The Rally Base Rally (RBR) is a bullish continuation pattern commonly used in Inner Circle Trader (ICT) concepts to identify areas where smart money is accumulating positions before driving the price higher.

It is a key pattern in price action and institutional trading, helping traders spot potential buying opportunities in a strong uptrend.

1. What is a Rally Base Rally (RBR) Pattern in ICT?

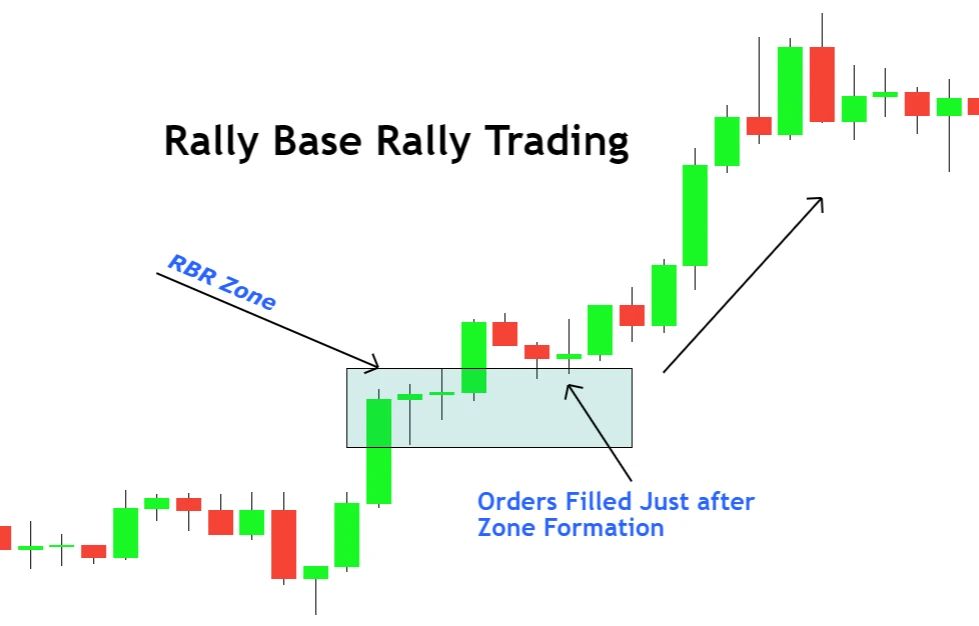

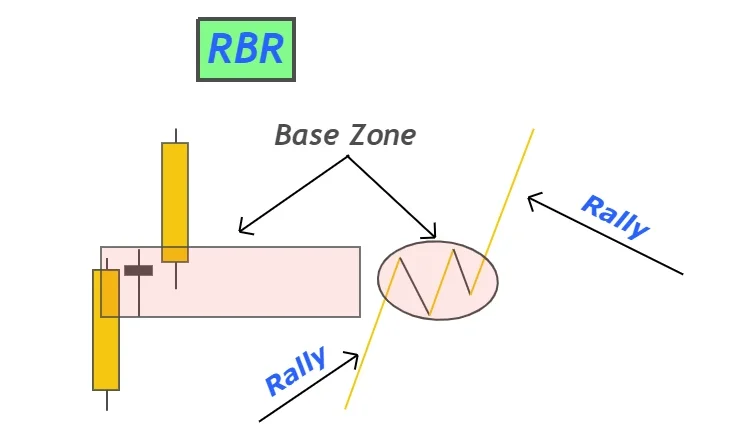

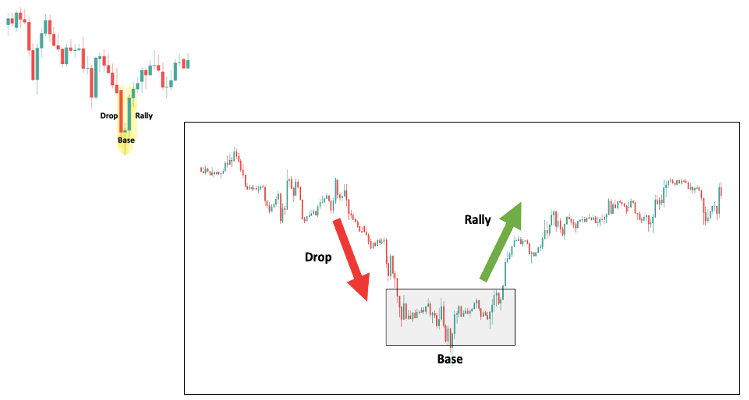

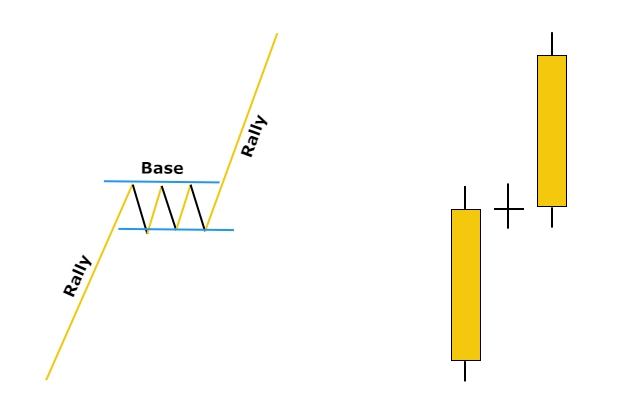

A Rally Base Rally (RBR) pattern consists of three main phases:

- Rally: A strong upward price movement.

