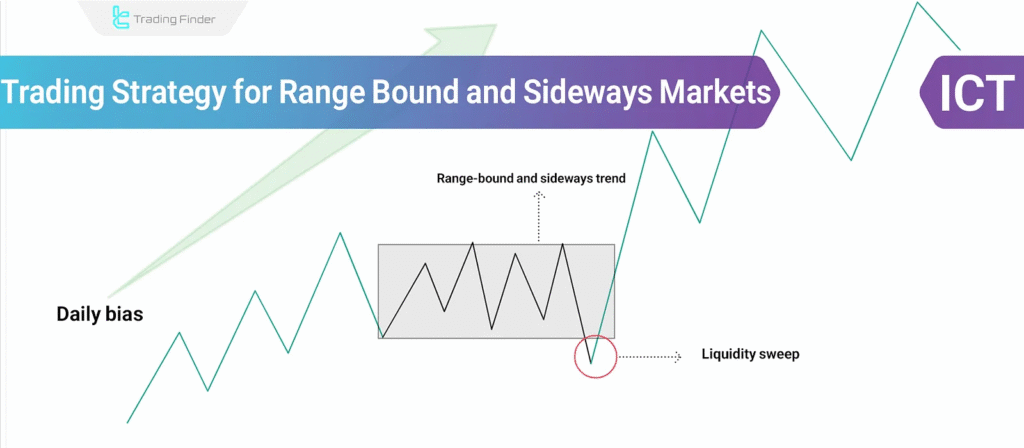

When the market is trending, it’s easier to follow the momentum. But many times, price moves sideways instead of up or down.

This is called consolidation or range-bound trading.

As per ICT (Inner Circle Trader), ranges are not random.

They often act as accumulation zones where Smart Money builds positions before the next big move.

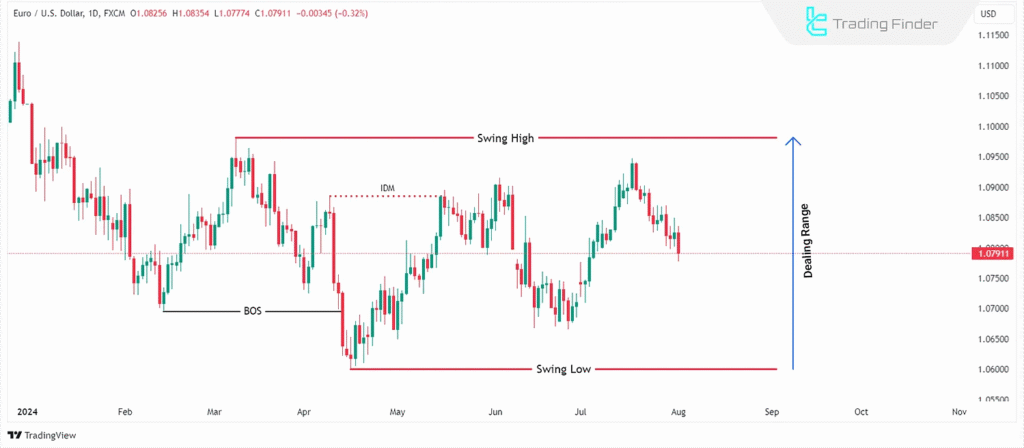

1. What is a Range in ICT?

A range is a market condition where price oscillates between two clear levels:

- Resistance (top of the range)

- Support (bottom of the range)

Instead of trending strongly, the market bounces back and forth inside these levels.

Example:

Imagine EUR/USD is moving between 1.0700 (support) and 1.0800 (resistance).

For several hours or even days, price keeps bouncing between these two points. That’s a consolidation.

2. Why Consolidation Happens in ICT?

ICT explains that consolidation is where liquidity builds up.

- Above the range high → stop-loss orders from sellers accumulate.

- Below the range low → stop-loss orders from buyers accumulate.

