RSI (Relative Strength Index) divergence is a powerful concept that traders often use to identify potential reversals in price movements.

When applied in conjunction with ICT (Inner Circle Trader) strategies, RSI divergence becomes even more potent, as it aligns with institutional concepts like liquidity sweeps, fair value gaps (FVGs), and order blocks.

Here’s how to effectively trade RSI divergence within the ICT framework.

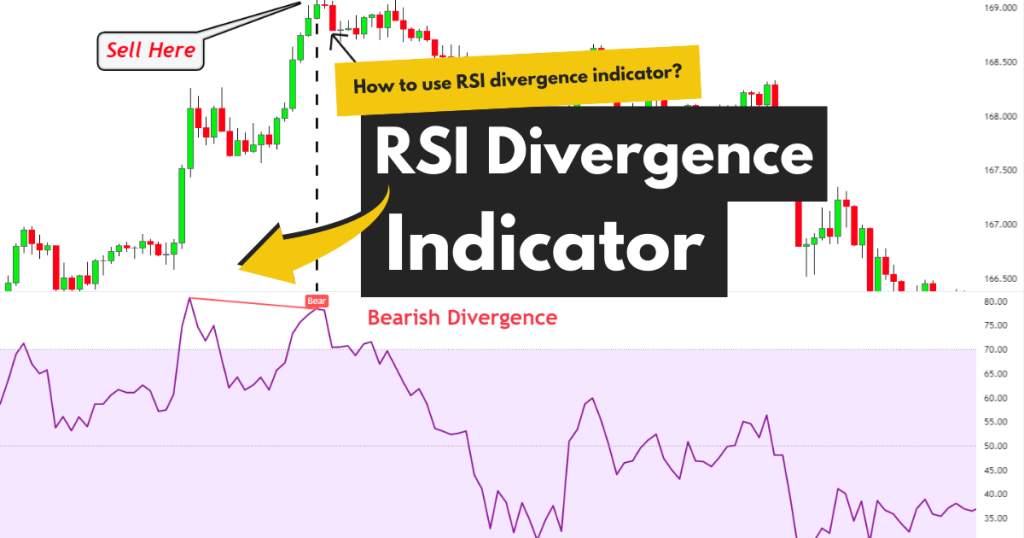

1. What is RSI Divergence?

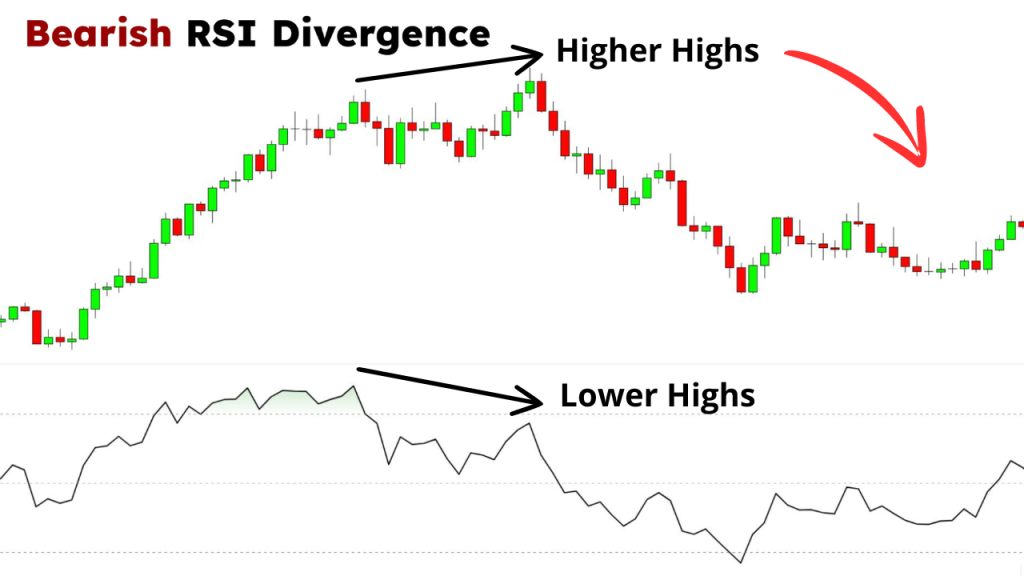

RSI divergence occurs when the price of an asset and its RSI indicator move in opposite directions:

- Bullish Divergence: Price forms lower lows, but RSI forms higher lows, signaling potential upward momentum.

- Bearish Divergence: Price forms higher highs, but RSI forms lower highs, signaling potential downward momentum.

In ICT, these divergences often align with areas of liquidity, order blocks, or other market structure elements.

2. Steps to Trade RSI Divergence in ICT

1. Identify Divergence in Confluence with ICT Concepts

Look for bullish or bearish divergence at key ICT zones:

- Near liquidity pools where price is expected to reverse after a sweep.

- Around significant order blocks that align with institutional activity.

- In areas of fair value gaps, suggesting price rebalancing.

