The ICT Unicorn strategy, based on the teachings of Inner Circle Trader (ICT), can help traders predict sharp price movements in various markets like stocks, crypto, forex, and futures.

This blog post will break down this strategy into easy-to-understand concepts with illustrative examples.

1. Understanding the Building Blocks in ICT Unicorn Strategy

The ICT Unicorn strategy hinges on two key concepts:

1. Fair Value Gaps (FVGs):

These are imbalances in the market that occur when prices jump rapidly up or down, leaving a gap in the price chart.

Think of it as a sudden surge or plunge in price, creating a void in the usual price flow.

These gaps represent areas where the price moved too quickly, leaving behind unfinished business.

When the price revisits these gaps, traders often see it as an opportunity to enter the market, expecting the price to fill the gap.

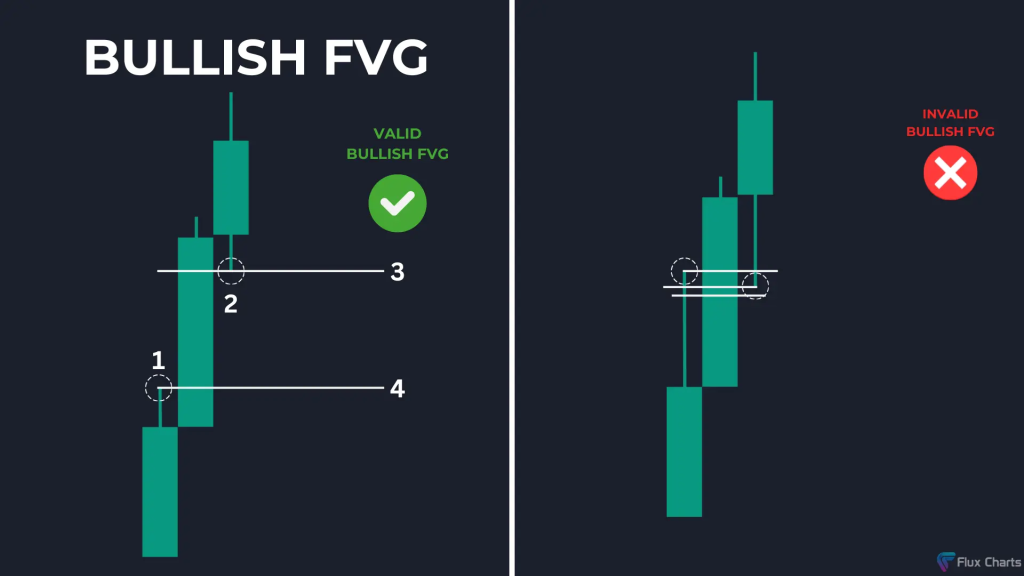

1. Bullish FVG:

This forms when the price jumps up rapidly.

It’s identified by three consecutive bullish (upward) candles where the high of the first candle doesn’t overlap the low of the third candle.

2. Bearish FVG:

This forms when the price drops sharply.

You’ll see three consecutive bearish (downward) candles where the low of the first candle doesn’t overlap the high of the third candle.

2. Breaker Blocks (BBs):

Imagine a support or resistance level that gets broken.

The area around this broken level can become a Breaker Block.

They are essentially invalidated Order Blocks (OBs), which are zones where significant buy or sell orders are placed.

When an Order Block fails to hold, it can reverse its role.

1. Bullish BB:

This forms when a bearish order block (support) is broken.

It is identified by a specific pattern: a low (L), followed by a high (H), a lower low (LL), and finally a higher high (HH).

2. Bearish BB:

This forms when a bullish order block (resistance) is broken.

Its pattern is: a high (H), a low (L), a higher high (HH), and a lower low (LL).

2. The Magic of the ICT Unicorn: Spotting the Setup

The ICT Unicorn setup occurs when a Fair Value Gap overlaps a Breaker Block.

To find this setup:

- Identify all Breaker Blocks on your price chart.

- Check for any Fair Value Gaps that overlap these Breaker Blocks.