Smart Money uses these areas to hunt liquidity. That means when price breaks out of the range, it often sweeps stops before choosing the real direction.

3. ICT Strategy for Range Trading

1. Mark the Range

Identify recent highs and lows where price has bounced multiple times.

- Draw horizontal lines at those levels.

- The zone between them is the range.

Example:

If GBP/USD keeps rejecting 1.2500 at the top and 1.2450 at the bottom, that’s your defined range.

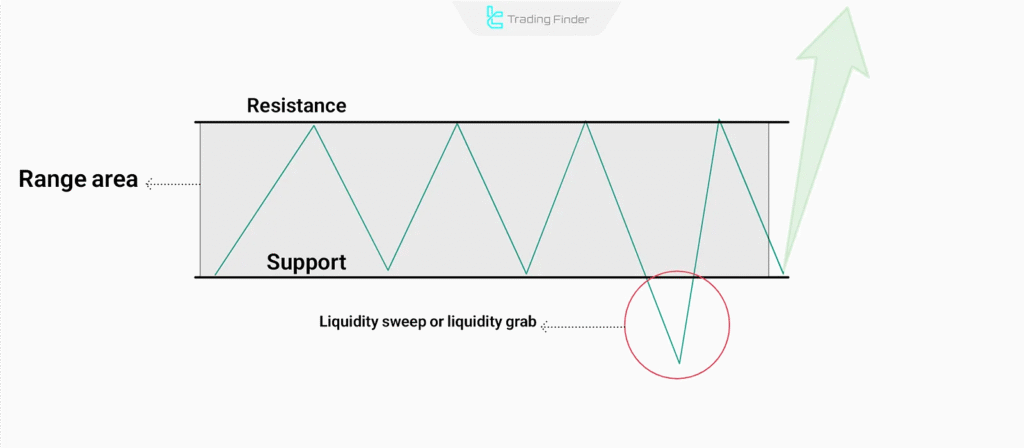

2. Wait for Liquidity Grab

ICT teaches that breakouts are often false first.

- Price may push above resistance to grab buy stops and then reverse down.

- Or, price may dip below support to take sell stops and then bounce higher.

This is called a stop hunt.

3. Trade Back Into the Range

Once the liquidity grab happens, the safer trade is often back into the range.

- If price spikes above resistance but closes back inside → sell back into the range.

- If price dips below support but closes back inside → buy back into the range.

Example:

EUR/USD spikes above 1.0800, but quickly falls back to 1.0785.

That’s a sign Smart Money only cleared stops.

A short trade targeting 1.0700 (support) is valid.

4. Watch for Breakouts

After enough liquidity has been collected, price eventually breaks out for real.

ICT suggests looking for:

- Displacement candles (large, impulsive moves).

- Market Structure Shifts (MSS) on lower timeframes.

Example:

If USD/JPY breaks below the range with a large bearish candle and does not return inside, that’s likely the true breakout.

You can then trade in that direction.

4. Practical Example: ICT Asian Session Range

During the Asian Session, the market often ranges with low volatility.

- ICT uses this consolidation to frame setups for the London Session.

- A stop hunt outside the Asian range often sets up the day’s trend.

Example:

- Asian range forms between 145.20–145.50 in USD/JPY.

- London session pushes above 145.50, clears liquidity, then dumps below 145.20.

- That becomes a high-probability short trade.

5. Tips for Range and Consolidation Trading in ICT

- Always mark the highs and lows of consolidation zones.

- Don’t chase the first breakout — wait for confirmation.

- Use ICT concepts like Liquidity Pools, Stop Hunts, and Market Structure Shifts.

- Focus on high-probability times like London Open and New York Open.

6. Final Thoughts

Trading ranges is about patience and reading liquidity.

Instead of guessing breakout directions, ICT’s approach teaches you to let Smart Money show their hand.

First, they collect liquidity inside consolidation.

Then, they move the market in the true direction.

If you master this, you’ll avoid false breakouts and catch the real move with confidence.

Leave a Reply