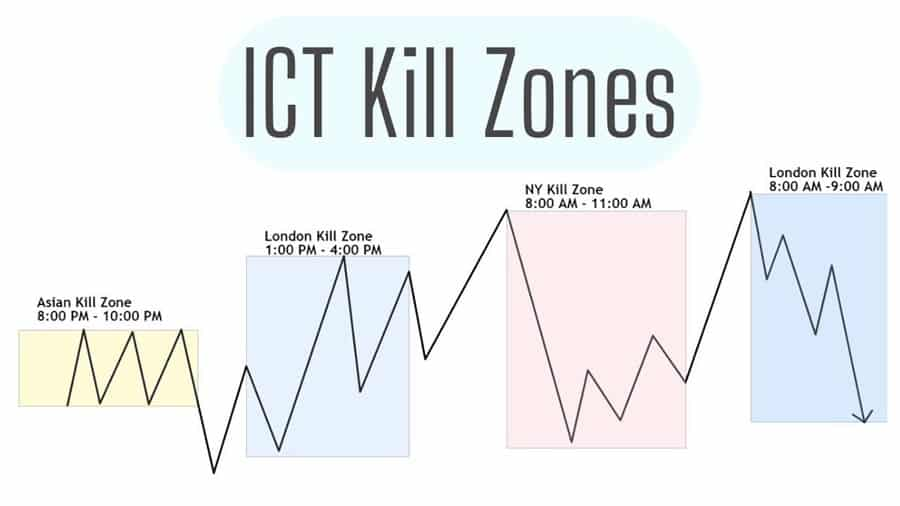

In Inner Circle Trader (ICT) trading, killzones refer to specific time windows where market volatility is typically higher due to institutional activity.

The main killzones are associated with the London Open, New York Open, and London Close, each offering unique opportunities and challenges in terms of price movement and liquidity.

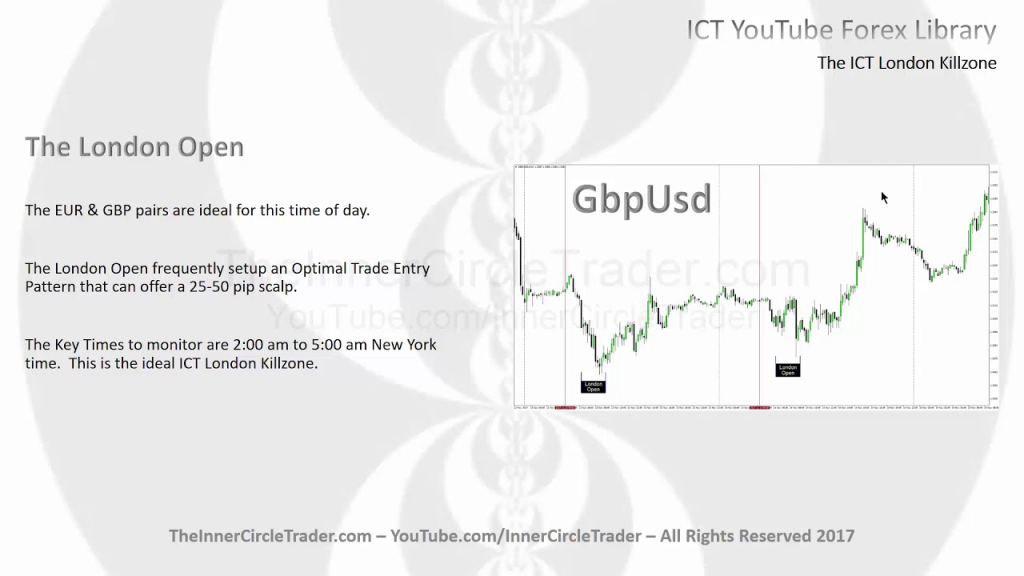

1. London Open Killzone in ICT

Time Frame:

2:00 AM – 5:00 AM EST

Purpose:

The London session generally sees significant market volume as it coincides with Europe’s largest financial markets starting their day.

This window often creates sharp moves as institutions place trades and adjust positions following the overnight markets.

Example:

Suppose the EUR/USD pair has been range-bound during the Asian session (11:00 PM – 2:00 AM EST).

As the London Open approaches, you might observe price consolidating just before a sudden breakout or retracement at 2:00 AM EST.

