In ICT (Inner Circle Trader) methodology, a Bearish Order Block refers to the last bullish candlestick (or series of bullish candles) before a significant downward price move occurs.

This block is seen as a zone of institutional interest where smart money has placed sell orders. It often acts as a resistance zone and a potential entry point for short trades.

1. Key Features of a Bearish Order Block in ICT

1. Precedes a Downward Move:

It marks the point where institutional players initiated large sell orders, causing the price to drop significantly.

2. Acts as Resistance:

Price often retraces to this zone before continuing the downward trend, making it an ideal area for trade entries.

3. High Volume Area:

It often aligns with zones of increased trading activity.

4. Smart Money Footprint:

Represents where institutions entered the market aggressively.

2. How to Identify a Bearish Order Block in ICT

1. Look for the Last Bullish Candle:

Before a sharp bearish move, identify the final bullish candle(s).

2. Observe Market Reaction:

A strong downward move should follow the bullish candle, breaking key levels such as a previous swing low or support level.

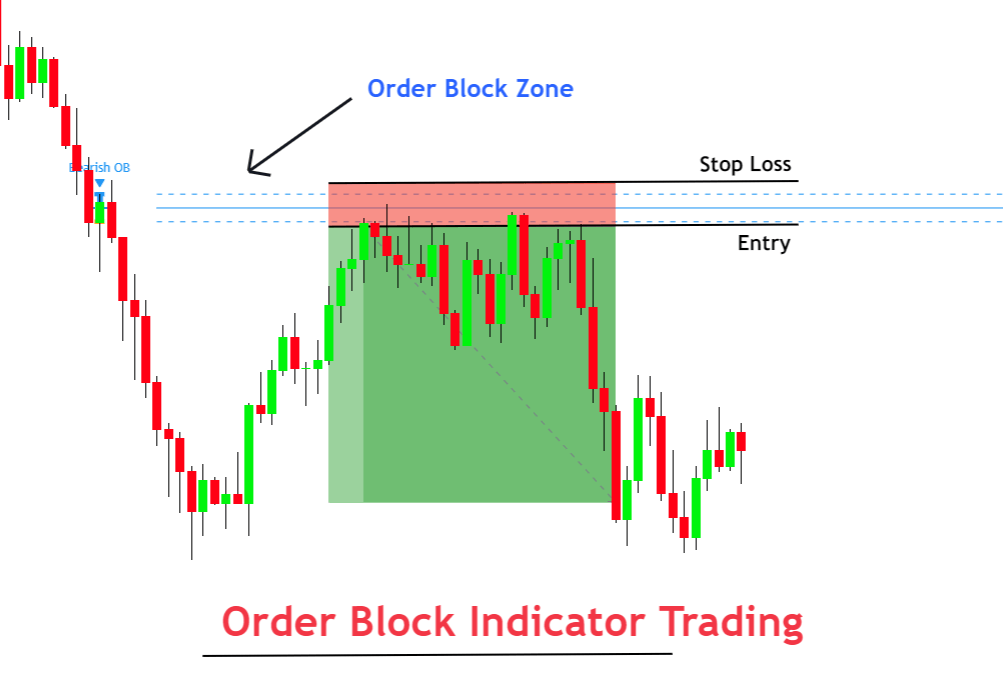

3. Mark the Zone:

Extend the range of the bullish candle to identify the bearish order block zone.

4. Wait for a Retest:

Price often retraces to this zone, offering a high-probability entry point for short trades.

3. Examples of Bearish Order Blocks

Example 1: EUR/USD Daily Chart

- Scenario:

- EUR/USD has been in a minor uptrend, creating a bullish candle at 1.2000.

- The next day, the price drops sharply to 1.1850, breaking the previous swing low.

- Identifying the Order Block:

- The last bullish candle before the drop is the bearish order block.

- Mark the high and low of this candle (e.g., 1.2010 to 1.1990).

- Trade Opportunity:

- When the price retraces to 1.2000, observe bearish price action, such as a bearish engulfing pattern, to enter a short trade.

- Target: 1.1800 (next liquidity pool).

- Stop-loss: Above 1.2020.

Example 2: GBP/USD 4-Hour Chart

- Scenario:

- GBP/USD has been consolidating, forming a bullish candle at 1.3200 before a sharp drop to 1.3100.

- Order Block Zone:

- The last bullish candle at 1.3200 is identified as the bearish order block.

- Extend this zone forward on the chart.

- Market Reaction:

- Price retraces to 1.3190, showing a rejection with a shooting star candlestick.

- Enter a short trade, targeting 1.3050, with a stop-loss above 1.3220.

4. Why Bearish Order Blocks Work in ICT

1. Institutional Footprint:

Reflects zones where large institutional sell orders were placed.

2. Liquidity Sweep:

Often aligned with liquidity pools, where retail traders’ stop-losses are triggered before the price reverses.

3. Market Psychology:

Retail traders interpret the retracement as a bullish reversal, but institutions use it to add to their short positions.

5. Tips for Trading ICT Bearish Order Blocks

1. Confluence is Key:

Combine with other ICT tools like fair value gaps (FVGs), liquidity pools, or Fibonacci retracements.

2. Wait for Confirmation:

Ensure price shows a clear rejection or reversal pattern within the order block zone.

3. Use Multiple Timeframes:

Identify order blocks on higher timeframes and refine entries on lower timeframes.

4. Risk Management:

Always place stop-loss orders above the high of the order block.

6. Common Mistakes

1. Forcing Trades:

Not all bullish candles before a downtrend are valid order blocks. Look for clear signs of institutional activity.

2. Ignoring Context:

Ensure the bearish order block aligns with the broader market structure and trend.

3. Overlooking Volume:

Pay attention to volume surges as an indication of institutional involvement.

7. Conclusion

The ICT Bearish Order Block is a powerful concept that highlights zones of institutional interest in the market.

By combining it with other ICT tools and strategies, traders can gain precise entry points for high-probability short trades.

Understanding its dynamics and practicing its application is key to mastering this tool in trading.

Leave a Reply