Institutional risk management practices differ significantly from those of retail traders.

These differences stem from the resources, strategies, and objectives unique to each group.

ICT (Inner Circle Trader) concepts provide valuable insights into these distinctions, especially in understanding how smart money approaches trading and risk management.

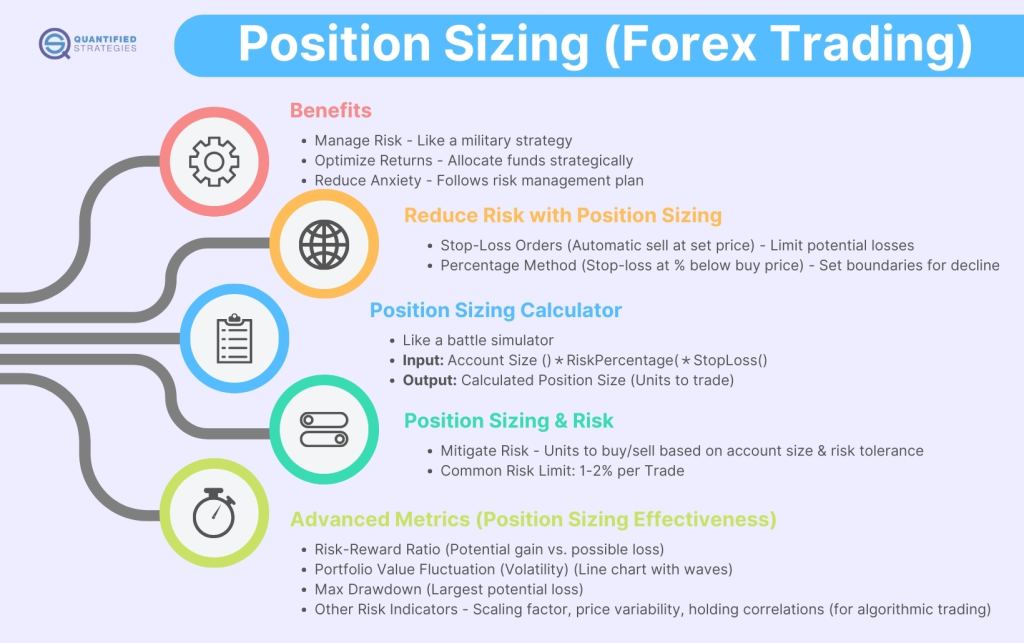

1. Institutions Use Risk Per Trade Metrics

Institutions:

- Limit risk per trade to a fraction of their capital, often 0.1%–1%.

- They allocate risk based on the probability of success and the quality of the setup.

- Example: A hedge fund managing $1 billion might risk $1 million on a trade, spread across multiple orders, ensuring exposure to minimal loss.

Retail Traders:

- Retail traders often risk a larger percentage, like 2%–5% of their account, which can lead to significant losses during drawdowns.

- Example: A retail trader with a $10,000 account may risk $500 per trade, which can be catastrophic during a losing streak.

2. Institutions Manage Positions Across Multiple Levels

Institutions:

- Use layered orders, entering and exiting trades gradually to reduce the market impact.

- Break trades into smaller units across different price levels to optimize execution.

- Example: When buying into a bullish trend, they might use order blocks to enter at fair value gaps (FVGs) or rebalance liquidity.

Retail Traders:

- Often execute trades in a single order without considering market depth.

- Example: A retail trader may buy all at once, creating slippage and increasing risk.

3. Institutions Operate in Key Liquidity Zones

Institutions:

- Enter trades around liquidity pools or order blocks to minimize market impact and align with market structure.

- Use killzones (e.g., London Open, New York Open) for better execution timing.

- Example: If price sweeps sell-side liquidity near a bullish order block, institutions may start accumulating positions.

Retail Traders:

- Tend to chase price movements, often entering trades at unfavorable levels after the market has moved.

- Example: A retail trader might buy after a sharp rally, entering just as the market corrects.

4. Institutions Have Access to Advanced Risk Management Tools

Institutions:

- Utilize sophisticated tools like algorithmic trading systems to manage and hedge risk.

- Hedge trades using options or futures to offset potential losses.

- Example: A bank trading EUR/USD may hold a buy position while simultaneously hedging with a sell position in a correlated currency pair, like GBP/USD.

Retail Traders:

- Lack access to hedging tools or don’t use them due to complexity or cost.

- Example: A retail trader may rely solely on stop-loss orders, which can fail during extreme volatility.

5. Institutions Focus on Portfolio Diversification

Institutions:

- Diversify across markets, asset classes, and trading strategies to spread risk.

- Example: A fund may simultaneously trade equities, forex, and commodities while employing both trend-following and mean-reversion strategies.