There are two types of Unicorn setups:

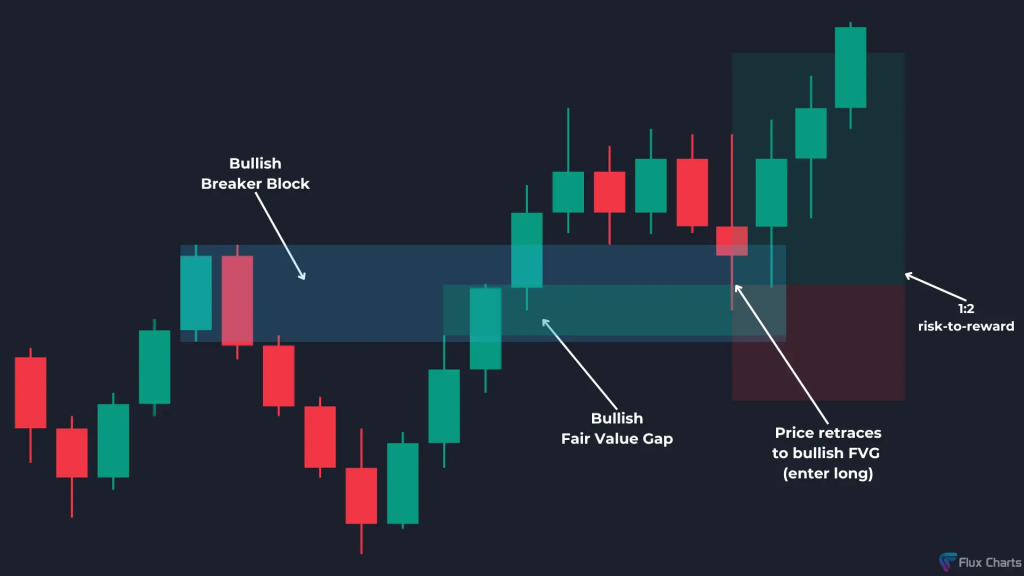

1. Bullish Setup:

A bullish Fair Value Gap overlaps a bullish Breaker Block. This signals a potential upward price movement.

2. Bearish Setup:

A bearish Fair Value Gap overlaps a bearish Breaker Block. This suggests a potential downward price move.

3. Putting the Strategy into Action: Trading the ICT Unicorn

1. Long Trades (Buying):

- Identify a Bullish ICT Unicorn setup.

- Wait for the price to retrace (pull back) to the bullish Fair Value Gap.

- Enter a long trade (buy).

- Set your stop-loss order below the bullish Breaker Block. This limits potential losses if the trade goes against you.

- Aim for a 1:2 risk-to-reward ratio. This means you’re targeting a profit twice the size of your potential loss.

2. Short Trades (Selling):

- Identify a Bearish ICT Unicorn setup.

- Wait for the price to retrace to the bearish Fair Value Gap.

- Enter a short trade (sell).

- Set your stop-loss order above the bearish Breaker Block.

- Aim for a 1:2 risk-to-reward ratio.

4. Real-World Examples of ICT Unicorn

1. Long Trade Example:

Imagine a bullish Breaker Block with a bullish Fair Value Gap above it.

As the price retraces to the gap, you buy, setting your stop-loss below the Breaker Block.

Your profit target would be twice the distance between your entry price and your stop-loss.

2. Short Trade Example:

Consider a bearish Breaker Block with a bearish Fair Value Gap below it.

When the price retraces to this gap, you sell, placing your stop-loss above the Breaker Block.

Your profit target would be double the distance between your entry and stop-loss.

5. Minimizing Risk: Avoiding Bad ICT Unicorn Setups

While no trading strategy guarantees 100% accuracy, you can improve your chances of success by:

1. Establishing a Trade Bias:

Determine whether you’re leaning towards bullish or bearish trades based on market conditions.

If bullish, focus only on bullish Unicorn setups, and vice-versa.

2. Confirming with Higher Timeframes:

Analyze the market trend on higher timeframes (e.g., 15-minute, 30-minute) if you’re trading on a lower timeframe (e.g., 5-minute).

This ensures your trade aligns with the overall market direction.

6. Timing and Tools for Trading ICT Unicorn

- Volatility is Key: The ICT Unicorn strategy works best in volatile markets.

- Trading Sessions: Consider trading during active sessions like New York, London, and Asia.

- Timeframes: The strategy can be applied to various timeframes, but remember to cross-check with higher timeframes for trend confirmation.

7. Backtesting and Automation for Trading the ICT Unicorn

1. Backtesting:

To test the strategy’s historical performance, you can use backtesting tools, such as the one available in the ICT Unicorn indicator by Flux Charts on TradingView.

2. ICT Unicorn Indicator:

This indicator, available on TradingView, automates the strategy, providing signals, stop-loss and take-profit levels, and more.

By understanding the core concepts of FVGs and Breaker Blocks, traders can effectively utilize the ICT Unicorn strategy to identify potential trading opportunities and manage their risk.

Leave a Reply