The Hammer candlestick is a powerful reversal signal used in ICT (Inner Circle Trader) trading strategies to identify potential turning points in the market.

It is commonly seen at the end of a downtrend, indicating a possible shift in market sentiment from bearish to bullish.

1. Understanding the Hammer Candlestick in ICT

The Hammer is a single candlestick pattern characterized by:

- A small real body near the top of the candle.

- A long lower wick at least twice the size of the body.

- Little to no upper wick.

- It appears at the bottom of a downtrend, signaling a potential reversal.

1. Why is the Hammer Important in ICT?

In ICT trading, the Hammer is significant because it aligns with liquidity concepts, order blocks, and fair value gaps (FVGs).

It often forms in areas where smart money absorbs liquidity before a price reversal.

2. Key ICT Concepts Related to the Hammer Candlestick

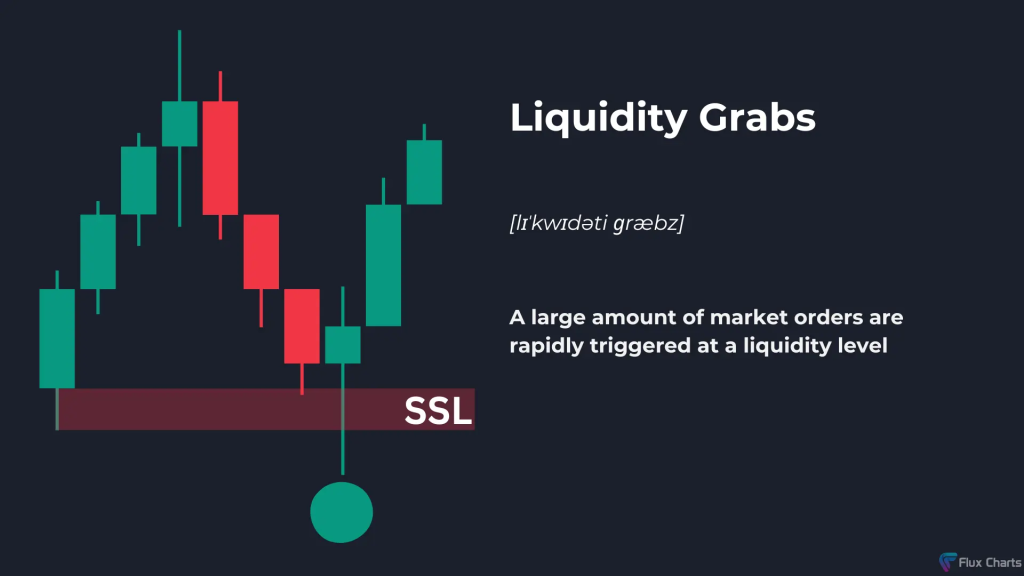

A. Liquidity Grab

- The market often takes out sell-side liquidity before reversing.

- Retail traders see a breakdown, but smart money accumulates positions.

- The Hammer forms when price sweeps a previous low and closes strong.

Example:

- GBP/USD is in a downtrend.

- Price drops sharply and sweeps liquidity below a key support level.

- A Hammer forms as price rejects lower levels and closes near its open.

- This suggests smart money accumulation before a bullish move.

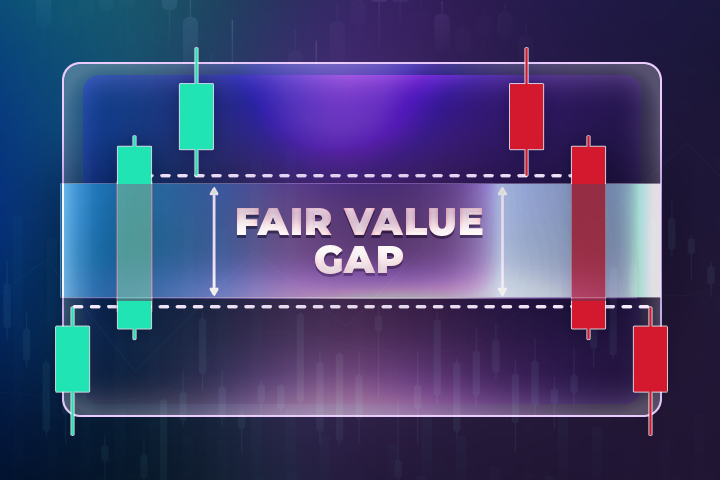

B. Order Blocks & Fair Value Gaps (FVGs)

- A Bullish Order Block (B.O.B) forms when a strong bullish move follows the Hammer.

- Hammers appear near Fair Value Gaps, indicating price imbalance correction.

- Traders look for confirmations like displacement and market structure shifts.

Example:

- EUR/USD is trading near a Bullish Order Block.

- A Hammer forms at the order block after price taps into liquidity.

- Price then rallies, confirming the smart money reversal.

3. How to Trade the Hammer in ICT

Step 1: Identify the Context

- Look for a downtrend with liquidity resting below previous lows.

- Identify key institutional price levels, order blocks, or FVGs.

Step 2: Wait for a Liquidity Sweep

- Price should take out sell-side liquidity before forming the Hammer.

- A long wick suggests rejection and smart money entry.

Step 3: Confirm Market Structure Shift

- A Break of Structure (BOS) or Change of Character (ChoCh) confirms reversal.

- Look for displacement—a strong bullish move after the Hammer.

Step 4: Enter the Trade

- Place a buy order near the Hammer’s midpoint or wick retracement.

- Stop-loss below the Hammer’s low.

- Target previous highs or premium zones.

Example Trade Setup on USD/JPY

- USD/JPY is in a downtrend and approaches a key Bullish Order Block.

- A Hammer forms after sweeping liquidity below a previous swing low.

- A bullish candle confirms the reversal, creating displacement.

- Trade entry at Hammer retracement, stop-loss below wick, target previous high.

4. Mistakes to Avoid while Trading Hammer Candlestick in ICT

- Trading the Hammer in the wrong context (needs liquidity grab & market shift).

- Entering too early without confirmation (wait for BOS/ChoCh).

- Ignoring Smart Money concepts like FVGs and order blocks.

5. Final Thoughts

The Hammer candlestick is an essential tool in ICT trading, particularly when combined with liquidity concepts, order blocks, and market structure shifts.

By mastering its role within Smart Money trading, traders can increase accuracy and trade with institutional flow.

Leave a Reply