In Inner Circle Trader (ICT) strategies, order blocks play a significant role in predicting market reversals.

Order blocks represent areas where institutional traders place large buy or sell orders, and they can indicate when the market is about to change direction.

By understanding and identifying these order blocks, traders can anticipate major reversals and align themselves with the institutional flow of the market.

In this detailed explanation, we’ll discuss how to use order blocks to predict market reversals, the steps to identify these blocks, and provide examples to illustrate the concept.

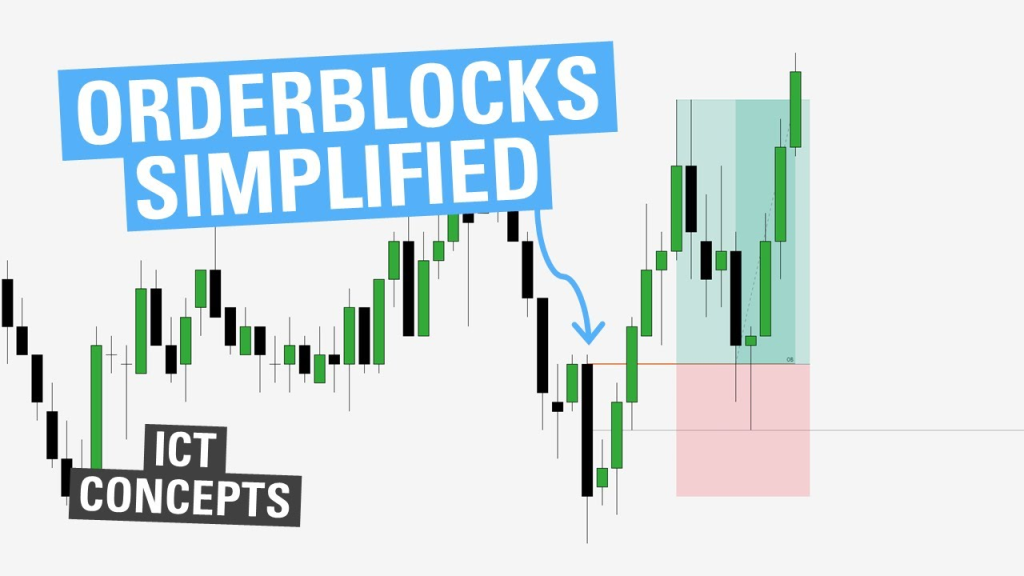

1. What is an Order Block?

An order block in ICT is the last bullish or bearish candle before a significant price movement in the opposite direction.

It represents an area where large institutions, also referred to as Smart Money, place their orders.

These institutional traders often leave traces of their activities in the form of order blocks.

Retail traders can use these clues to predict when a market reversal is likely to occur.

Order blocks are:

1. Bullish Order Blocks:

These indicate a potential upward reversal when the last bearish candle appears before a sharp upward move.

2. Bearish Order Blocks:

These signal a potential downward reversal when the last bullish candle appears before a sharp downward move.

2. Why Do Order Blocks Help Predict Market Reversals?

Order blocks help predict market reversals because they show where institutions have placed large orders.

Institutions cannot move the entire market in a single trade without causing significant price fluctuations, so they often execute their orders in phases.

When price returns to an order block, institutions are likely to re-enter their positions, causing the market to reverse or continue in the desired direction.

3. Key Points of Order Blocks for Reversals:

1. High-Volume Areas:

These blocks are often created in areas where large volumes of trades occur, signaling that institutions are active in the market.

2. Market Structure Shift:

Order blocks usually coincide with breaks in market structure, which indicate the beginning of a reversal.

3. Price Reaction:

When price returns to an order block, the market often reacts by reversing the trend as institutional traders re-enter the market.

4. Efficient Market Entry:

Identifying these areas allows traders to enter trades in alignment with Smart Money, improving the probability of success.

