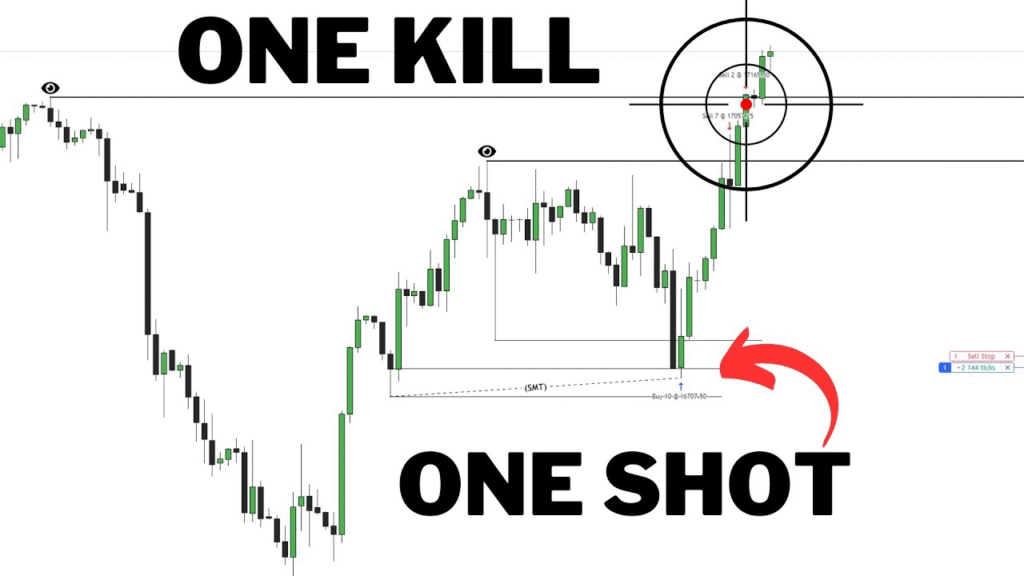

The One Shot One Kill model is a powerful and highly focused intraday trading strategy developed by ICT (Inner Circle Trader).

The idea is simple:

Take one high-probability trade per day. That’s it. One shot, one kill.

It’s designed for traders who want to trade less but smarter, aiming for precision entries with a high win rate using Smart Money Concepts.

1. The Core Philosophy of ICT One Shot One Kill (OSOK) Model

Instead of taking multiple trades a day and overtrading, OSOK teaches you to:

- Wait patiently for the setup

- Strike with accuracy during a killzone

- Exit after hitting your profit target (or stop)

This helps you avoid emotional burnout and increases your focus on quality over quantity.

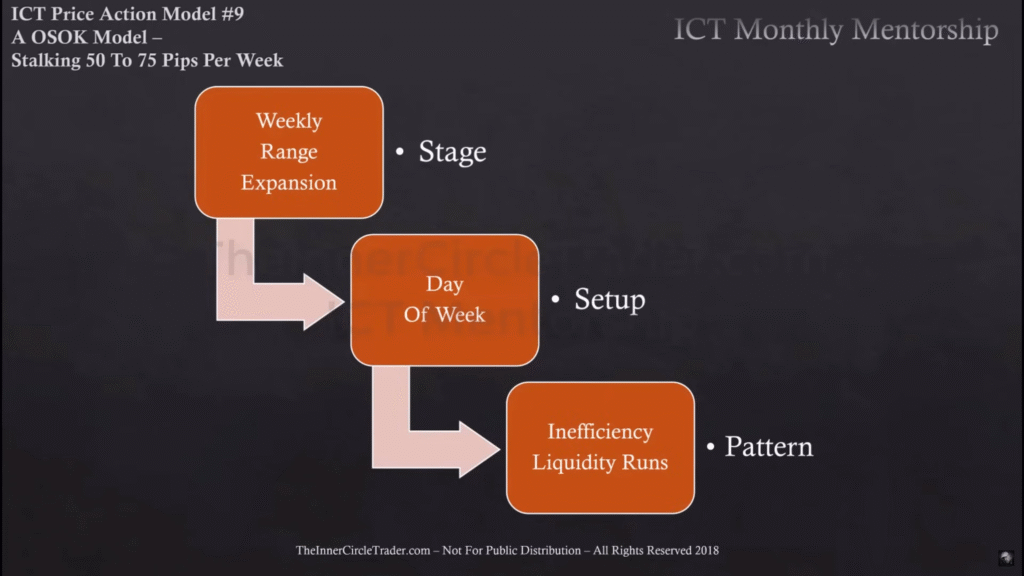

2. When to Use the ICT OSOK Model

It is best used:

