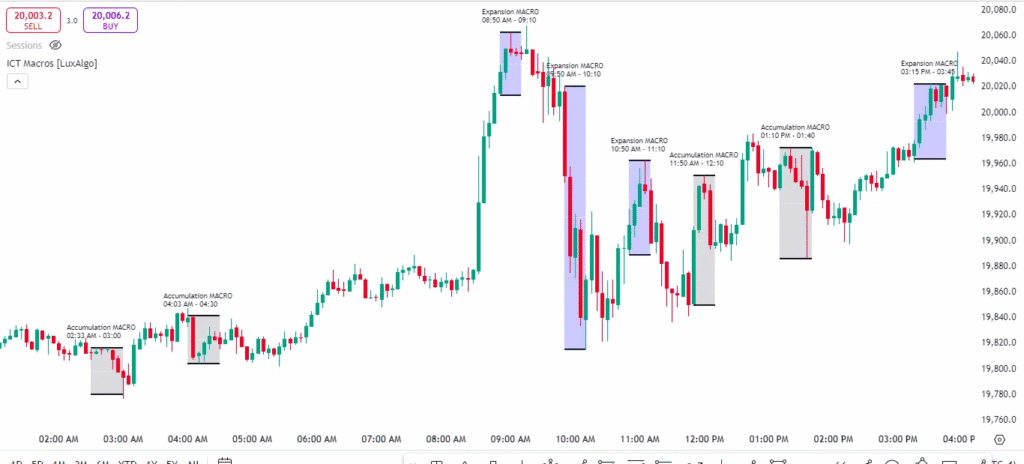

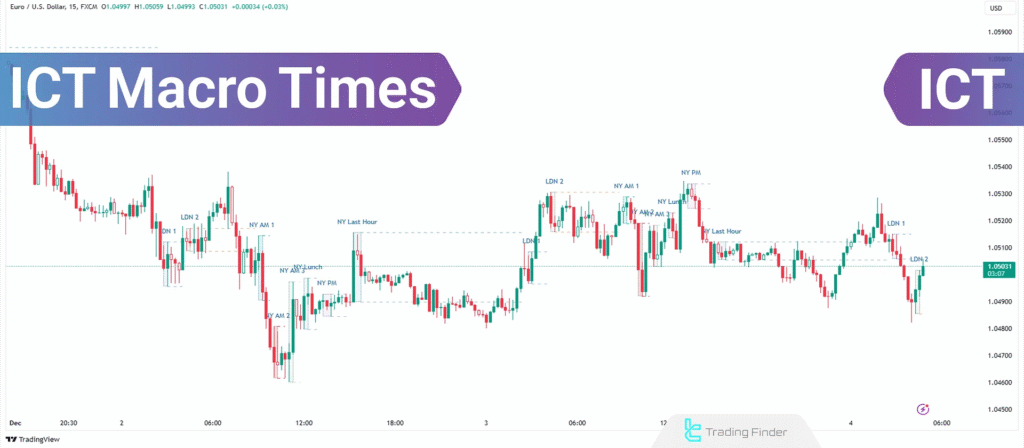

ICT Macro Times refer to specific times of the trading day when the market is most likely to show high-probability moves.

These times are based on institutional trading activity, especially from major financial hubs like London and New York.

Michael J. Huddleston (ICT) teaches that Smart Money operates in specific windows, and these windows repeat every day.

1. Why Macro Times Matter?

Smart Money doesn’t trade randomly. They:

- Accumulate or distribute during quiet hours

- Cause manipulations before a major move

- Make large entries and exits during predictable timeframes

When you align your trading with these macro time windows, you increase the probability of catching big moves and avoiding false breakouts.

2. The Three Major ICT Macro Times

1. London Open Killzone (LOKZ)

- Time: 2:00 AM – 5:00 AM EST (7:00 AM – 10:00 AM London time)

- Purpose: This is when London banks start trading.

- Behavior: Market often creates fakeouts or liquidity sweeps, followed by real direction.

Example:

Price forms equal lows during Asian range.

At London open, it sweeps the lows (inducement) and then rallies.

→ That’s your high-probability long setup.