- Base: A small consolidation or pause in price, where accumulation takes place.

- Rally: A continuation of the upward trend after the base is formed.

This pattern represents smart money accumulation at a particular price level before price continues in the intended direction.

The base is crucial because it signifies an area of interest where institutions place buy orders.

2. Characteristics of a Rally Base Rally Pattern in ICT

- Strong upward move before the base (bullish momentum).

- A narrow-range base (small consolidation) with minimal downward movement.

- The second rally moves past the high of the first rally, confirming continuation.

- Liquidity pools form below the base, acting as support for future retests.

This pattern typically appears at key Fair Value Gaps (FVGs), Order Blocks (OBs), or Institutional Reference Points (IRPs) in ICT methodology.

3. How to Identify a Rally Base Rally in ICT?

Step 1: Find a Strong Bullish Rally

- Look for a sharp bullish move where price forms a strong bullish candle sequence.

- This move usually happens after a liquidity grab or a Judas Swing during key trading sessions like the London Open or New York Open.

Step 2: Spot the Base Formation

- The price pauses or consolidates after a strong rally, forming a small range with multiple wicks.

- This base is usually near an order block, fair value gap, or breaker block.

Step 3: Wait for the Next Rally Confirmation

- The second rally must break past the previous high, confirming that the bullish trend is continuing.

- If price returns to the base and finds support, it provides a high-probability entry for buying.

4. Examples of Rally Base Rally in ICT

Example 1: RBR in GBP/USD on a 15-Minute Chart

- The price rallies from 1.2800 to 1.2850 with strong bullish momentum.

- The price then consolidates between 1.2835 and 1.2845, forming a base.

- After a brief pause, the price rallies again to 1.2900, continuing the uptrend.

- The base at 1.2835 acts as a support zone, where traders look for a retracement entry.

Trade Entry: Place a buy limit order at 1.2835 with stop-loss below the base at 1.2825 and target 1.2900.

Example 2: RBR in EUR/USD on a 1-Hour Chart

- EUR/USD breaks above 1.1000 with strong bullish candles.

- Price forms a base at 1.1020, consolidating in a tight range.

- Liquidity grabs below the base signal that smart money is accumulating.

- The price then rallies to 1.1080, confirming the continuation.

Trade Entry: Enter on a pullback to the base (1.1020-1.1030), with a stop-loss at 1.1010 and a take-profit at 1.1080.

5. How to Trade the Rally Base Rally Pattern in ICT?

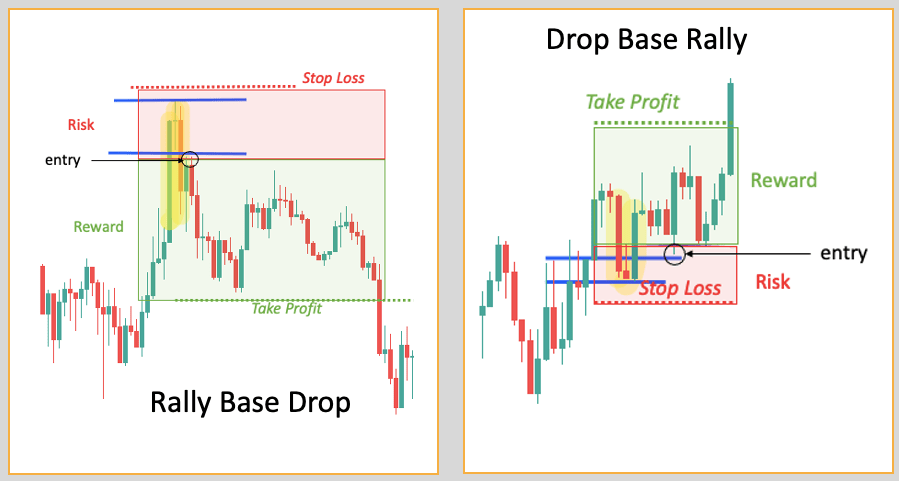

1. Entry Strategy:

- Enter after a bullish retracement to the base or on confirmation of the breakout.

- Use Fair Value Gaps (FVGs) and Order Blocks (OBs) to refine entries.

- Wait for a liquidity sweep below the base before taking a buy position.

2. Stop-Loss Placement:

- Place stop-loss below the base to protect against false breakouts.

- Use a previous swing low or institutional level for better risk management.

3. Take-Profit Strategy:

- First Target: High of the first rally.

- Second Target: Next liquidity zone or a higher timeframe order block.

6. Final Thoughts

The Rally Base Rally (RBR) pattern is a powerful bullish continuation structure in ICT trading.

It helps traders identify smart money accumulation zones and capitalize on high-probability buying opportunities.

By combining this pattern with liquidity concepts, Fair Value Gaps (FVGs), and institutional trading strategies, traders can increase their accuracy and improve trade execution.

Key Takeaways:

- Look for strong bullish rallies followed by a small consolidation base.

- Wait for a retracement to the base or confirmation breakout.

- Use FVGs, Order Blocks, and liquidity sweeps to refine trade entries.

- Place stop-loss below the base and target the next liquidity zone.

By mastering this pattern, traders can trade in sync with institutional order flow, improving trade accuracy and profitability.

Leave a Reply