4. Steps to Use Order Blocks for Market Reversals

1. Identify the Last Opposing Candle Before a Significant Move

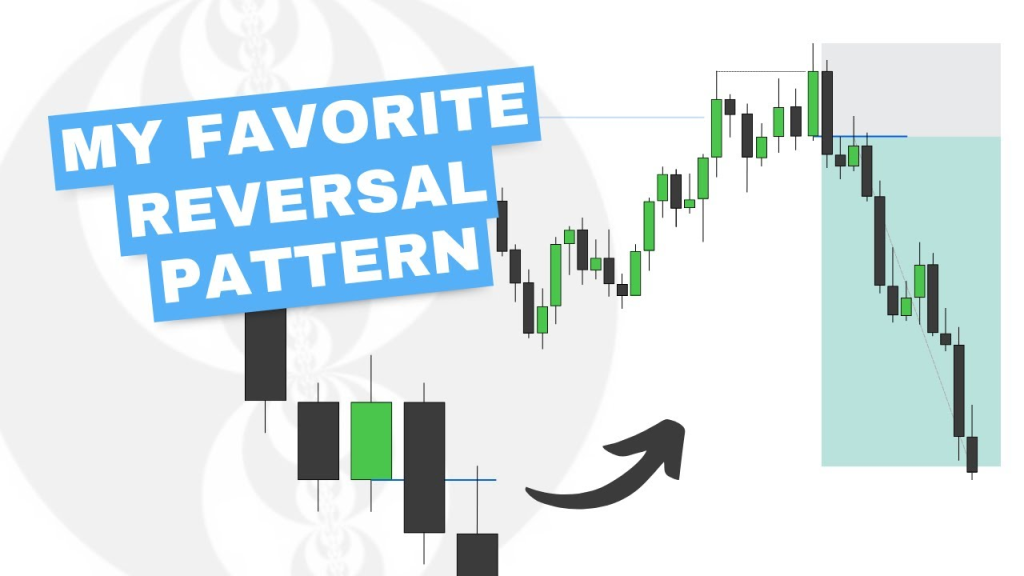

1. Bullish Reversal:

Find the last bearish candle before a strong upward move. This bearish candle represents a bullish order block.

2. Bearish Reversal:

Find the last bullish candle before a strong downward move. This bullish candle is a bearish order block.

2. Wait for a Market Return to the Order Block

Once the order block is identified, wait for the price to return to this level. The market may retrace to this area, signaling that institutional traders are likely to place additional orders, causing the price to reverse.

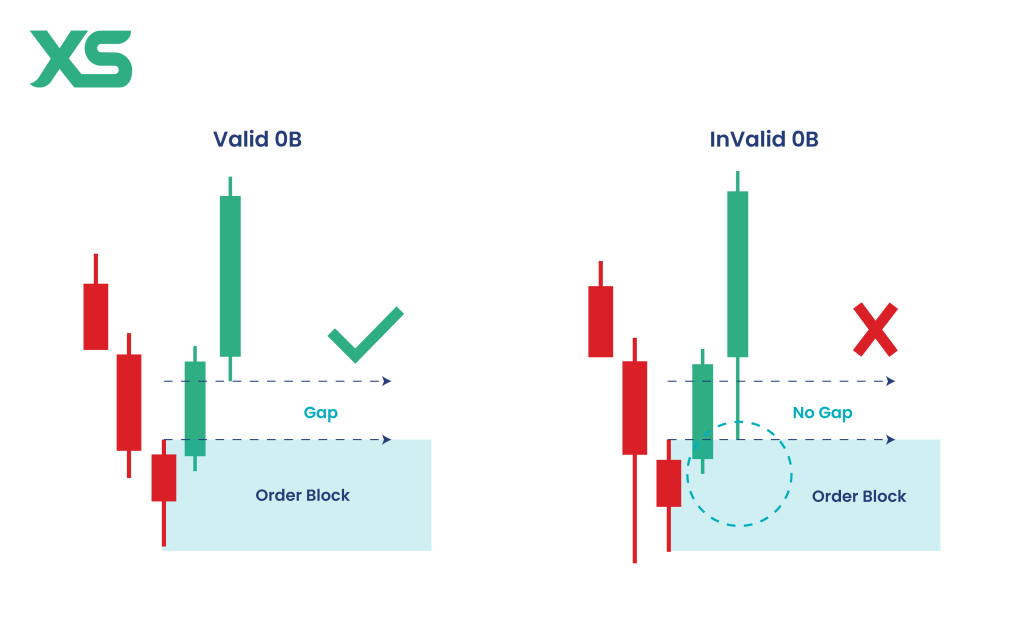

3. Confirm the Reversal with Price Action

When price reaches the order block, look for price action signals that confirm the reversal. These might include:

1. Engulfing patterns:

A strong candle that completely engulfs the previous one, indicating that institutional traders are active.

2. Pin bars:

Candles with long wicks showing rejection of lower (or higher) prices, confirming a reversal.