- During the New York Session (10 AM – 11 AM EST)

- After identifying liquidity runs or false moves

- When you have a clear daily bias (bullish or bearish)

3. Components of ICT OSOK Model

Here’s what you need to execute the OSOK trade:

1. Daily Bias

Understand whether the market is likely to go up or down today.

Use tools like:

- Previous day’s high and low

- Daily imbalance or FVG

- HTF market structure (4H, Daily)

2. Liquidity Raid

Look for price to raid a liquidity pool in the opposite direction of your bias.

Example:

If you’re bullish, wait for price to take out a recent low (inducement).

That’s when Smart Money grabs liquidity before moving up.

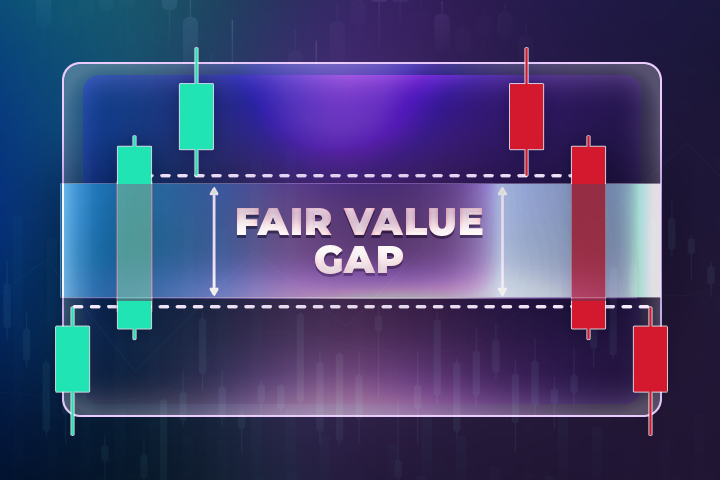

3. Displacement and FVG

After the raid, price usually displaces strongly in your bias direction.

Look for a Fair Value Gap (FVG) — this is your entry point.

4. Entry & Target

- Enter on a retracement into the FVG (ideally during NY Killzone).

- Set stop loss just below/above the raid.

- Target a logical liquidity level — like the opposite high or low.

4. Example of OSOK Trade in ICT in a Bullish Setup

1. Scenario: Bullish Day in EUR/USD

- Daily Bias: Bullish (price is moving toward a daily imbalance)

- NY Killzone (10 AM EST): Price dips below a London session low

- Liquidity Grab: It raids the low, then displaces upward

- FVG Formed: A bullish fair value gap appears

- Entry: You enter on the retracement into the FVG

- Target: Previous high or a known liquidity level

- Result: You hit your 2R target — done for the day

One shot. One kill. No overtrading. No revenge trading.

5. Example of ICT OSOK in a Bearish Setup

- Daily Bias: Bearish

- Price moves above a key London high during NY Killzone (liquidity raid)

- Strong bearish move with a clean FVG

- Enter short on retracement

- Target is the recent low or a sell-side liquidity level

6. Tips for Success with OSOK in ICT

- Be patient. The setup might appear only once a day.

- Don’t chase — wait for a clean displacement + FVG.

- Know your bias before the session starts.

- Trade only during Killzones for best results.

- Use clean risk management. Aim for at least 1:2 RR.

7. Final Thoughts

The ICT One Shot One Kill Model is not about being in the market all day.

It’s about being a disciplined sniper, waiting for your shot, and walking away once it hits.

If you’re tired of taking 5–10 trades a day and getting nowhere, this model will transform your mindset and results.

Would you like a visual cheat sheet or checklist for this model?

I can create that next.

Leave a Reply