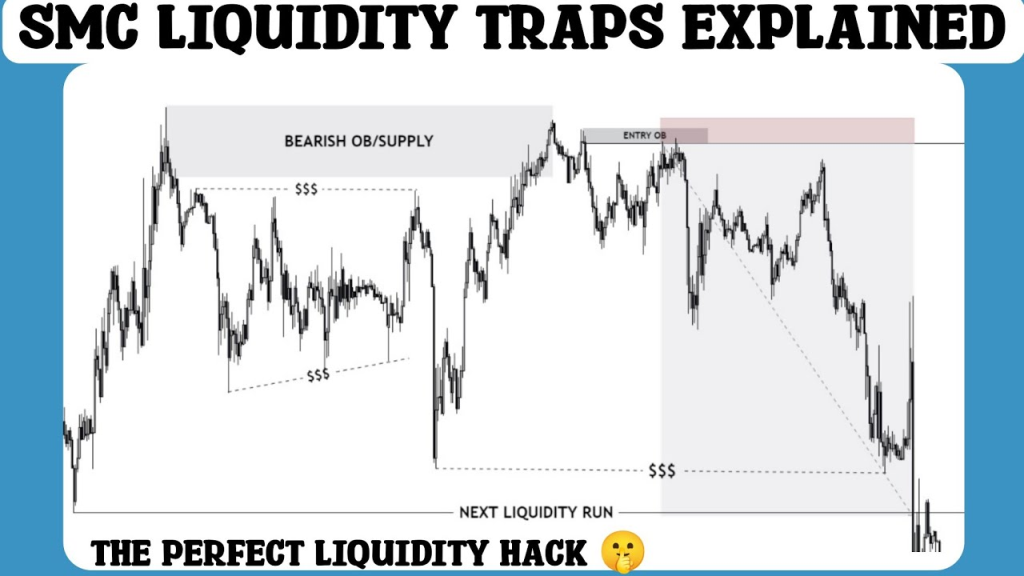

In Inner Circle Trader (ICT) concepts, liquidity traps are techniques used by institutional traders or “smart money” to lure retail traders into weak positions, creating the liquidity necessary for larger trades.

Liquidity traps exploit the predictable behavior of retail traders, who often enter the market at perceived breakout or support/resistance levels.

Smart money uses these levels to generate the liquidity they need to enter or exit positions profitably.

Here’s a detailed explanation of liquidity traps, including how they work, why they happen, and examples to illustrate.

1. What is a Liquidity Trap in ICT?

A liquidity trap occurs when smart money manipulates price to lure retail traders into positions that create the liquidity smart money requires to execute large trades.

Smart money needs liquidity to place large orders, which is provided by stop-loss orders or entries made by retail traders at anticipated levels.

Key elements of a liquidity trap include:

- False Breakouts and Stop Hunts: Smart money pushes prices beyond key levels to trigger stop-loss orders or induce retail traders to enter trades in the wrong direction.

- Liquidity Pools: Smart money targets clusters of stop orders above or below recent highs and lows, where retail traders tend to place their stops.

2. Why Do Liquidity Traps Work in ICT?

Liquidity traps work because retail traders often place orders at psychologically significant levels, such as support, resistance, or round numbers.

They also tend to follow common trading signals like breakouts or breakdowns, expecting a continuation of the trend.

Smart money, aware of these tendencies, uses this knowledge to create liquidity by inducing retail traders to enter positions that can be taken advantage of.

For example:

When a retail trader goes long at a perceived breakout, they often place their stop-loss orders below recent lows.

Smart money will then push the price below this low to capture liquidity, reversing the trend after trapping retail traders in weak positions.

3. How Does Smart Money Create Liquidity Traps in ICT?

Smart money creates liquidity traps using two main techniques:

- Breakout and Reversal Trap (False Breakout)

- Consolidation and Liquidity Sweep (Stop Hunts)

Each of these strategies exploits retail trading behavior at key levels.