ICT traders can look for entries in the direction of the breakout, often observing liquidity grabs just before price moves in the intended direction.

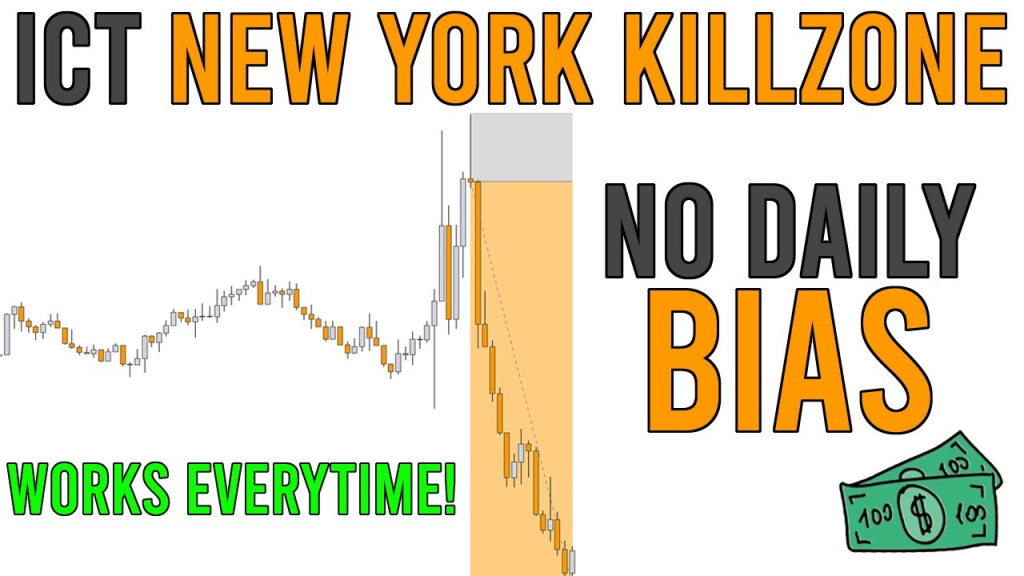

2. New York Open Killzone in ICT

Time Frame:

7:00 AM – 10:00 AM EST

Purpose:

This period overlaps with the London session and is marked by increased trading activity as U.S. markets prepare to open.

During the New York Open, institutions often adjust their positions to factor in European price action, resulting in strong moves and trend reversals.

Example:

Let’s say GBP/USD is trending upward during the London session, reaching a high point just before 7:00 AM EST.

As the New York Open Killzone begins, you might see a retracement or “pullback” as New York traders take profits or establish new positions, potentially causing a temporary downtrend.

ICT traders can look for signs of consolidation followed by strong directional moves, often aligning with liquidity areas established during the London session.

3. London Close Killzone in ICT

Time Frame:

10:00 AM – 12:00 PM EST

Purpose:

This window marks the close of the London session and often sees a reversal or slowdown of trends established earlier in the day as European markets wrap up.

Example:

If GBP/USD was trending upward during the New York session, you may see a retracement around 10:00 AM EST as the London Close approaches.

Institutional traders might exit positions, causing price to pull back temporarily.

ICT traders watch for potential reversals or consolidation during this time, as it often presents an opportunity to enter positions aligned with the day’s prevailing trend.

4. Benefits of Trading ICT Killzones

- Higher Volatility: Killzones align with high-volume trading times when institutions are most active.

- Clearer Price Patterns: The increased activity during these times can form more reliable price action patterns for entry and exit.

- Alignment with Institutional Moves: By understanding killzones, ICT traders can time entries to align with institutional order flow.

5. Summary Table of ICT Killzones

| Killzone | Time (EST) | Typical Behavior | Key Strategy |

|---|---|---|---|

| London Open | 2:00 AM – 5:00 AM | High-volume breakout moves | Look for breakout or continuation trades. |

| New York Open | 7:00 AM – 10:00 AM | Trend reversals, pullbacks | Wait for retracements, align with trend. |

| London Close | 10:00 AM – 12:00 PM | Trend slowdown, reversals | Look for end-of-session reversals. |

6. Conclusion

Killzones in ICT trading provide a structured way to capitalize on institutional order flow.

By trading during these high-volume windows, traders can leverage liquidity shifts, trend continuations, and reversals effectively.

This helps ICT traders align with larger market movements, maximizing the potential for profitable trades.

Leave a Reply