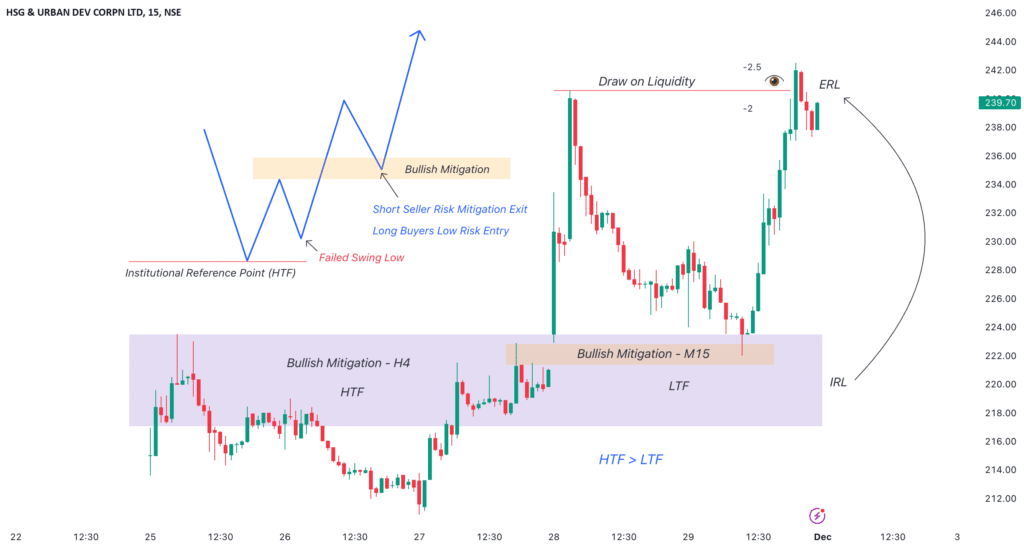

A Mitigation Block is a price level where Smart Money has to “mitigate” or cover their previous positions.

In simpler terms:

It’s a zone where institutional traders come back to close losing positions or rebalance their books after price moves strongly in the opposite direction.

This creates high-probability entry zones for us as retail traders.

1. Why Does a Mitigation Block Form in ICT?

Let’s say Smart Money (like big banks) entered a buy position, but the market moved lower instead of going up.

Later, when price returns to the original level of that buy, they exit or rebalance their earlier position.

This causes a reaction at that level, which can be used as a trading opportunity.

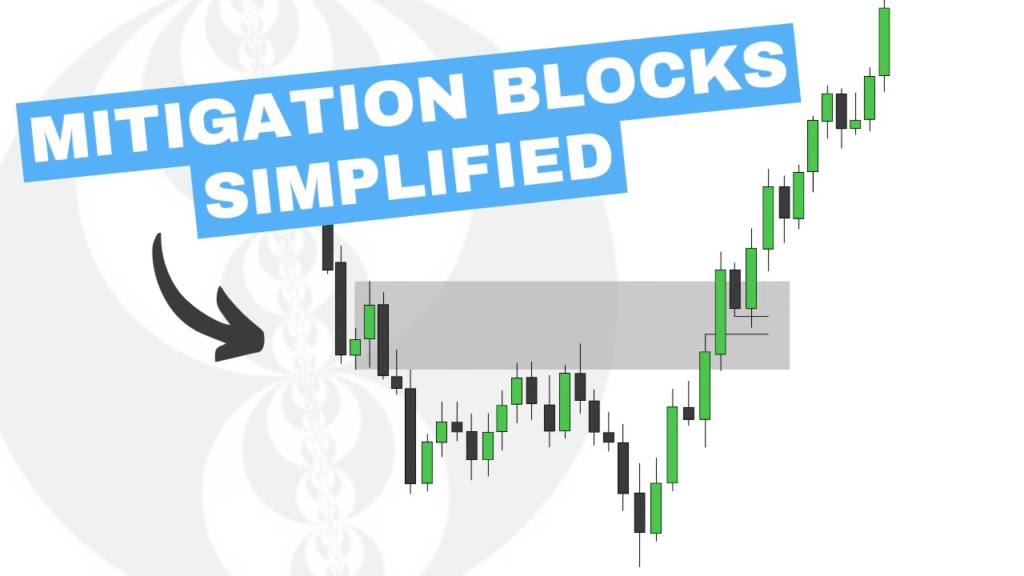

2. Key Idea behind Mitigation Block in ICT

A Mitigation Block is:

