A Bullish Order Block is a key Institutional Trading Concept (ICT) that represents a zone of significant buying activity by institutions or “smart money.”

It is the last bearish candle before a bullish move that breaks a structure or creates a new swing high.

These areas indicate where institutions have left footprints in the market, allowing traders to anticipate potential support and future bullish reversals.

1. Key Characteristics of a ICT Bullish Order Block

1. Last Bearish Candle Before a Bullish Move:

The bullish move breaks a significant structure (e.g., resistance or swing high).

2. Strong Impulse Move:

A sharp and sustained bullish rally follows the order block.

3. Institutional Interest:

These zones highlight where institutions or smart money have executed large buy orders.

4. Support Zone:

Price often revisits these zones, creating opportunities for long entries.

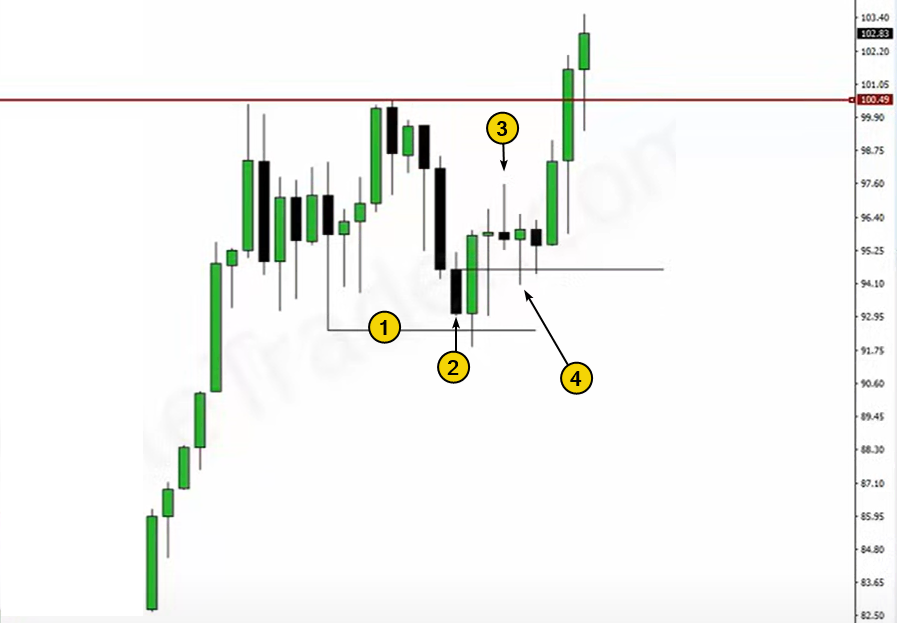

2. Steps to Identify a Bullish Order Block in ICT

1. Find the Last Bearish Candle:

Look for the bearish candle immediately before a strong bullish impulse.

2. Confirm Structure Break:

Ensure the bullish move breaks a prior resistance, swing high, or market structure.

3. Mark the Order Block:

Highlight the open and close of the bearish candle as the order block zone.

4. Wait for Price to Return:

Price often retraces to the order block before continuing higher.

3. How to Trade Using Bullish Order Blocks in ICT

Step 1: Identify Market Structure

Confirm that the market is in an uptrend or has recently transitioned from a downtrend to an uptrend.

Step 2: Locate the Bullish Order Block

Find the last bearish candle before the bullish breakout.

Step 3: Wait for Price Retracement

Allow price to revisit the bullish order block, aligning with confluence factors like Fibonacci retracement or Fair Value Gaps (FVGs).

Step 4: Look for Confirmation

Use price action signals such as bullish engulfing candles or lower timeframe break of structure (BOS) to confirm a potential bounce.

Step 5: Enter the Trade

Enter a long position once confirmation is observed.

Step 6: Set Stop-Loss and Target

Place a stop-loss just below the order block and set a profit target based on nearby resistance or Fibonacci extensions.

Example 1: Bullish Order Block on EUR/USD

- Market Context:

- EUR/USD is in an uptrend, with a recent high at 1.1050.

- Bullish Impulse:

- Price breaks the resistance at 1.1050 and rallies to 1.1100.

- Order Block Identification:

- The last bearish candle before the rally is at 1.1030 to 1.1040.

- Trade Setup:

- Price retraces to the order block at 1.1035.

- Confirmation: Bullish engulfing candle forms at this level.

- Entry:

- Enter long at 1.1040.

- Stop-loss: Below the order block at 1.1025.

- Target: Next resistance at 1.1150.

Example 2: Bullish Order Block on GBP/USD

- Market Context:

- GBP/USD has been in a range, with resistance at 1.3150.

- Bullish Breakout:

- Price breaks above 1.3150 and rallies to 1.3200.

- Order Block Identification:

- The last bearish candle before the breakout is between 1.3130 and 1.3140.

- Trade Setup:

- Price retraces to the order block.

- Confirmation: Lower timeframe BOS occurs near 1.3140.

- Entry:

- Enter long at 1.3140.

- Stop-loss: Below the order block at 1.3120.

- Target: Previous high at 1.3250.

4. Tips for Trading ICT Bullish Order Blocks

1. Combine with Confluences:

Align order blocks with Fibonacci retracements, Fair Value Gaps, or killzones like London Open or New York Open.

2. Use Lower Timeframes for Precision:

Drop to lower timeframes (e.g., 5-min or 15-min) for refined entries.

3. Wait for Confirmation:

Avoid blindly entering; look for candlestick confirmation or a microstructure break.

5. Benefits of Trading ICT Bullish Order Blocks

1. High Accuracy:

Order blocks often represent institutional interest, leading to precise trade setups.

2. Low Risk, High Reward:

Entries near order blocks minimize risk with tight stop-loss levels.

3. Predictive Power:

Helps traders anticipate reversals or continuations based on institutional behavior.

6. Conclusion

The Bullish Order Block is a cornerstone of ICT trading, offering insights into institutional buying zones.

By identifying and trading these zones, traders can align their strategies with the “smart money” and improve their trading accuracy.

Combining order blocks with other ICT tools like Fibonacci retracements and FVGs can further enhance trade setups, creating a powerful edge in the market.

Leave a Reply