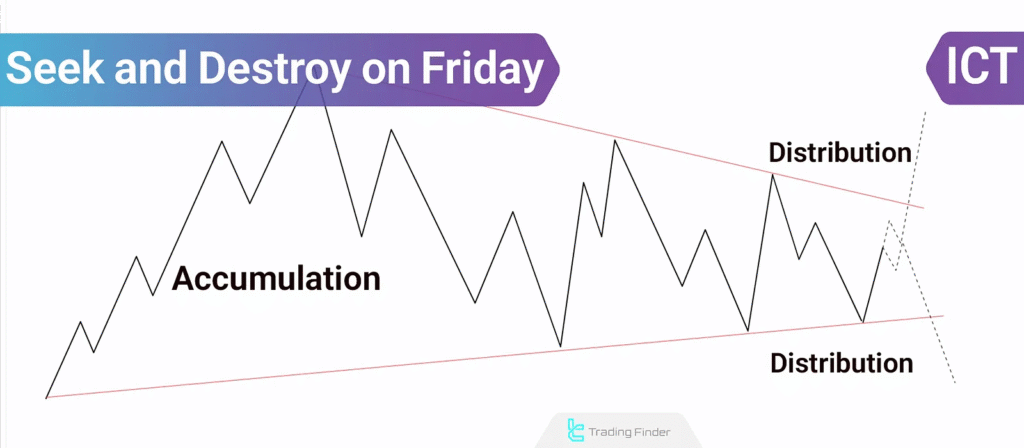

“Seek and Destroy” is a Friday-specific trading setup.

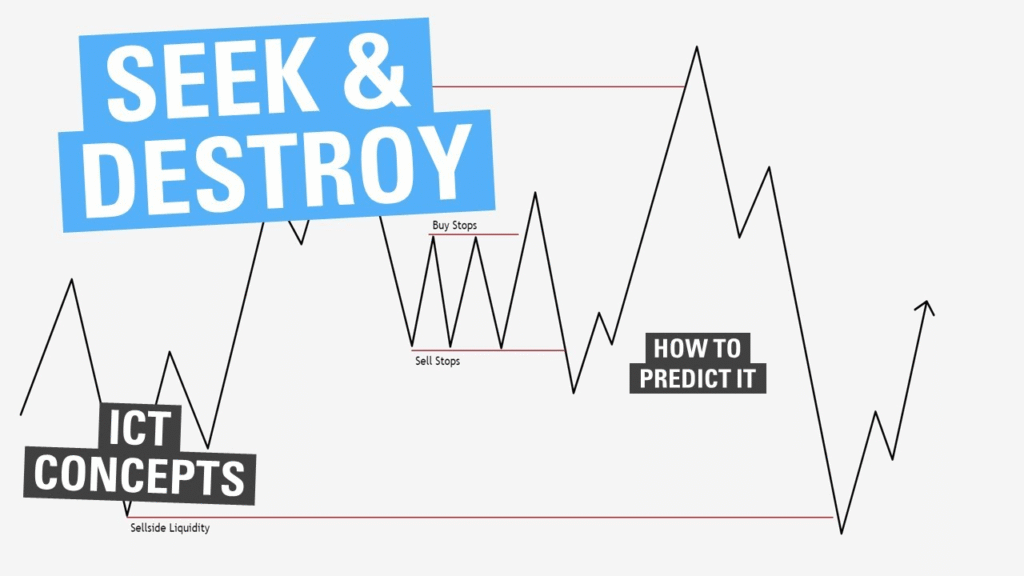

Michael J. Huddleston (ICT) named it that way because the market:

- Seeks liquidity (above highs or below lows made earlier in the week)

- Then destroys those traders who got trapped chasing breakouts.

It’s a classic liquidity run and reversal setup.

1. Why Only on Friday?

Fridays are important because:

- Smart Money wants to close the week by collecting profits.

- They trap breakout traders by pushing price to one side (fake move).

- Then reverse it, taking out both sides of liquidity.

That’s why Fridays often have stop hunts and reversals.

