, wait for price to retrace into this gap.

If price comes down to 1.2680, shows bullish confirmation (like a smaller BOS or bullish order block), you can go long.

Target the next external liquidity level.

2. Why This FVG is Important

It tells you:

- Smart Money entered with strength.

- They left an imbalance — and they may return to fill it.

- You can catch that return and ride the move with them.

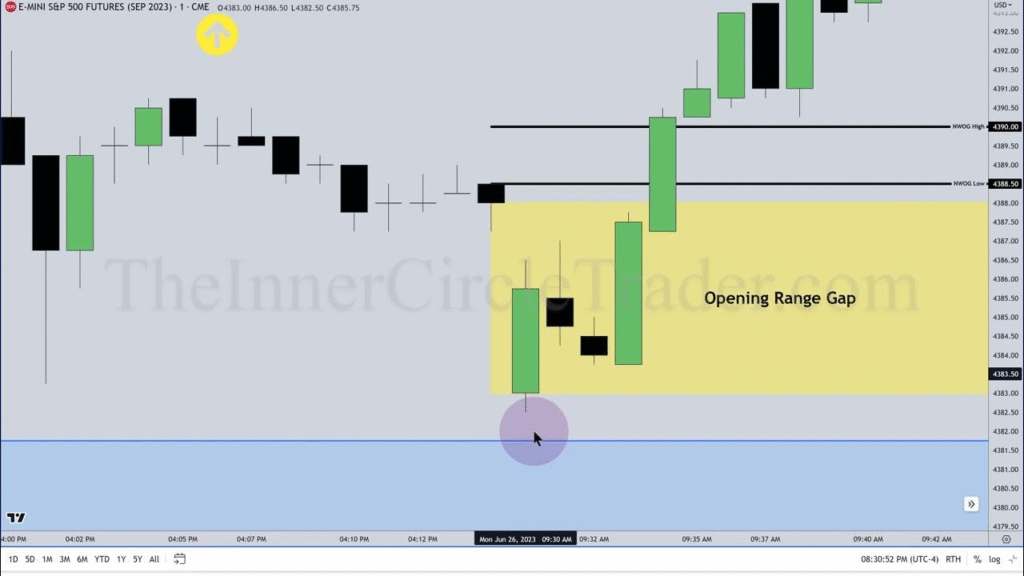

3. ICT Opening Range

The Opening Range is the time window in which you observe and measure price behavior.

It helps you:

- Define the likely direction for the session.

- Spot liquidity pools and fake moves.

- Plan high-probability entries after the manipulation is done.

1. Most Common Opening Ranges:

- Asian Session Range: 00:00 – 05:00 (New York time)

- London Kill Zone: 02:00 – 05:00

- New York Opening Range: 07:00 – 09:30

ICT often uses 8:30 AM – 9:30 AM EST as a powerful Opening Range for NY session.

This is when liquidity is injected, and Smart Money starts showing true direction.

2. How to Use the Opening Range:

- Mark the high and low of the 8:30–9:30 candle(s).

- Wait for liquidity to be taken on one side.

- Look for a reversal setup to go in the opposite direction.

3. Example:

You’re watching the NY session on NASDAQ (NAS100):

- From 8:30–9:30 AM EST, the market forms a range between 15,200 and 15,350.

- At 9:45 AM, price spikes above 15,350 — grabbing buy-side liquidity.

- You see a sharp rejection + FVG forming.

Now, you look to go short as price is likely to reverse and run toward the sell-side liquidity (below 15,200).

4. Combining Both Concepts: ICT 1st Presented Fair Value Gap and ICT Opening Range

Here’s how you masterfully combine them:

- Watch the Opening Range (say 8:30–9:30 AM).

- Identify liquidity grab or false breakout.

- Wait for a market structure shift (BOS).

- Identify the 1st Presented FVG that forms.

- Trade into it — and then ride the real move.

This approach gives you:

- Clean setups

- Clear risk-to-reward

- Confidence that you’re trading with Smart Money

5. Final Thoughts

- The 1st Presented Fair Value Gap is a golden zone after structure shifts.

- The Opening Range shows where price is likely to fake out before moving.

- Together, they help you predict direction and enter at precise spots.

Always wait for confirmation like a BOS, CHoCH, or Order Block.

With practice, this will become one of your most powerful setups.

Leave a Reply