2. Confirm Market Structure

Use ICT principles to confirm market structure:

- Look for a break of structure (BOS) in the direction of the divergence.

- Combine the RSI signal with ICT tools like the optimal trade entry (OTE) to refine entry points.

3. Entry Strategy

Enter trades at high-probability zones:

- For bullish divergence: Enter after price reacts positively to a bullish order block.

- For bearish divergence: Enter after price reacts negatively to a bearish order block.

4. Define Stop Loss and Take Profit Levels

- Place stop loss below/above the identified order block or liquidity zone.

- Target take profits at opposing liquidity zones or significant market structure levels.

3. Example 1: Bullish Divergence

1. Scenario: EUR/USD Pair

- Price Action: Price makes a lower low at 1.1050, sweeping liquidity below a previous low.

- RSI: Forms a higher low, signaling bullish divergence.

- ICT Context: A bullish order block is visible at 1.1035–1.1050, and price shows signs of rejection.

- Trade Execution:

- Entry: Buy at 1.1060 after a confirmation candle above the order block.

- Stop Loss: 1.1030 (below the order block).

- Take Profit: 1.1120, targeting the next liquidity pool.

2. Outcome:

Price rallies as expected, validating the confluence of RSI divergence and ICT strategies.

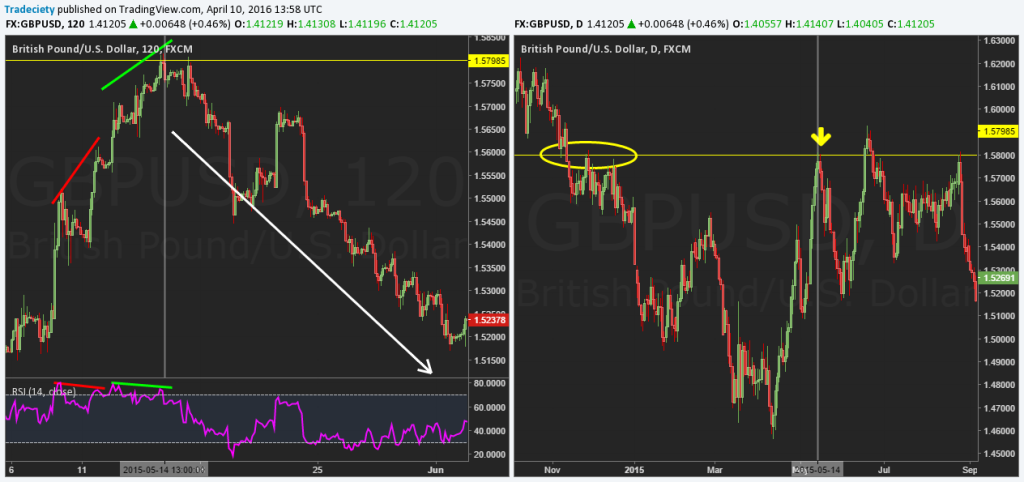

4. Example 2: Bearish Divergence

1. Scenario: GBP/USD Pair

- Price Action: Price makes a higher high at 1.3200, targeting buy-side liquidity.

- RSI: Forms a lower high, indicating bearish divergence.

- ICT Context: A bearish order block is identified at 1.3180–1.3200, and price shows rejection.

- Trade Execution:

- Entry: Sell at 1.3185 after rejection from the order block.

- Stop Loss: 1.3220 (above the order block).

- Take Profit: 1.3100, targeting sell-side liquidity.

2. Outcome:

Price declines sharply, confirming the bearish divergence and order block alignment.

5. Tips for Effective RSI Divergence Trading in ICT

1. Combine Divergence with Institutional Concepts:

Always align RSI signals with ICT zones like liquidity pools, FVGs, or order blocks for higher probability setups.

2. Avoid Overbought/Oversold Traps:

RSI overbought/oversold conditions alone aren’t reliable; use them in conjunction with divergence and ICT analysis.

3. Monitor Killzones:

Enter trades during ICT killzones (e.g., London Open, New York Open) for higher accuracy.

4. Use Confirmation Tools:

Wait for BOS, liquidity sweeps, or rejection from order blocks before entering trades.

6. Common Mistakes to Avoid while Trading RSI Divergence in ICT

1. Ignoring Market Structure:

Divergence without proper market context (like BOS or liquidity sweeps) can lead to false signals.

2. Trading Divergence in Isolation:

RSI divergence alone doesn’t guarantee success; it must align with ICT principles.

3. Poor Risk Management:

Always set appropriate stop loss and take profit levels based on ICT strategies.

7. Conclusion

RSI divergence is a valuable tool for spotting potential reversals in trading, and when integrated with ICT concepts, it can significantly enhance trading accuracy.

By aligning divergence signals with market structure, liquidity zones, and order blocks, traders can achieve precise entries and exits.

Use a disciplined approach, combine ICT and RSI signals, and regularly review trades for consistent improvement.

Leave a Reply