Identifying the top forex traders in the USA and understanding their unique market strategies provides valuable insights into successful trading methodologies.

Below is a list of notable traders, their backgrounds, and the distinctive edges they employ in the forex markets:

1. George Soros

Background: Renowned as “The Man Who Broke the Bank of England,” Soros is a legendary figure in currency trading.

Unique Edge: Soros capitalizes on macroeconomic imbalances and policy shifts.

His most famous trade involved shorting the British pound in 1992, anticipating the UK’s exit from the European Exchange Rate Mechanism, resulting in a profit exceeding $1 billion.

2. Paul Tudor Jones

Background: Founder of Tudor Investment Corporation, Jones is a prominent hedge fund manager with a focus on global macro trading.

Unique Edge: Jones combines technical analysis with macroeconomic insights to predict market movements.

He is known for his adeptness in identifying market inflection points and effectively managing risk.

3. Stanley Druckenmiller

Background: A protégé of George Soros, Druckenmiller managed the Quantum Fund and later founded Duquesne Capital.

Unique Edge: Druckenmiller employs a top-down investment approach, focusing on macroeconomic trends and capitalizing on currency valuations influenced by interest rate differentials and economic policies.

4. Bruce Kovner

Background: Founder of Caxton Associates, Kovner is a notable figure in the hedge fund industry with significant success in forex trading.

Unique Edge: Kovner utilizes a combination of fundamental analysis and technical indicators, emphasizing disciplined risk management and leveraging global economic insights to inform his trading decisions.

5. Andrew Krieger

Background: Gained prominence at Bankers Trust in the late 1980s with aggressive currency trading strategies.

Unique Edge: Krieger is known for identifying overvalued currencies and executing large-scale trades to exploit these discrepancies, notably his significant short position against the New Zealand dollar in 1987.

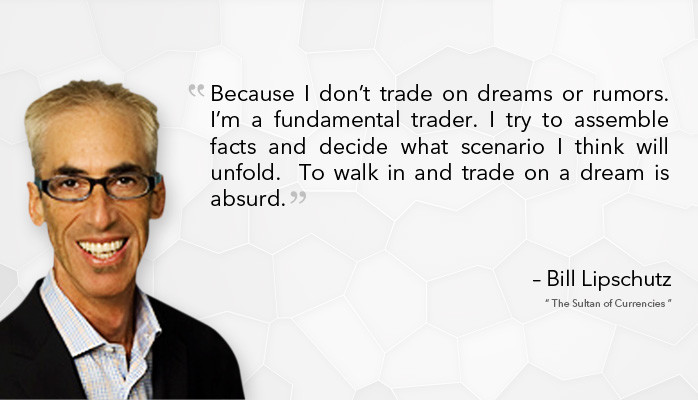

6. Bill Lipschutz

Background: A prominent forex trader who managed substantial portfolios at Salomon Brothers and later co-founded Hathersage Capital Management.

Unique Edge: Lipschutz emphasizes the importance of market sentiment and psychology, combining technical analysis with an understanding of market participants’ behaviors to inform his trading strategies.

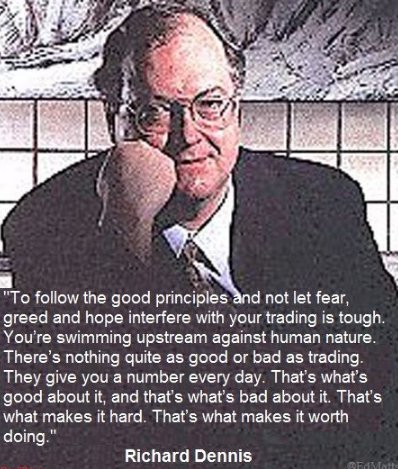

7. Richard Dennis

Background: Co-creator of the “Turtle Trading” experiment, Dennis is a commodities trader with significant influence in trading education.

Unique Edge: Dennis advocates for trend-following strategies, utilizing systematic approaches to capture sustained market movements, and emphasizes the importance of disciplined risk management.

8. John R. Taylor Jr.

Background: Founder of FX Concepts, a pioneering currency hedge fund specializing in forex market strategies.

Unique Edge: Taylor integrates quantitative models with macroeconomic analysis, focusing on systematic trading strategies that leverage statistical patterns and economic indicators.

9. Michael Marcus

Background: A founding member of the Commodities Corporation and a mentor to several successful traders.

Unique Edge: Marcus employs a blend of technical analysis and fundamental insights, with a focus on understanding market psychology and maintaining flexibility in trading approaches.

10. Paul Rotter

Background: Known as the “Flipper,” Rotter is a trader who gained recognition for his rapid trading strategies in the bond futures market.

Unique Edge: Rotter utilizes high-frequency trading techniques, capitalizing on short-term market inefficiencies and liquidity imbalances, often executing numerous trades within short time frames.

These traders have demonstrated exceptional skill in navigating the complexities of the forex markets, each employing unique strategies that leverage their understanding of macroeconomic factors, technical analysis, market psychology, and disciplined risk management.

Leave a Reply