Refining your trading strategy using advanced Inner Circle Trader (ICT) techniques involves mastering key concepts such as institutional order flow, liquidity, and precision entries.

This ensures higher accuracy, better risk management, and consistent profitability.

Below is a detailed explanation of how to incorporate these techniques effectively, with examples.

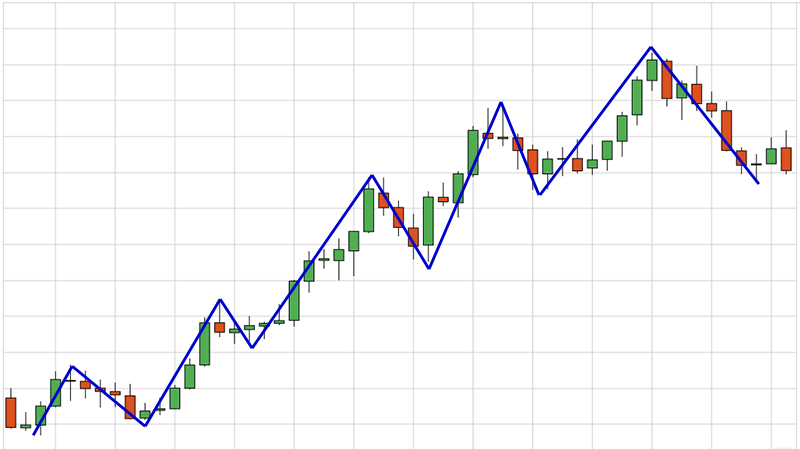

1. Mastering Market Structure and Price Action in ICT

Understanding market structure is fundamental to ICT.

Advanced traders focus on identifying break of structure (BOS) and change of character (CHOCH) to pinpoint trend reversals or continuations.

Example:

If GBP/USD shows a BOS on the H1 timeframe after taking out a key liquidity zone, it indicates a potential trend reversal.

Refine your entry by waiting for a retracement to an order block near the BOS.

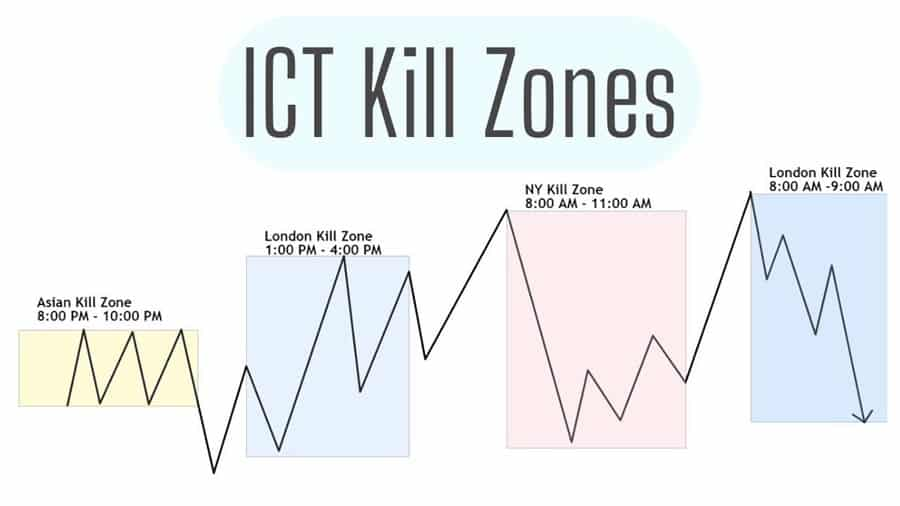

2. Incorporating ICT Killzones in ICT

Killzones are specific time periods during major market sessions (e.g., London Open, New York Open) where institutional activity is heightened.

Example:

During the London Open (2 AM – 5 AM EST), look for liquidity sweeps near key levels.

If EUR/USD sweeps liquidity below a support level and forms a bullish order block, enter a long trade within the killzone for optimal timing.

3. Using Optimal Trade Entry (OTE) in ICT

The OTE pattern allows traders to enter trades at high-probability levels by focusing on retracements.

1. Steps to Use OTE:

- Identify the impulse leg of a trend.

- Use the Fibonacci tool to measure the leg.

- Look for price retracements to the 61.8%-79% zone for entry.

2. Example:

On USD/JPY, a strong bullish move from 140.00 to 141.00 retraces to 140.30 (within the OTE zone).

Enter long at 140.30 with a stop-loss below 140.00 and target 141.50.

4. Identifying Liquidity Pools and Raids in ICT

Advanced ICT traders focus on liquidity pools to anticipate price movements.

These pools are areas where stop-loss orders or pending orders are clustered.

Example:

If AUD/USD consolidates near 0.6800, a liquidity pool may exist above 0.6820 (buy stops) and below 0.6780 (sell stops).

Monitor price action to identify a liquidity raid followed by a reversal.

