In ICT (Inner Circle Trader) strategies, reversal and continuation patterns play crucial roles in recognizing shifts in market direction and momentum.

These patterns reflect how institutional trading activity might influence the market, allowing traders to align their strategies with the “smart money.”

Understanding these patterns can help in identifying potential entry and exit points with higher probabilities.

1. Reversal Patterns in ICT

Reversal patterns indicate potential shifts in market direction, often signaling the end of a trend and the beginning of a new trend in the opposite direction.

In ICT, these patterns are particularly meaningful when they coincide with key institutional levels or liquidity zones.

Common Reversal Patterns

a) ICT Swing Highs and Swing Lows

Swing High: A peak point in the price action, usually indicating a potential turn from bullish to bearish momentum.

Swing Low: A low point indicating a potential shift from bearish to bullish momentum.

Example: In an uptrend, if GBP/USD forms a swing high near a significant resistance or institutional order block, it might indicate that institutions are starting to take profits or place sell orders, suggesting a reversal could be imminent.

b) Change of Character (CHOCH)

CHOCH is one of the primary signals of a reversal in ICT.

It represents a shift from bullish to bearish structure or vice versa.

Example: Suppose EUR/USD has been trending upwards, and a bullish swing high is followed by a lower low (indicating CHOCH).

This shift in character suggests institutions might be reversing positions, setting up for a new downtrend.

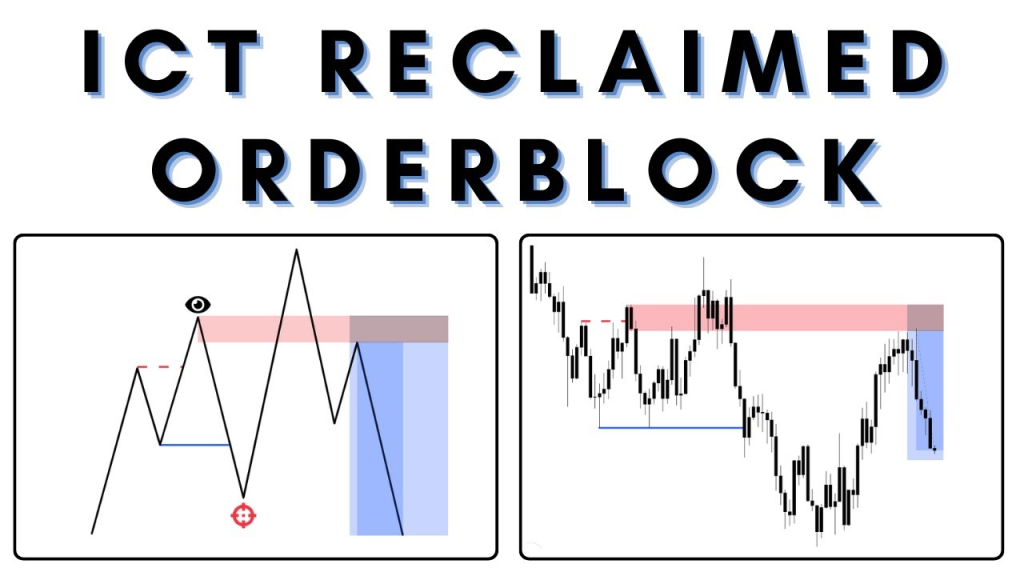

c) Order Blocks and Reclaimed Order Blocks

When price reverses and returns to an old order block (reclaimed order block), it often signifies a potential reversal.

Example: Price on USD/JPY touches an order block on a higher timeframe, reverses back, and retests the block.

The reclaimed order block can be used to confirm a reversal in line with institutional trading behavior.

d) Using Reversal Patterns with ICT Concepts

Align reversal patterns with liquidity levels (e.g., stop hunts, liquidity sweeps).

Look for reversals near key kill zones, such as the London or New York open, when institutional players are active.

2. Continuation Patterns in ICT

Continuation patterns suggest that the prevailing trend is likely to continue.

These patterns are crucial for traders who want to capitalize on institutional momentum instead of betting against it.

Continuation patterns are often used to identify re-entry points in an ongoing trend, which institutional traders tend to manipulate.

