The ICT Reclaimed Order Block Theory is a concept that builds on the core idea of order blocks in trading, where institutional levels are targeted for trade entries and exits.

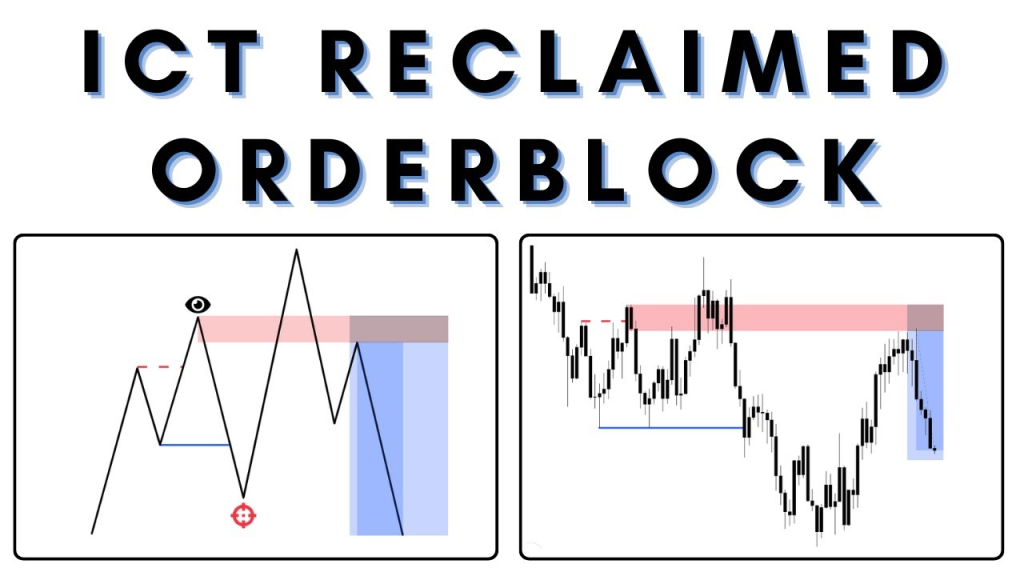

A “reclaimed order block” is essentially an order block that initially fails but is later “reclaimed” by institutional traders, presenting a valuable trade setup.

This setup identifies market levels where smart money could be re-entering, providing an opportunity for retail traders to align with institutional moves.

1. Key Concepts in ICT Reclaimed Order Block Theory

1. Order Block (OB):

This is typically the last bullish or bearish candle before a significant price movement.

An order block represents an area where institutional money likely has positioned trades.

In a bullish setup, this would be the last bearish candle before a strong upward move.

For a bearish setup, it’s the last bullish candle before a strong down move.

2. Failed Order Block:

Sometimes, price will move against the order block direction, seemingly invalidating the level.

This initial failure might indicate retail traders’ participation as they expect a breakout, but institutions have other intentions.

3. Reclaimed Order Block:

When price revisits this “failed” order block and breaks back in the original direction, it indicates that institutional interest remains at this level.

This setup signals a reclaimed order block, which suggests the market is now ready to move in the intended direction.

2. Why Reclaimed Order Blocks Occur in ICT

Reclaimed order blocks occur as institutions manipulate price levels to either generate liquidity or trigger retail traders’ stop-loss orders.

By causing a temporary break of an order block and then reclaiming it, institutions can gather the liquidity necessary to drive the market in their preferred direction.

3. Steps to Identify a Reclaimed Order Block in ICT

1. Identify the Original Order Block:

Look for the last opposing candle (bullish for downtrends, bearish for uptrends) before a strong price move.

2. Observe a Break or Violation:

Watch for price to break or move against this order block.

At this stage, many retail traders might interpret it as a breakout in the opposite direction.

3. Wait for Price to Reclaim the Block:

Monitor price action to see if it reclaims the original order block.

This indicates that the level is still respected by institutional players.

4. Confirm with Market Structure:

Once the order block is reclaimed, look for a confirmation in the form of a break of structure (BOS) or change of character (CHOCH), showing that the market aligns with the intended direction.

5. Enter Trade:

Place trades in the direction of the reclaimed order block with stops below the original order block (for longs) or above (for shorts).