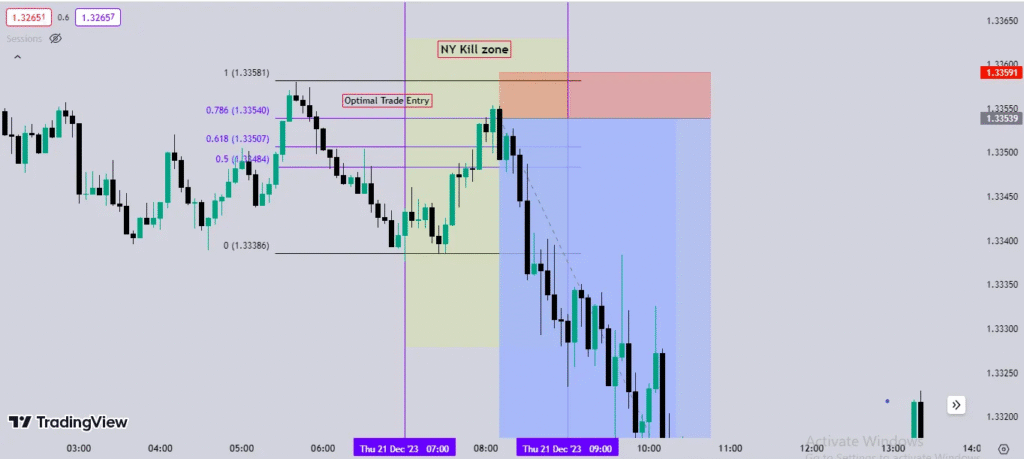

2. New York Open Killzone (NYKZ)

- Time: 7:00 AM – 10:00 AM EST

- Purpose: This is when US institutions enter the market.

- Behavior: You often see a reversal or continuation of the London move.

- High-impact news is often released in this zone (e.g., CPI, NFP).

Example:

London session makes a strong bullish move.

NY opens, creates a pullback into a fair value gap (FVG), and continues the bullish run.

→ Perfect time to enter on the retracement.

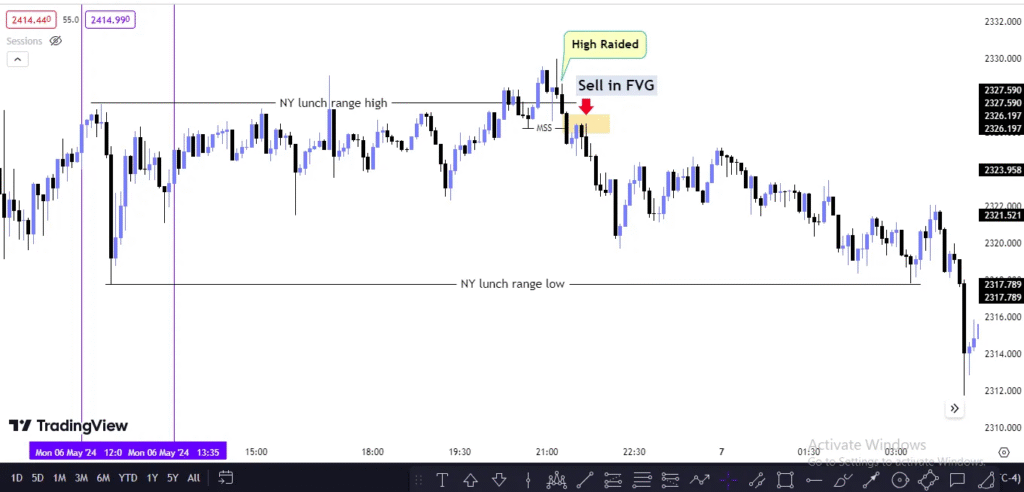

3. New York Lunch and Reversal (Power of 3 Setup)

- Time: 11:00 AM – 1:00 PM EST

- Purpose: Institutions close positions or trap late traders.

- Behavior: You’ll see consolidations, false breaks, or clean reversals.

Example:

Price shows consolidation during the lunch hour.

After 12:30 PM EST, it spikes in the opposite direction of the morning trend.

→ High chance of reversal trade.

