Forex trading in India is subject to strict regulations imposed by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI).

While it is legal, there are significant restrictions on how it can be conducted, who can participate, and which currency pairs can be traded.

1. Legal Aspects of Forex Trading in India

1. Trading Only INR-Paired Currencies is Legal

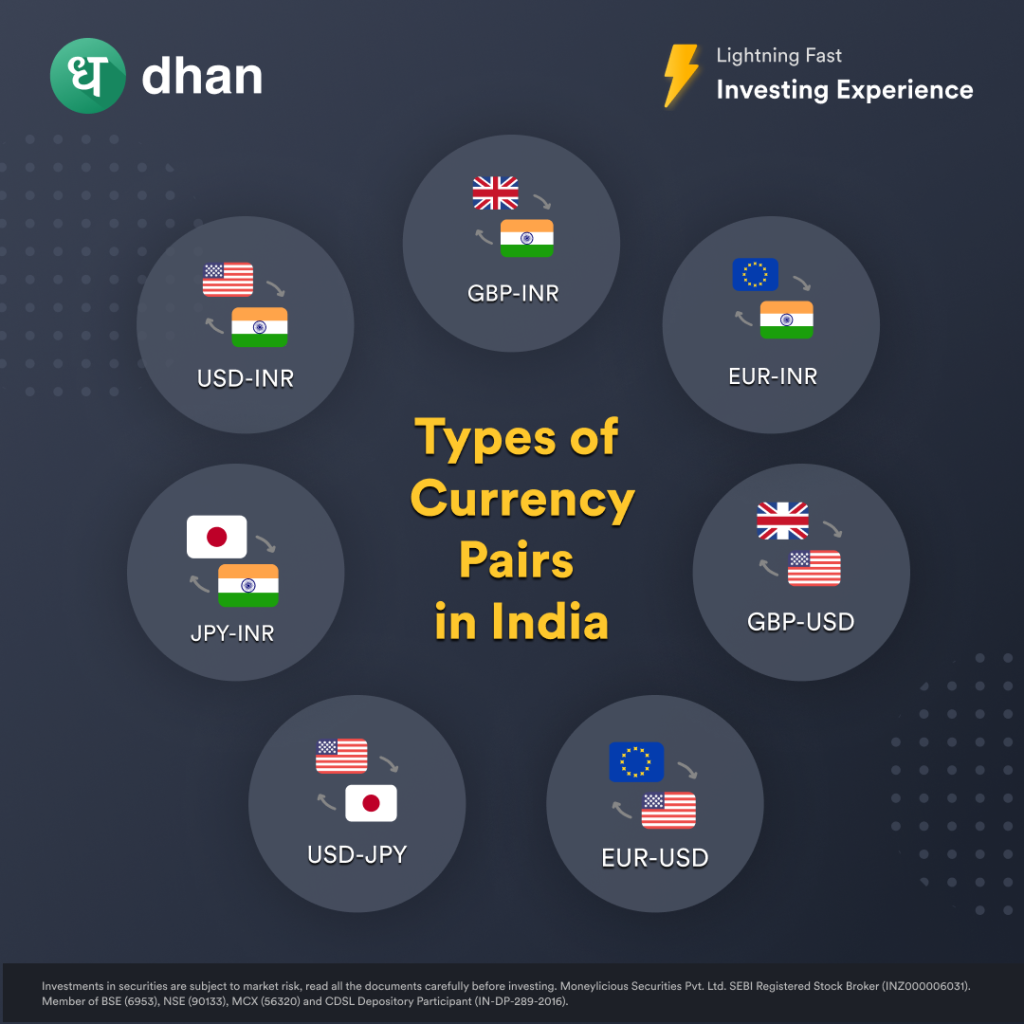

The RBI and SEBI allow Indian residents to trade only in currency pairs that include the Indian Rupee (INR). These pairs are:

- USD/INR (US Dollar – Indian Rupee)

- EUR/INR (Euro – Indian Rupee)

- GBP/INR (British Pound – Indian Rupee)

- JPY/INR (Japanese Yen – Indian Rupee)

These trades must be executed on SEBI-regulated exchanges like:

- National Stock Exchange (NSE)

- Bombay Stock Exchange (BSE)

- Multi Commodity Exchange (MCX-SX)

Example:

If an Indian trader wants to trade the USD/INR currency pair, they must do so through a registered broker on the NSE or BSE, rather than through an international forex broker.

2. Trading Non-INR Pairs is Illegal for Indian Residents

Indian traders cannot legally trade forex pairs that do not involve INR, such as:

- EUR/USD

- GBP/USD

- USD/JPY

This restriction exists because the Foreign Exchange Management Act (FEMA), 1999 prohibits unregulated forex transactions that could impact India’s foreign exchange reserves.

Example:

If an Indian trader tries to trade EUR/USD using an international broker like Exness or IC Markets, they are violating FEMA regulations, which could lead to legal consequences.

3. Use of Foreign Brokers is Illegal in India

Indian traders are not allowed to use offshore forex brokers that provide access to high-leverage and unrestricted forex pairs.

Some international platforms operate illegally in India, but using them can result in:

- Account freezing by Indian banks

- Legal penalties under FEMA

- Loss of funds with no legal protection

Example:

An Indian trader deposits money on a foreign forex platform like XM or OctaFX, which allows them to trade EUR/USD.

This is a direct violation of FEMA.

If the broker refuses withdrawals, Indian authorities will not be able to intervene, as the company is not registered in India.

4. Legal Ways to Trade Forex in India

Indian residents can legally trade forex by:

- Using SEBI-regulated brokers like Zerodha, Upstox, or Angel One.

- Trading only INR currency pairs on NSE, BSE, or MCX-SX.

- Using authorized banks and institutions for forex transactions.

Example:

A professional trader in India trades USD/INR on NSE using Zerodha.

This is completely legal since the broker is regulated by SEBI and the trade involves an INR currency pair.

5. International Forex Trading via LRS (For NRIs & Institutional Traders)

The Liberalized Remittance Scheme (LRS) allows individuals to send up to $250,000 per year abroad, which some traders use for forex trading. However:

- LRS cannot be used for margin-based forex trading.

- Banks can reject transactions if they suspect forex trading activity.

Example:

An Indian trader deposits funds into a foreign broker under LRS.

If the bank detects margin trading, they may block the transaction and report it to the RBI.

2. What Happens If You Trade Forex Illegally in India?

Trading forex through unauthorized platforms can result in:

- Frozen bank accounts (Banks monitor transactions to foreign brokers).

- FEMA violations, leading to legal action and hefty fines.

- Loss of funds, as offshore brokers are not accountable under Indian law.

Example:

A trader in Mumbai deposits ₹1 lakh on an offshore forex broker.

Later, they cannot withdraw their profits. Since the broker is unregulated in India, no legal action can be taken to recover funds.

3. Conclusion: Is Forex Trading Legal in India?

Yes, forex trading is legal in India but only under strict conditions:

- Trade only INR-based currency pairs (USD/INR, EUR/INR, GBP/INR, JPY/INR).

- Use SEBI-registered brokers and Indian exchanges (NSE, BSE, MCX-SX).

- Avoid international brokers and non-INR pairs to comply with FEMA.

Final Tip: If you’re in India and want to trade forex, always use a regulated Indian broker and stay within legal guidelines to avoid penalties.

Leave a Reply