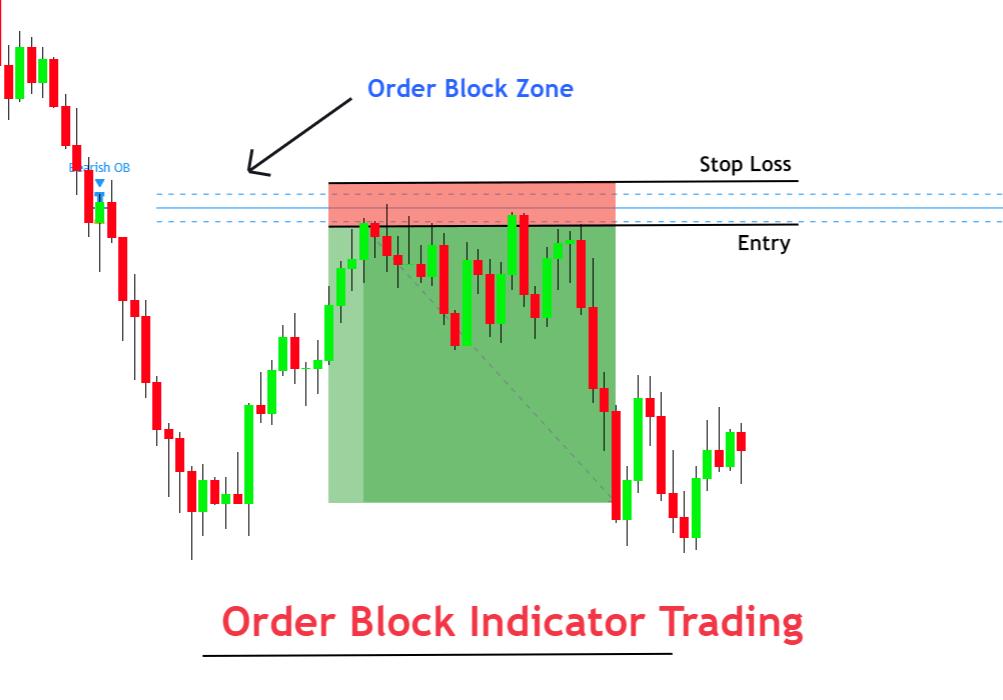

4. Enter the Trade

Once the reversal is confirmed, enter a trade in the direction of the reversal.

- Bullish Reversal: Enter a buy trade after confirming the bullish reaction at the order block.

- Bearish Reversal: Enter a sell trade after confirming the bearish reaction at the order block.

5. Set Stop-Loss and Target Levels

- Place your stop-loss just below the order block for a bullish reversal or above it for a bearish reversal.

- Target the next key level, such as a previous high, low, or liquidity pool, as your take-profit zone.

5. Example 1: Bullish Reversal Using a Bullish Order Block

Imagine the EUR/USD pair has been in a downtrend for several days. However, after making a new low, the market suddenly starts to rally.

The last bearish candle before this sharp rally forms a bullish order block.

1. Identification:

The last bearish candle before the rally is marked as a bullish order block.

2. Price Return:

After the rally, the price retraces and returns to this order block.

3. Confirmation:

When the price touches the order block, it forms a bullish engulfing candle, confirming that institutions are re-entering their long positions.

4. Entry:

The trader enters a buy trade, with a stop-loss below the order block and targeting the previous swing high.

The price reverses at the order block and continues upward, aligning with institutional buying.

6. Example 2: Bearish Reversal Using a Bearish Order Block

Consider the GBP/JPY pair in an uptrend. Before a sharp downward move, the last bullish candle forms a bearish order block.

1. Identification:

The last bullish candle before the significant downward move is marked as a bearish order block.

2. Price Return:

After the downward move, the price retraces and returns to this order block.

3. Confirmation:

As the price reaches the order block, a bearish pin bar forms, indicating rejection of higher prices and confirming the institutions are re-entering their short positions.

4. Entry:

The trader enters a sell trade, with a stop-loss above the order block and targeting the next liquidity pool or swing low.

The price reverses at the bearish order block and continues downward.

7. How to Combine Order Blocks with Other ICT Concepts

Order blocks can be even more powerful when combined with other ICT concepts, such as:

1. Market Structure:

Reversals are more significant when they coincide with breaks in market structure.

2. Liquidity Pools:

Institutions often target liquidity pools when initiating reversals, so placing trades near these pools can increase success rates.

3. Fair Value Gaps (FVG):

These gaps often occur near order blocks and can provide additional confirmation for reversals.

8. Why Order Blocks Are Reliable for Reversals in ICT

Order blocks are reliable because they represent areas where institutional traders are active.

Retail traders often fail to predict reversals because they focus on lagging indicators, while institutional traders are already planning their next move.

By aligning with the institutional flow through order blocks, ICT traders can anticipate and take advantage of market reversals earlier than retail traders.

9. Conclusion

Order blocks offer a highly effective way to predict market reversals in ICT strategies.

By understanding how institutional traders place their large orders and identifying the last opposing candle before a major move, traders can find high-probability reversal points in the market.

Combining order blocks with price action signals and other ICT concepts further improves the accuracy of these trades.

Key takeaways:

- Order blocks are formed by the last bullish or bearish candle before a significant price move.

- These areas often indicate where institutional traders placed large orders, signaling a potential market reversal.

- Waiting for price confirmation at the order block improves the likelihood of a successful trade.

- Combining order blocks with other ICT concepts increases trading accuracy and profitability.

Mastering order blocks in ICT can give traders a powerful edge in predicting market reversals and trading alongside Smart Money.

Leave a Reply