3. Other Important Times in ICT

1. Midnight Open (00:00 AM EST)

- Often marks the daily open

- Used to anchor bias and daily range

2. 4 PM EST – FX Daily Close

- Market tends to slow down

- Institutions rebalance

- Avoid trading after this time

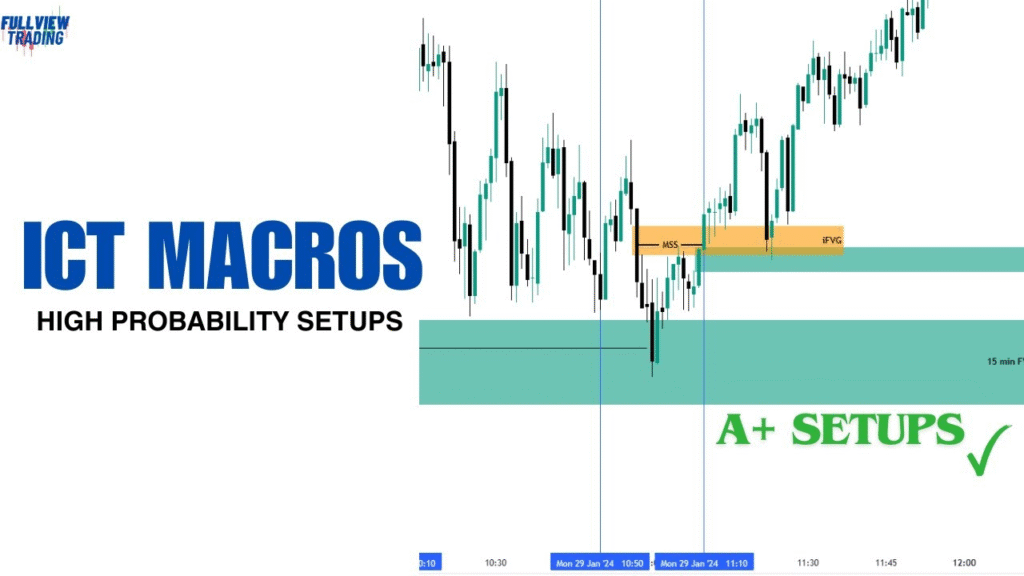

4. How to Use ICT Macro Times in Your Strategy

- Define Bias Beforehand

Use HTF (Higher Time Frame) structure to decide bullish or bearish bias. - Wait for Price to Enter a Macro Time Zone

Don’t trade before it — wait for Smart Money to show its hand. - Look for Liquidity Sweeps, FVGs, Mitigation Blocks, or CHoCH

These act as triggers within macro time windows. - Enter with Confirmation

You don’t need to predict. Let the market show displacement or BOS, then enter on a pullback.

5. Example Trade Using Macro Times in ICT

Pair: GBP/USD

Bias: Bullish (HTF structure, bullish OB)

Asian Range: Market is consolidating

- London Open (2 AM – 5 AM EST)

→ Price sweeps Asian lows (inducement)

→ Breaks structure to the upside (displacement)

→ You wait for price to return to FVG

→ Enter long - New York Open (7 AM – 10 AM EST)

→ Price retraces again

→ Hits a 15M FVG and reacts

→ You re-enter or scale in

Result: The market expands in your direction for the day.

6. ICT Macro Times + Economic News

During macro times, major economic news is often released.

Examples include:

- 8:30 AM EST → Non-farm payrolls, CPI, PPI, etc.

- 2:00 PM EST → FOMC interest rate decisions

Always be cautious. Wait for news to hit, then trade the reaction, not the news itself.

7. Final Tips on ICT Macro Times

- Avoid trading before macro times – most moves are fake

- Focus only on 2-3 hours per session – that’s when Smart Money is active

- Combine macro times with liquidity concepts and SMC tools

- Journaling each macro time movement will boost your understanding fast

8. Final Thoughts

ICT Macro Times are the most predictable moments in the market.

They are repeating daily cycles, giving you structure and rhythm to follow — no more chasing random moves.

When you align with these institutional windows and pair them with Smart Money Concepts like FVGs, mitigation blocks, and CHoCHs, your trades become much more efficient and accurate.

Would you like a printable cheat sheet or trading session map based on these macro times?

I can make that for you next.

Leave a Reply