- The opposite candle before a strong displacement

- Acts like a hidden support or resistance zone

- Often overlaps with a Fair Value Gap (FVG) or an Order Block

- Price usually reacts to it and continues in the direction of displacement

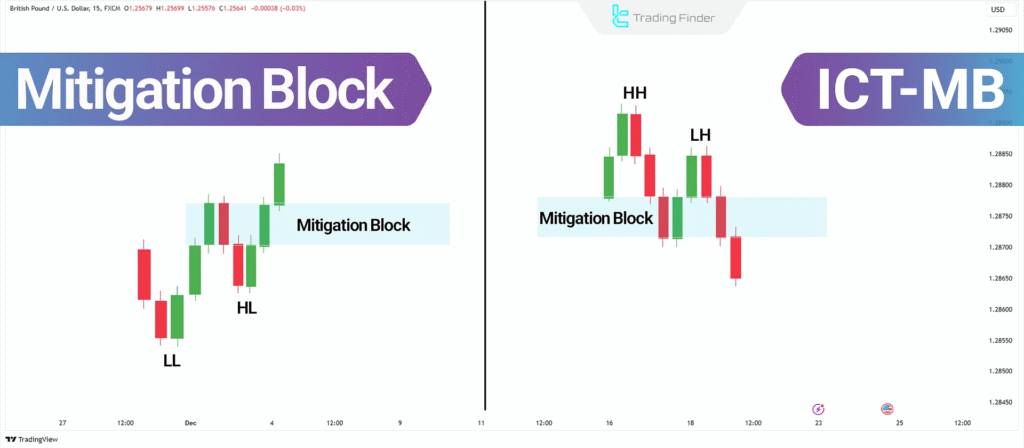

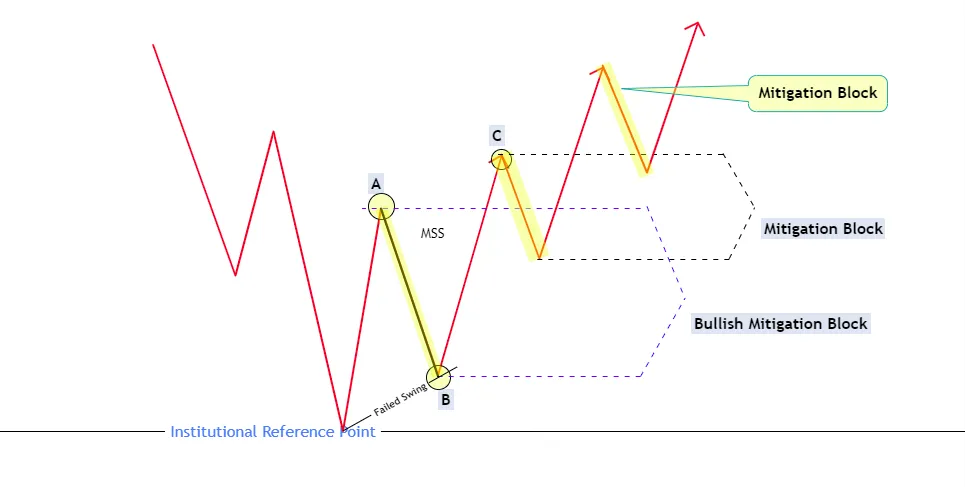

3. Bullish Mitigation Block Example in ICT

Imagine this price action:

- Market is bullish

- A bearish candle forms just before a strong bullish move

- That bearish candle is the Mitigation Block

- Later, price comes back down to that bearish candle

- The zone holds, and price moves up again

You can enter long at the mitigation block with a stop just below it.

1. Visualize This:

Strong Down Candle (Mitigation Block)

⬇️

Strong Bullish Move (Displacement)