Retail Traders:

- Often over-concentrate on one market or asset, increasing exposure to risk.

- Example: A trader may put all capital into forex, ignoring diversification benefits.

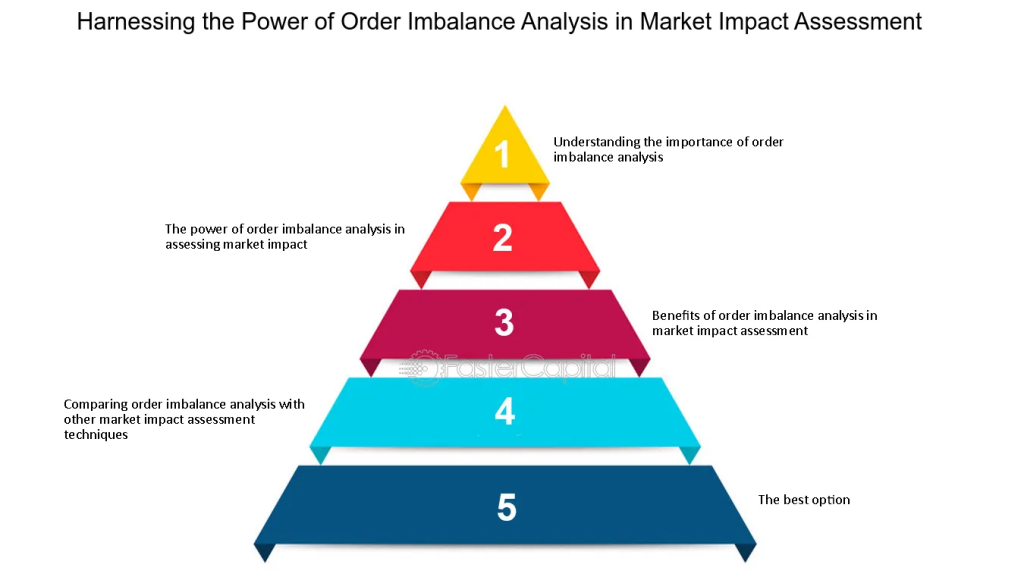

6. Institutions Use Market Impact Analysis

Institutions:

- Avoid entering trades in a way that moves the market against their position.

- Example: Instead of buying 10,000 lots of EUR/USD at once, they spread the order over multiple price levels and sessions.

Retail Traders:

- Their smaller trade sizes generally have minimal market impact, but they often ignore timing, leading to poor entries.

- Example: A retail trader may impulsively buy at a breakout without considering potential stop hunts.

7. Institutions Use Advanced Data Analysis

Institutions:

- Employ data scientists and algorithms to analyze historical data, liquidity patterns, and market behavior.

- Example: They might use AI to predict where liquidity pools exist or when price will rebalance to a fair value gap.

Retail Traders:

- Rely on basic indicators or limited analysis, often overlooking broader market dynamics.

- Example: A trader might use only RSI without considering market structure or liquidity sweeps.

8. Risk Management During News Events

Institutions:

- Anticipate and plan for market volatility around economic data releases (e.g., NFP, FOMC).

- Example: A bank may scale out of positions before news or place hedged trades to minimize exposure.

Retail Traders:

- Often unaware of or unprepared for high-impact events, leading to stop-outs or account blowups.

- Example: A trader may enter a position minutes before an announcement, resulting in massive slippage.

9. Case Study: Institutional Risk Management in Action

Scenario: A liquidity sweep occurs in the GBP/USD pair.

- Institutional Approach:

- Observe the sweep near a bullish order block at 1.2100.

- Enter multiple buy orders as price shows rejection and starts to move higher.

- Place stop loss below the order block (e.g., 1.2070).

- Hedge risk by shorting EUR/GBP, assuming inverse correlation.

- Retail Approach:

- Spot the rally late and enter impulsively at 1.2200.

- Set a tight stop loss near the current low (e.g., 1.2175).

- Stop-out occurs as the market retraces to the order block.

Outcome: Institutions profit from their structured entry, while retail traders incur losses.

10. Key Takeaways for Retail Traders

- Adopt Institutional Practices: Use concepts like order blocks, fair value gaps, and liquidity pools for better entries and exits.

- Risk Small: Limit risk per trade to a small percentage of capital, ideally below 1%.

- Diversify and Hedge: Consider multiple markets and strategies to spread risk.

- Analyze Timing: Trade during killzones and avoid impulsive entries.

- Educate Yourself: Leverage ICT strategies to align with smart money practices.

By mimicking institutional risk management techniques, retail traders can increase their chances of consistent profitability while minimizing unnecessary losses.

Leave a Reply