ICT (Inner Circle Trader) trading methods require precision, analysis, and access to detailed market data.

Choosing the right platforms and tools can significantly enhance a trader’s ability to implement ICT strategies effectively.

Below is a detailed overview of platforms and tools ideal for ICT trading, along with examples and use cases.

1. Trading Platforms for ICT

a) MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Why It’s Ideal:

- Supports custom indicators for ICT concepts like order blocks, fair value gaps (FVGs), and liquidity zones.

- Offers excellent charting tools, low latency execution, and multi-timeframe analysis.

Example:

- A trader uses a custom “ICT Order Block” indicator on MT4 to automatically mark key order block levels for GBP/USD.

Pro Tip:

- Integrate ICT templates with predefined indicators like Fibonacci retracements to quickly identify Optimal Trade Entries (OTE).

b) TradingView

- Why It’s Ideal:

- Highly intuitive charting interface.

- Community-created scripts and indicators for ICT methods.

- Multi-device accessibility and advanced alerts system.

Example:

- A trader sets alerts for when EUR/USD touches a key fair value gap on the H4 timeframe while monitoring a lower timeframe for entry precision.

Pro Tip:

- Use TradingView’s replay mode to backtest ICT strategies such as CHOCH (Change of Character) or liquidity sweeps.

c) NinjaTrader

- Why It’s Ideal:

- Real-time market depth and order flow tools.

- Advanced analytics for institutional-level insights.

Example:

- A trader monitors order flow on the ES (E-mini S&P 500) to identify liquidity zones and anticipate smart money moves.

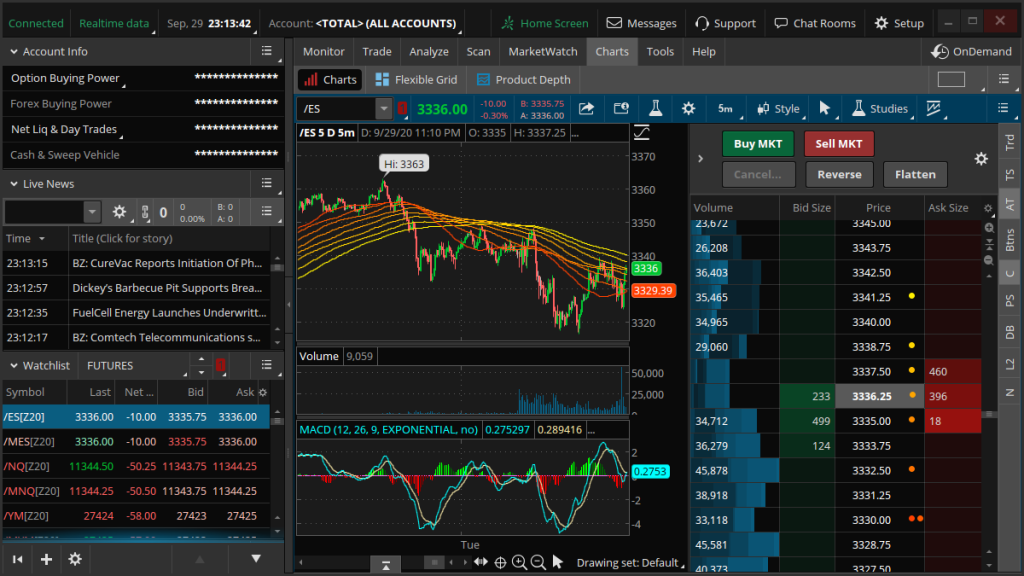

d) Thinkorswim (by TD Ameritrade)

- Why It’s Ideal:

- Professional-grade charting tools and data.

- Advanced scanning for specific patterns like order blocks or liquidity sweeps.

Example:

- A trader uses Thinkorswim to filter stocks with significant fair value gaps and overlays ICT concepts to identify high-probability setups.