⬆️

Price returns to the down candle

✅ Reaction → Entry Point

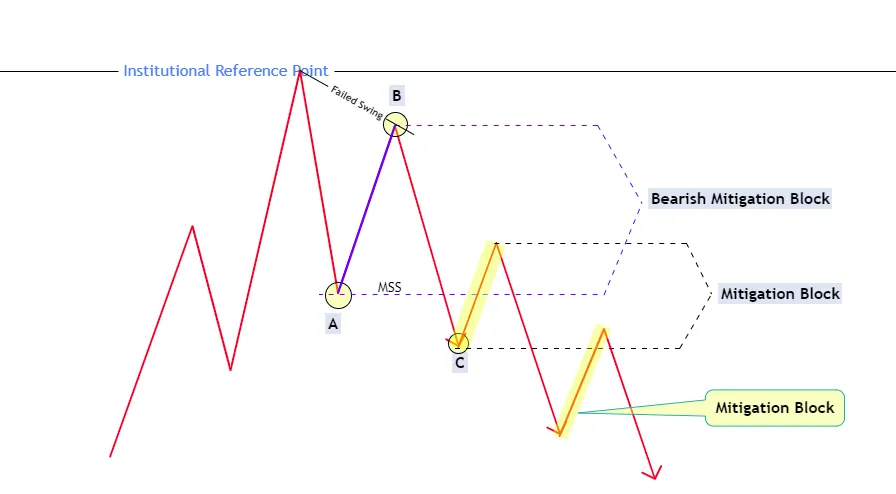

4. Bearish Mitigation Block Example in ICT

- Market is bearish

- A bullish candle forms just before a strong bearish move

- That bullish candle becomes the Mitigation Block

- Price later retraces up to that bullish candle

- It reacts and drops again

You can enter short at the mitigation block with a stop just above it.

1. Real Example – EUR/USD

- Let’s say EUR/USD breaks structure to the downside

- A strong bearish move follows, but right before that was a bullish candle

- That bullish candle becomes the bearish mitigation block

- Price comes back up to that candle

- Then drops again — that’s where Smart Money mitigated

- You take a short at that point

5. Difference Between Order Block and Mitigation Block in ICT

Many traders confuse the two. Here’s the difference:

| Order Block | Mitigation Block |

|---|---|

| Final up/down candle before a move that breaks structure | Opposite candle before displacement |

| Seen as a decision point | Seen as a rebalancing point |

| Stronger in HTFs | Seen more clearly on intraday or LTFs |

Sometimes, a mitigation block overlaps with an order block, making it even stronger.

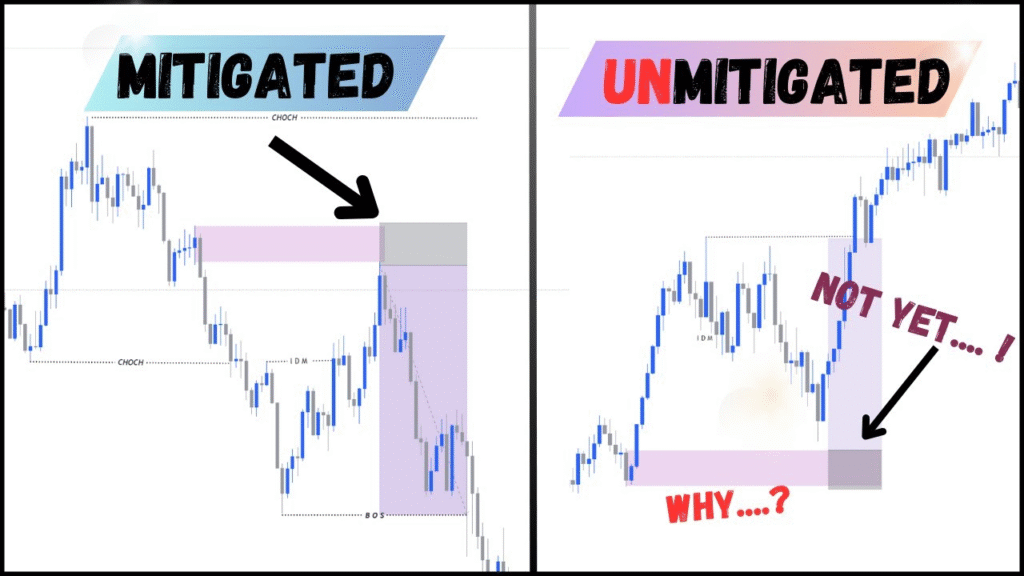

6. How to Trade ICT Mitigation Blocks

- Identify a strong move (displacement)

- Look at the opposite candle just before the move

- Mark that candle as your mitigation block

- Wait for price to return to that level

- Enter your trade on reaction or confirmation (e.g., breaker, FVG, CHoCH)

7. Tips for Success Trading Mitigation Block in ICT

- Combine mitigation blocks with market structure and liquidity concepts

- Use time-based confluences like Killzones

- Look for FVGs near the mitigation block

- Practice spotting them on 15M, 5M, or 1H charts

8. Final Thoughts

The Mitigation Block is one of ICT’s advanced Smart Money concepts.

It gives you insight into how institutions manage risk, and allows you to piggyback their actions.

When used correctly with market structure and liquidity, it becomes a powerful entry tool in your trading system.

Would you like a chart example or visual template of a mitigation block? I can create that next.

Leave a Reply