4. Types of Liquidity Traps in ICT with Examples

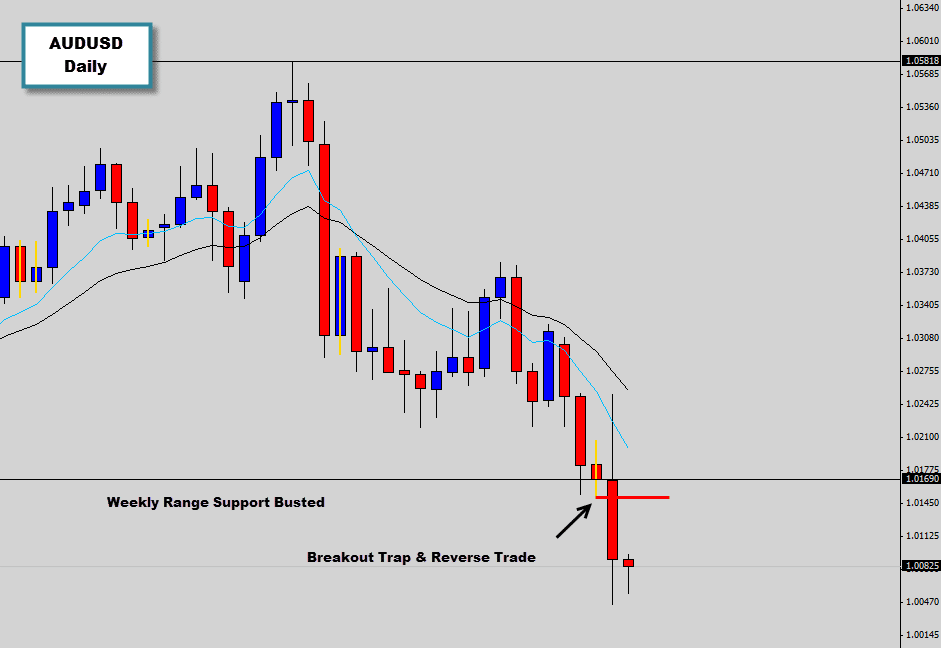

A. Breakout and Reversal Trap (False Breakout)

In this trap, smart money creates a false breakout by pushing the price beyond a key support or resistance level.

Retail traders, expecting a continuation, enter trades in the direction of the breakout, while smart money simultaneously reverses the price to trap these positions.

Example of a Breakout Trap:

Let’s say EUR/USD has been trading in a range between 1.1000 (support) and 1.1100 (resistance).

Retail traders, anticipating a breakout above 1.1100, start placing buy orders in hopes of a continuation.

Smart money pushes the price above 1.1100, triggering these buy orders and attracting additional buyers.

However, after absorbing the buy orders, smart money sells heavily, reversing the price direction and trapping retail traders in losing positions.

The price then drops sharply back into the range, causing retail traders to close their positions at a loss.

B. Consolidation and Liquidity Sweep (Stop Hunt)

A stop hunt is when smart money moves the price to trigger stop-loss orders around recent highs or lows.

By doing this, they create the liquidity necessary to enter large positions, often pushing the price in the opposite direction immediately afterward.

Example of a Stop Hunt:

Suppose GBP/USD has formed a low around 1.2500, with retail traders placing stop-loss orders just below this level.

Smart money identifies this as a liquidity pool and pushes the price down to 1.2480, triggering stop-loss orders from retail traders holding long positions.

With these stops triggered, the sell orders provide smart money the liquidity needed to buy at 1.2480.

After accumulating enough long positions, smart money then pushes the price higher, causing retail traders to miss out on the recovery or re-enter too late.

5. Identifying Liquidity Traps in ICT

To identify liquidity traps, look for clues like:

- False Breakouts: Rapid breakouts that quickly reverse, especially at major support or resistance levels.

- Wicks Beyond Key Levels: Large wicks that briefly break key levels, signaling a likely stop hunt.

- Price Reversal after Sweep: If price sweeps a recent high or low and reverses with strong momentum, it’s often a liquidity trap.

6. How to Use Liquidity Traps in ICT Trading Strategy

By recognizing liquidity traps, traders can align their entries with smart money rather than being caught by it.

Here are some practical steps:

- Wait for Confirmation of the Trap: Avoid entering on initial breakouts or breakdowns; instead, wait to see if the move sustains or reverses.

- Look for Entry After the Liquidity Sweep: Enter trades after the price sweeps a key level and then reverses.

- Utilize Key Levels as Targets: Use previous liquidity areas (highs/lows) as potential exit or profit-taking levels.

7. Real-World Example of a Liquidity Trap in ICT

Consider USD/JPY trending upwards, with a recent swing high at 140.00. Many retail traders see this as resistance and place sell orders at this level, with stops slightly above 140.10.

Smart money drives the price just above 140.10 to trigger these stops, creating a sudden spike.

Once the stops are triggered, liquidity is generated, and smart money begins shorting heavily, pushing the price back down.

Retail traders who shorted at the initial level are trapped, watching the price reverse against their expectations.

8. Liquidity Trap vs. Normal Market Movements

Liquidity traps differ from normal market movements because they:

- Exploit Retail Behavior: They actively lure retail traders into weak positions.

- Create Sharp Reversals: Price often reverses quickly after a liquidity sweep, leaving trapped positions at a disadvantage.

- Are Deliberate: Smart money deliberately moves the price to target liquidity pools.

9. Conclusion

In ICT trading, understanding liquidity traps provides insight into how smart money creates liquidity by manipulating price at key levels, trapping retail traders in unfavorable positions.

By recognizing these traps and avoiding impulsive trades at breakout points, traders can align with institutional flow and use liquidity traps to enter high-probability trades.

Leave a Reply