2. Analytical Tools for ICT

a) Fibonacci Retracement Tool

- Why It’s Ideal:

- Essential for determining premium and discount zones, and spotting OTE levels.

Example:

- A trader draws Fibonacci levels on GBP/JPY after a strong bullish move. Price retraces to the 62%-79% zone, aligning with an order block, signaling a potential entry.

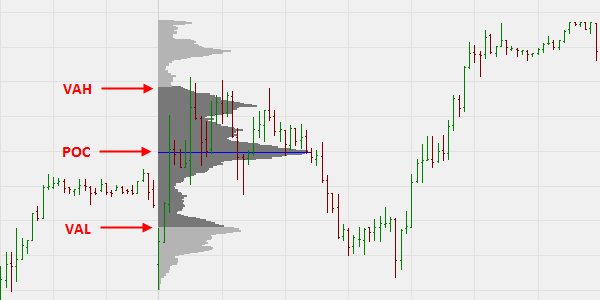

b) Volume Profile Tools

- Why It’s Ideal:

- Helps identify high-activity zones where institutions might be accumulating or distributing.

Example:

- On EUR/USD, a trader notices high volume at a fair value gap level, indicating institutional interest and a potential reversal point.

3. Broker Platforms for ICT

a) IC Markets

- Why It’s Ideal:

- Low spreads and excellent execution speeds, crucial for precision trading in ICT.

Example:

- A scalper trades using ICT’s killzones (London Open) on EUR/USD, relying on IC Markets for low latency order execution.

b) OANDA

- Why It’s Ideal:

- Great for institutional-level data, reliable pricing, and easy integration with trading platforms like MT4 and TradingView.

Example:

- A trader uses OANDA’s historical data to backtest ICT strategies on USD/JPY.

4. Backtesting and Journaling Tools for ICT

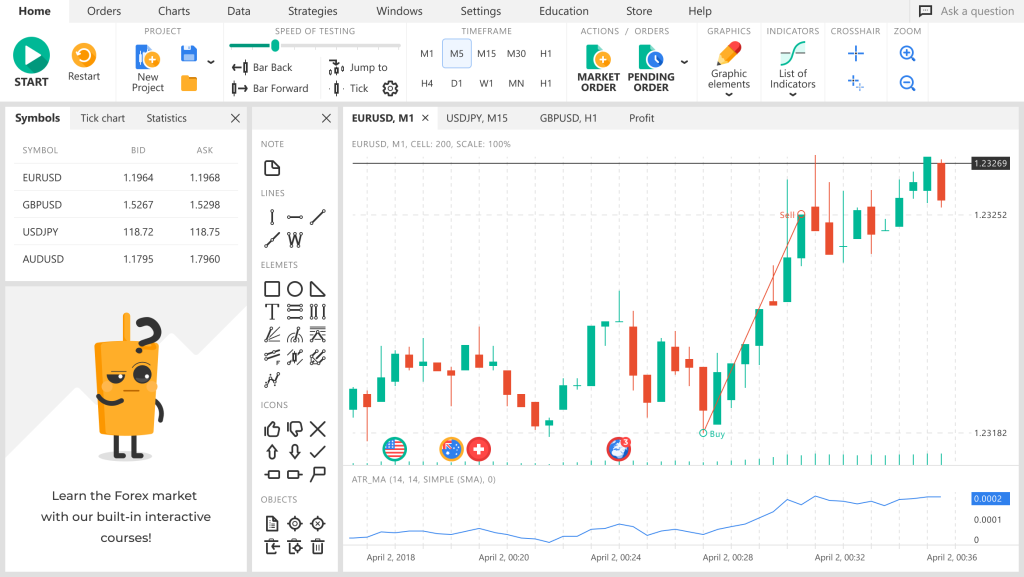

a) Forex Tester

- Why It’s Ideal:

- Simulate trades in historical markets to refine ICT strategies.

Example:

- A trader backtests a liquidity sweep and displacement strategy on GBP/USD during the New York Open killzone.