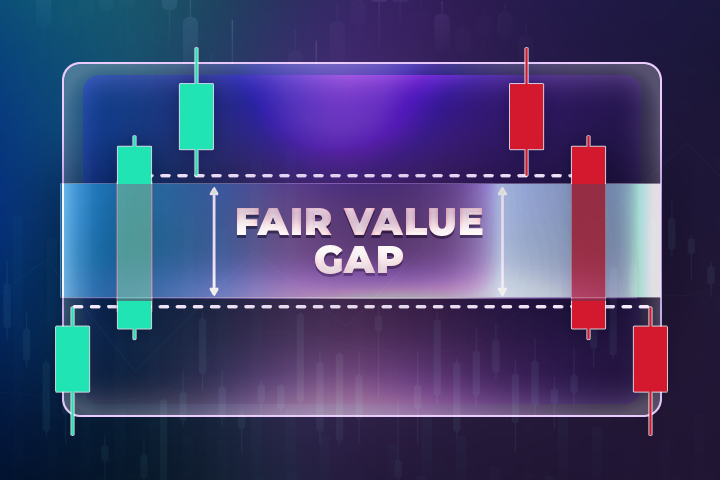

5. Leveraging Fair Value Gaps (FVGs) in ICT

Fair Value Gaps occur when there is an imbalance in price caused by rapid institutional moves.

Example:

On GBP/USD, a bearish FVG forms between 1.3250 and 1.3220 after a strong downward move. Wait for a retracement into the FVG for a short entry, with a stop-loss above the FVG and a target at the next support.

6. Refining with Order Blocks in ICT

Order blocks represent zones where institutional traders placed large buy or sell orders.

Example:

On EUR/USD, a bullish order block forms at 1.0900 after a strong rejection from a liquidity zone.

Enter a long trade at the order block with a stop-loss below its low and target the next resistance at 1.1000.

7. Integrating Multiple Timeframe Analysis in ICT

Use higher timeframes (H4, Daily) to define major trends and lower timeframes (M15, M5) to refine entries.

Example:

If the Daily chart shows a bearish trend on AUD/USD and the H1 chart forms a BOS, wait for a retracement to a lower timeframe order block to enter short.

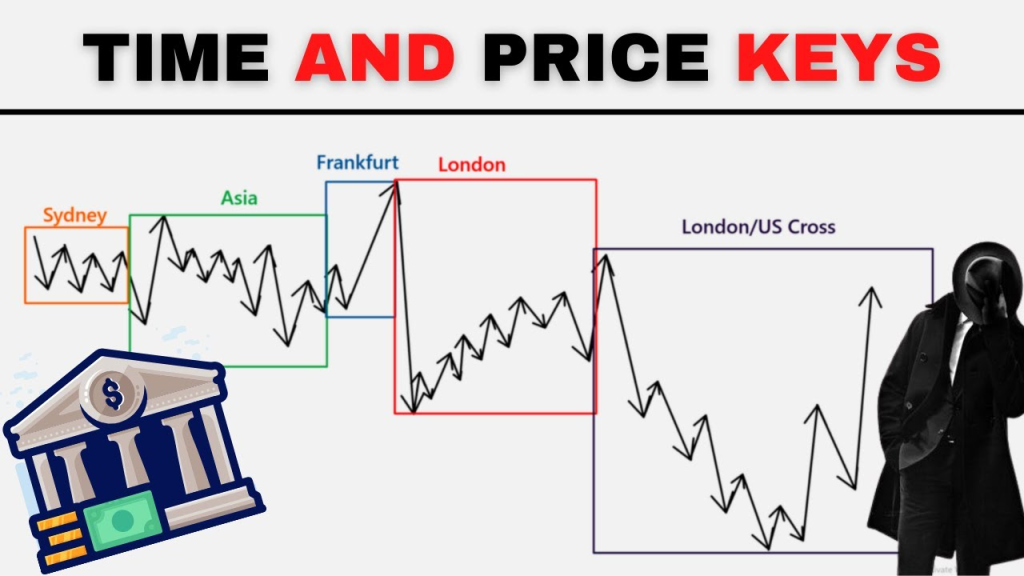

8. Aligning Trades with Key Time Zones in ICT

Institutional traders operate within specific time zones (London, New York).

Refine your trades by aligning them with these sessions.

Example:

Enter trades during the New York Open after confirming a liquidity sweep in the London session.

If USD/JPY sweeps liquidity during the London session and forms a bullish order block, wait for the New York Open to confirm bullish continuation.

9. Employing Risk Management Techniques in ICT

Advanced ICT trading requires precise risk management.

Use proper position sizing, stop-loss placement, and risk-to-reward ratios.

Example:

For a $10,000 account, risk 1% per trade ($100).

If trading EUR/USD, place a stop-loss 20 pips away and adjust position size to match the risk (0.5 lots).

10. Journaling and Backtesting in ICT

Keep a detailed trading journal to record trades, strategies, and outcomes.

Backtest ICT concepts to identify patterns and refine your approach.

Example:

Backtest EUR/USD trades using order blocks and FVGs during the London session to determine their success rate.

11. Combining ICT Concepts

Integrate multiple ICT tools (e.g., order blocks, FVGs, OTE) for confluence.

Example

If USD/CAD forms a bullish order block at 1.3100, aligns with an FVG, and retraces into the OTE zone during the London Open, this confluence increases trade accuracy.

12. Conclusion

Refining your trading strategy with advanced ICT techniques involves mastering a combination of concepts such as order blocks, killzones, OTE, and liquidity analysis.

With patience, discipline, and practice, these tools can elevate your trading to professional levels.

Always backtest strategies and adapt them to market conditions for consistent results.

Leave a Reply