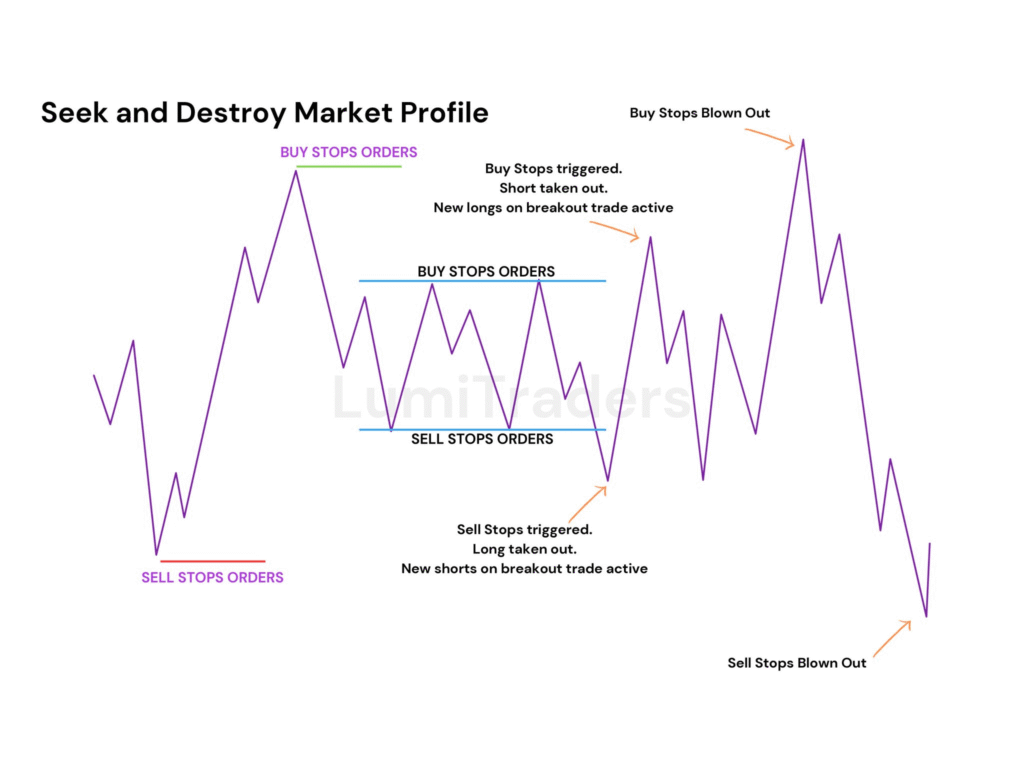

2. The Core Idea behind ICT Seek and Destroy Friday

Here’s how the market moves on a Seek and Destroy Friday:

- Price trades in a range for most of the week.

- On Friday, it breaks the range — usually during the New York session.

- That break is false — price hits liquidity and reverses fast.

- The market “destroys” both sides — people who chased breakouts and those who got in too early.

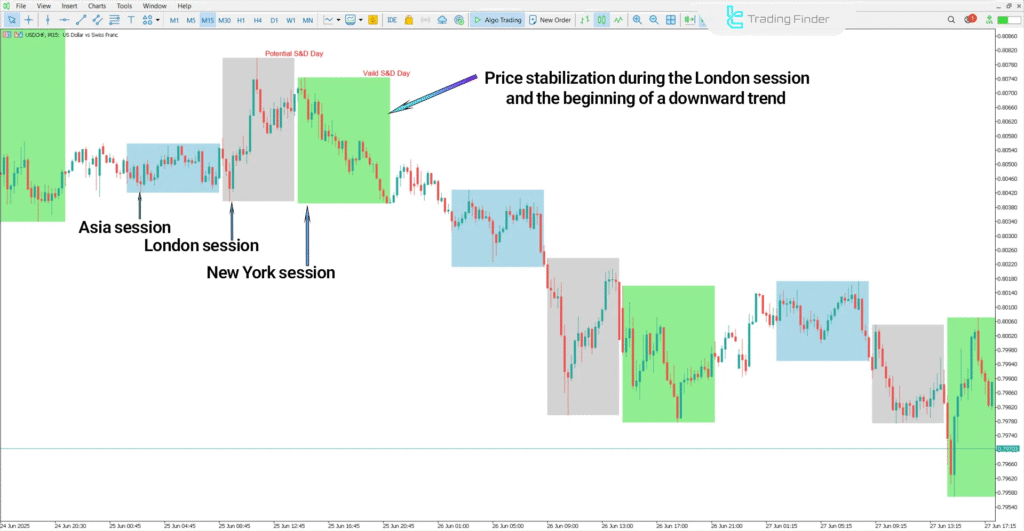

3. Time Windows for ICT Seek and Destroy Friday Setup

- New York Killzone (7:00 AM – 10:00 AM EST)

- Focus more around 8:30 AM – 9:30 AM EST

- Best seen on 15 min or 5 min charts

4. Step-by-Step: How to Trade ICT Seek and Destroy Friday

Step 1: Define the Weekly Range

- Use the high and low of Monday–Thursday.

- Mark those levels on your chart.

Example:

- Weekly High: 1.2750 (GBP/USD)

- Weekly Low: 1.2620

Step 2: Watch for Liquidity Grabs

On Friday, watch price during the NY session:

- If price spikes above the weekly high → look for buy-side liquidity grab.

- If price dips below the weekly low → look for sell-side liquidity grab.

This is the “seek” part.

Step 3: Wait for Reversal Confirmation

Don’t enter blindly.

Look for signs that Smart Money has finished their move:

- Break of Structure (BOS) or Change of Character (CHoCH)

- Fair Value Gap (FVG) forms

- Order Block forms at the extreme

These are signs that price is now reversing.

Step 4: Enter with Precision

Once you see confirmation:

- Enter on the FVG or Order Block retracement.

- Stop-loss just beyond the liquidity grab.

- Target: opposite side of the range or internal liquidity.

5. Example Trade – GBP/USD: ICT Seek and Destroy Friday

Let’s say you’re trading on Friday:

- Weekly High = 1.2750

- Friday NY session → price spikes up to 1.2765

- You notice a fast rejection and a 15-min BOS

- A small FVG forms around 1.2740–1.2745

- You go short at 1.2745, SL = 1.2770, TP = 1.2650

That’s a high-probability trade based on a Seek and Destroy move.

6. Bonus Tip: Look for Opposite Side Target

After the fake move, Smart Money often targets the opposite side of the weekly range.

If they grabbed buy-side liquidity, they might:

- Drop price aggressively

- Close the week near the weekly low

This is how both sides are “destroyed” — breakout buyers and sellers alike.

7. What Makes ICT Seek and Destroy Friday Setup So Effective?

- Happens often on Fridays

- Uses clear weekly levels

- Works best during high liquidity sessions

- Combines multiple ICT concepts: liquidity, FVG, BOS, order blocks

8. Final Words

ICT Seek and Destroy Friday is about catching false breakouts that happen late in the week.

To trade it effectively:

- Know your weekly range

- Watch for liquidity grabs on Friday

- Wait for confirmation (BOS, FVG, etc.)

- Enter with tight risk and high reward

It’s one of the most profitable setups once you practice it consistently.

Leave a Reply