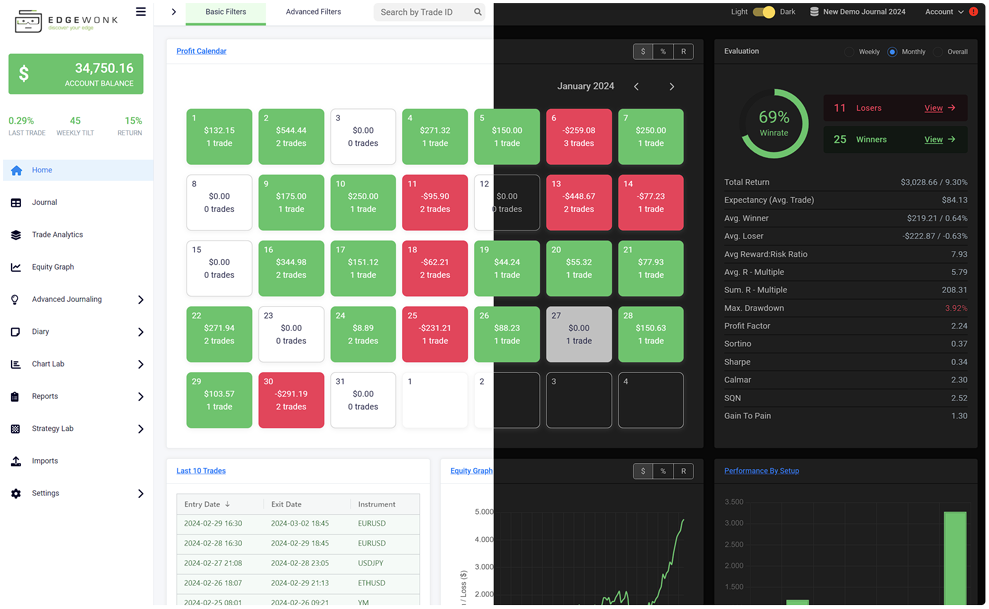

b) Edgewonk

- Why It’s Ideal:

- Comprehensive trade journaling and analytics.

- Allows tagging trades based on ICT concepts like FVG, OTE, and CHOCH.

Example:

- A trader reviews performance and notices that trades executed within ICT killzones yield a higher win rate.

5. ICT-Specific Indicators and Tools

a) ICT Indicator Suite for MT4/MT5

- Why It’s Ideal:

- Custom indicators designed for ICT strategies, including order blocks, FVGs, and liquidity zones.

Example:

- The “ICT FVG Finder” highlights fair value gaps automatically, saving time on manual analysis.