4. Example of a Reclaimed Order Block Setup in ICT

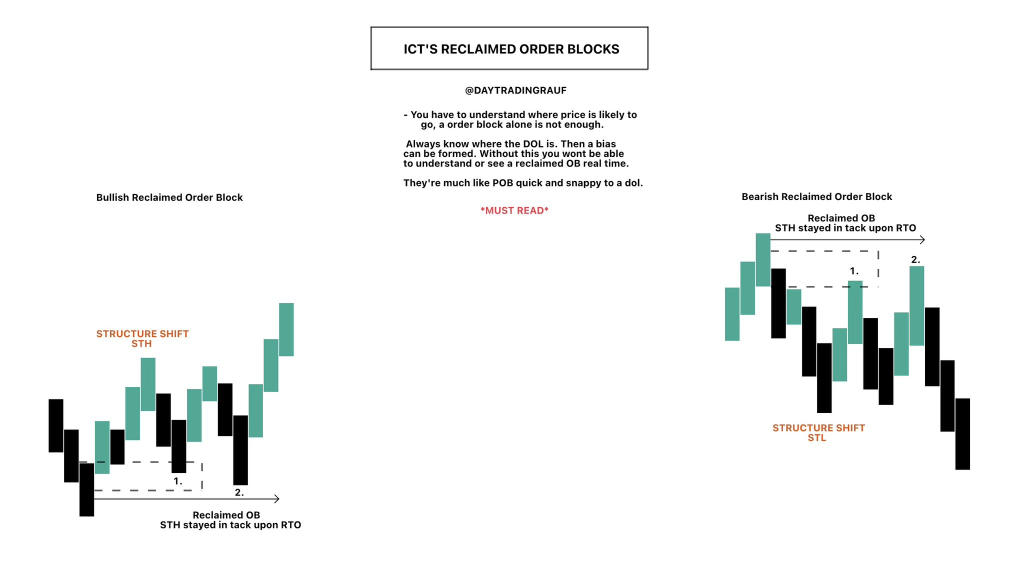

1. Bullish Reclaimed Order Block Scenario in ICT:

Step 1: Let’s say EUR/USD has been in an uptrend, and you identify a bullish order block around 1.1000, representing the last bearish candle before a significant move upwards.

Step 2: Price retraces and dips below 1.1000, temporarily moving lower and appearing to invalidate the order block.

Many retail traders might short at this point, seeing a potential breakdown.

Step 3: After liquidity has been gathered, price sharply reverses back above the 1.1000 level, indicating that institutions are reclaiming the order block.

Step 4: As price moves up, it breaks the previous swing high, confirming the reclaimed order block’s validity.

Step 5: A trader could enter a long trade at the order block’s reclaim, placing a stop below the low created during the initial break, with the target set at the next resistance level.

2. Bearish Reclaimed Order Block Scenario in ICT:

Step 1: Suppose GBP/USD has been in a downtrend, and you identify a bearish order block at 1.3200.

Step 2: Price moves up, breaking the 1.3200 level, and seems to invalidate the bearish order block.

Many traders may take this as a bullish breakout.

Step 3: Price suddenly reverses below 1.3200, reclaiming the bearish order block.

Step 4: Price then breaks below the previous swing low, affirming the downtrend and confirming institutional selling interest.

Step 5: A trader could enter a short position here with a stop just above 1.3200 and a target at the next support level.

5. Practical Tips for Using Reclaimed Order Blocks in ICT

1. Confirmation is Key:

Wait for additional confirmation like BOS or CHOCH after the reclaim to strengthen the trade setup.

2. Higher Timeframes are Reliable:

Reclaimed order blocks on higher timeframes (e.g., 1-hour, 4-hour, daily) are generally more reliable than lower timeframes due to reduced noise.

3. Look for Confluence:

Align reclaimed order blocks with other ICT concepts, such as liquidity pools or kill zones, to enhance trade probability.

6. Why Reclaimed Order Blocks Matter in ICT

Reclaimed order blocks are critical because they reveal institutional intentions after a trap or false move.

By waiting for a reclaim, retail traders can avoid false breakouts and align their entries with institutional moves, improving trade success rates.

7. Summary

In ICT trading, the reclaimed order block strategy helps traders capitalize on institutional moves after an initial fake-out.

By waiting for the reclaim of an order block and confirming market structure alignment, traders can enhance their entries, aiming to follow the “smart money.”

Leave a Reply