Common Continuation Patterns

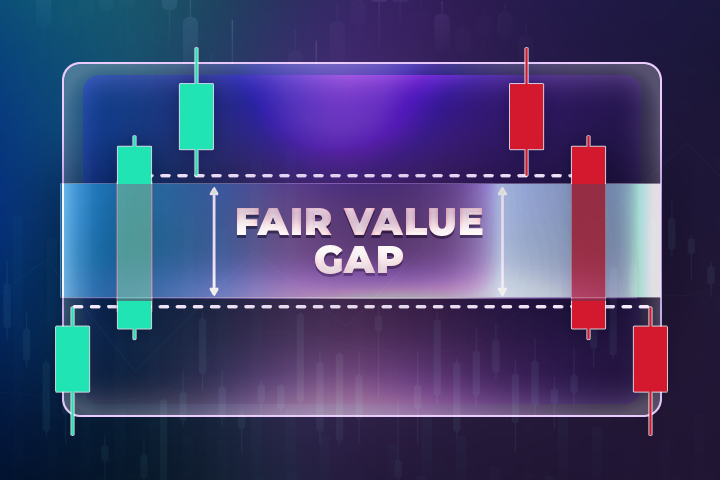

a) Fair Value Gaps (FVGs)

A Fair Value Gap, or imbalance, occurs when price moves quickly, leaving a gap between candles on the chart.

Institutions often target these gaps for entries in the trend’s direction, filling them as they add liquidity to continue the trend.

Example: In an uptrend on EUR/USD, a sharp bullish candle creates an FVG.

When price retraces to this gap and finds support, it suggests that institutions may be adding positions, reinforcing the uptrend.

b) Break of Structure (BOS)

A BOS confirms a continuation when price breaks a recent high (in an uptrend) or low (in a downtrend).

It confirms that the institutional momentum in the trend direction remains strong.

Example: If GBP/USD breaks a previous swing high, then retraces to a demand zone or FVG, this BOS supports the notion of trend continuation, allowing for entry at a more favorable price point.

c) Liquidity Pools (Buy and Sell Stops)

In continuation scenarios, liquidity pools serve as areas where institutions might build more positions.

For instance, in an uptrend, institutions might push price down temporarily to trigger sell stops before moving price higher.

Example: For a long-term uptrend in EUR/USD, institutions may push price down to hit a liquidity pool of sell stops, filling their orders at lower prices before driving price back up to continue the trend.

3. Practical Examples of Reversal and Continuation Patterns in ICT

Example 1: EUR/USD Reversal Using a Swing High and CHOCH

- Identify Swing High: EUR/USD forms a swing high at 1.1500 after an extended uptrend.

- Confirm CHOCH: Price breaks below a recent higher low, indicating a change of character (CHOCH) and signaling a potential reversal to the downside.

- Reclaimed Order Block: Price retests the last bullish order block, providing a confirmation of the reversal, and traders can enter short with a stop above the reclaimed block.

Example 2: USD/JPY Continuation Pattern Using BOS and FVG

- Identify BOS: USD/JPY breaks above a recent high, establishing the ongoing uptrend.

- Spot FVG: A Fair Value Gap forms during the uptrend. Price retraces to this gap, indicating that institutional buyers might be re-entering.

- Enter Long: A continuation trade entry is placed at the FVG with a stop below the gap, aligning with the uptrend continuation.

4. Best Practices for Trading Reversal and Continuation Patterns in ICT

Trade in High Volume Sessions: Both reversals and continuations are most reliable during peak sessions like London and New York Opens.

Combine with Institutional Levels: Look for confluence with order blocks, liquidity pools, and fair value gaps.

Patience and Confirmation: For reversals, wait for a clear CHOCH or reclaimed order block.

For continuations, confirm with a BOS or retest of liquidity zones.

5. Summary

In ICT, reversal and continuation patterns are integral for aligning trades with institutional moves.

Reversal patterns help traders spot shifts in trends, particularly near key levels like swing highs, swing lows, and reclaimed order blocks.

Continuation patterns allow traders to ride ongoing trends by recognizing setups like BOS and FVGs, which indicate institutional support for the prevailing trend.

Mastery of these patterns can help traders achieve a balanced approach to entries and exits, optimizing trade success.

Leave a Reply