The Inversion Fair Value Gap (IFVG) is a concept in ICT (Inner Circle Trader) trading strategy that identifies areas where price might reverse direction or experience a shift in trend.

Unlike regular Fair Value Gaps, which generally signal areas where price will revisit in the direction of the prevailing trend, an Inversion Fair Value Gap implies that the gap can act as an area of resistance or support, prompting price to invert its direction.

The IFVG is commonly used by traders to anticipate market reversals or trend shifts when the price interacts with these specific gaps.

1. What is an Inversion Fair Value Gap in ICT?

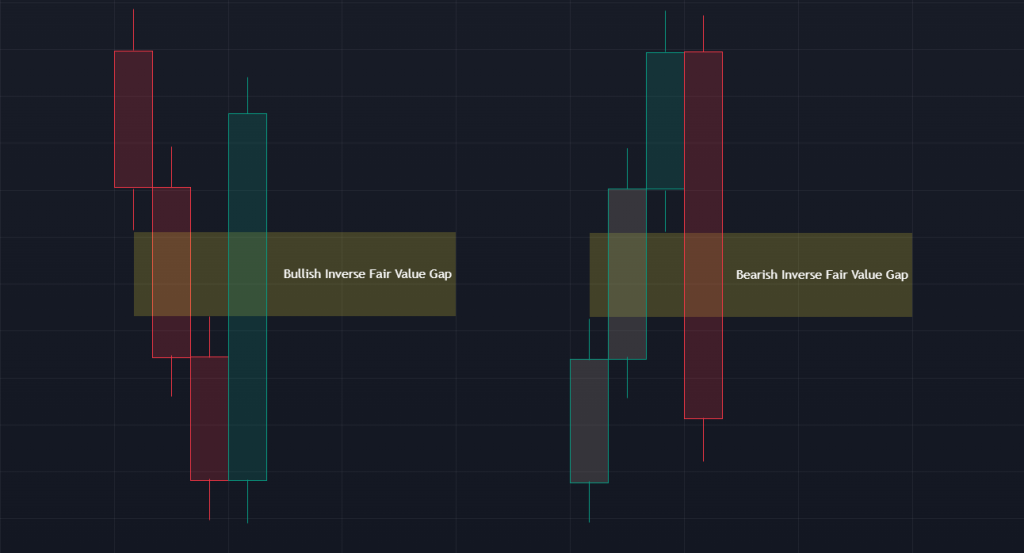

A Fair Value Gap (FVG) occurs when there is a three-candle pattern where the first and third candles do not overlap, creating a gap between them.

In an uptrend, an FVG forms when the first candle is bullish, the second candle is very bullish (with a large body and minimal wicks), and the third candle is smaller and bullish.

This indicates an imbalance, as the price moved too quickly, leaving a void.

An Inversion Fair Value Gap, however, occurs when the price revisits this gap from the opposite direction, potentially reversing direction.

When the price encounters an IFVG, it can signal a potential point of resistance (in a downtrend) or support (in an uptrend) as the gap acts as a barrier that halts or reverses the movement.

2. Example of Inversion Fair Value Gap in Action in ICT

Let’s consider two scenarios: an uptrend encountering resistance at an IFVG and a downtrend encountering support at an IFVG.

Scenario 1: Inversion Fair Value Gap in a Downtrend (Resistance)

Imagine that GBP/USD has been in a downtrend.

At a certain point, a three-candle formation creates a Fair Value Gap between 1.3000 and 1.3030.

Initially, this FVG acts as a typical gap where price might retrace to rebalance, but this time the price moves past the gap and returns to it from below, testing it as resistance.

- Price Movement: GBP/USD rallies up towards the FVG zone at 1.3000–1.3030.

- Reaction at IFVG: As the price reaches this gap, sellers are waiting at this level, and it serves as a resistance point.

- Reversal Confirmation: GBP/USD fails to close above the IFVG, forming a bearish candle. This suggests that institutional traders are using the gap as a resistance level, pushing the price back down.

- Entry: A short position can be taken as soon as there is a sign of rejection within the gap, with a stop loss above 1.3030 (top of the FVG).

This IFVG serves as a signal that sellers are actively defending this zone, creating a potential reversal in the market.

Scenario 2: Inversion Fair Value Gap in an Uptrend (Support)

Now, let’s assume that EUR/USD is in an uptrend and creates an FVG between 1.1000 and 1.1030.

Later, the price retraces back into this zone from above, suggesting that the gap could now act as a support level.

- Price Movement: EUR/USD dips back down to the FVG area at 1.1000–1.1030.

- Reaction at IFVG: Buyers see value in this zone, and the gap now serves as a support area.

- Reversal Confirmation: Price rejects the bottom of the IFVG (1.1000) and forms a bullish candle within the gap, showing buyer interest.

- Entry: A long position is entered once a bullish signal appears within the IFVG, with a stop loss below 1.1000.

In this case, the IFVG serves as a support level, allowing traders to re-enter in the direction of the uptrend.

3. Practical Tips for Trading Inversion Fair Value Gaps in ICT

1. Confirm with Volume and Price Action:

To avoid false signals, combine IFVG analysis with volume spikes or candlestick patterns.

2. Watch Higher Time Frames:

IFVGs are more reliable on higher time frames (e.g., 1-hour or daily charts) as they attract more institutional attention.

3. Set Conservative Stops:

Place stops slightly beyond the gap to allow for minor fluctuations, as IFVGs can sometimes experience wicks within the gap before reversing.

4. Key Takeaways

IFVGs are crucial areas for reversals, acting as resistance in downtrends and support in uptrends.

They represent areas of high institutional interest, where banks or large players might step in to defend their positions.

Effective on Higher Time Frames: Larger time frames give more weight to IFVGs, making them more reliable in trend reversals or continuations.

The Inversion Fair Value Gap offers a unique approach to identifying possible reversals by treating traditional FVGs as support or resistance zones in the opposite trend.

By mastering IFVGs, traders can gain an edge in recognizing these hidden areas of institutional interest.

Leave a Reply