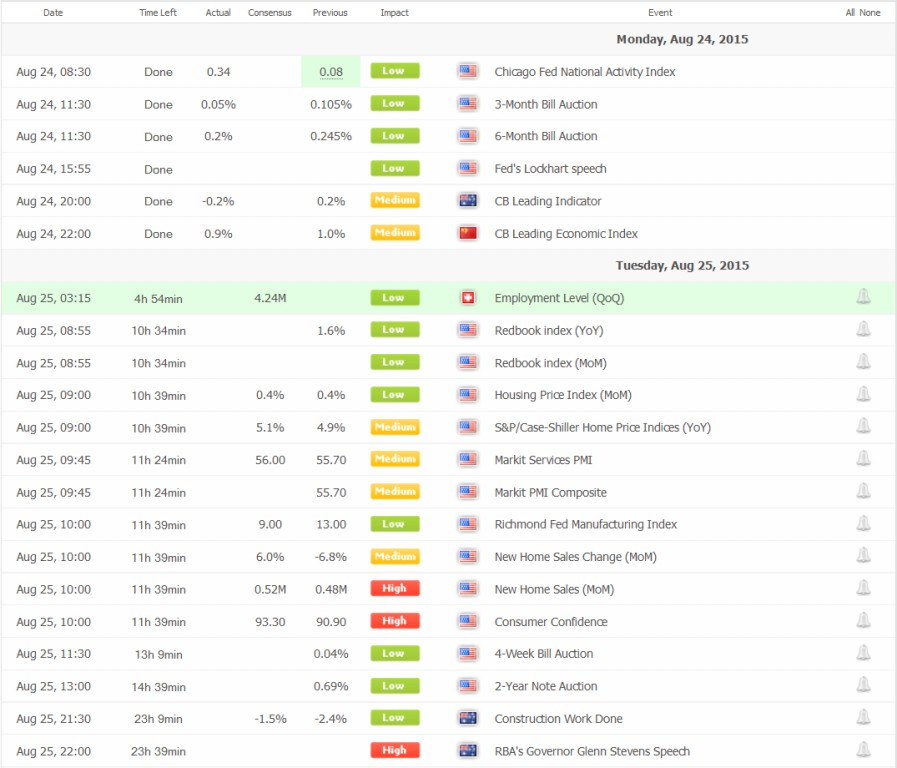

6. Economic Calendar Tools for ICT

a) Forex Factory

- Why It’s Ideal:

- Tracks high-impact economic news and events, helping traders align their strategies with market volatility.

Example:

- A trader avoids entering a position during major announcements like NFP (Non-Farm Payroll) that could disrupt technical setups.

b) Myfxbook Economic Calendar

- Why It’s Ideal:

- Offers detailed economic events with volatility ratings and historical comparisons.

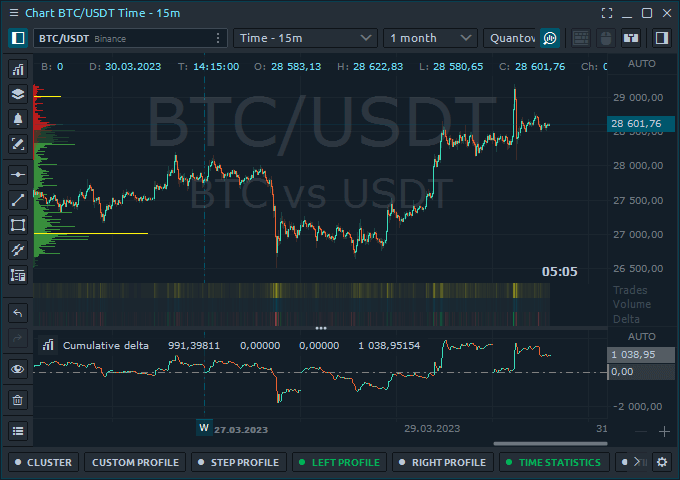

7. Data Analytics Platforms for ICT

a) Quantower

- Why It’s Ideal:

- Advanced order flow and market depth analysis.

Example:

- A trader identifies institutional buying clusters on BTC/USD using Quantower’s heatmap.

8. Combining Tools for Maximum Effectiveness for ICT

- Example Workflow:

- TradingView: Perform initial technical analysis and mark key ICT levels.

- MT4: Execute trades using ICT-specific indicators and manage positions.

- Edgewonk: Journal trades for review and improvement.

- Use Case:

- During the London Open killzone, a trader notices a liquidity sweep on TradingView. They confirm institutional interest using Quantower’s order flow tool and execute the trade via IC Markets.

9. Key Takeaways

- Platform Integration: Combine platforms like MT4, TradingView, and Thinkorswim for a comprehensive trading approach.

- Backtesting and Journaling: Use Forex Tester and Edgewonk to refine strategies and track performance.

- Stay Updated: Leverage tools like Forex Factory to align trades with market-moving events.

- ICT-Specific Tools: Prioritize platforms and indicators that support ICT concepts directly.

With the right combination of tools and platforms, traders can effectively implement ICT strategies, making data-driven decisions and aligning with institutional market behavior.

Leave a Reply