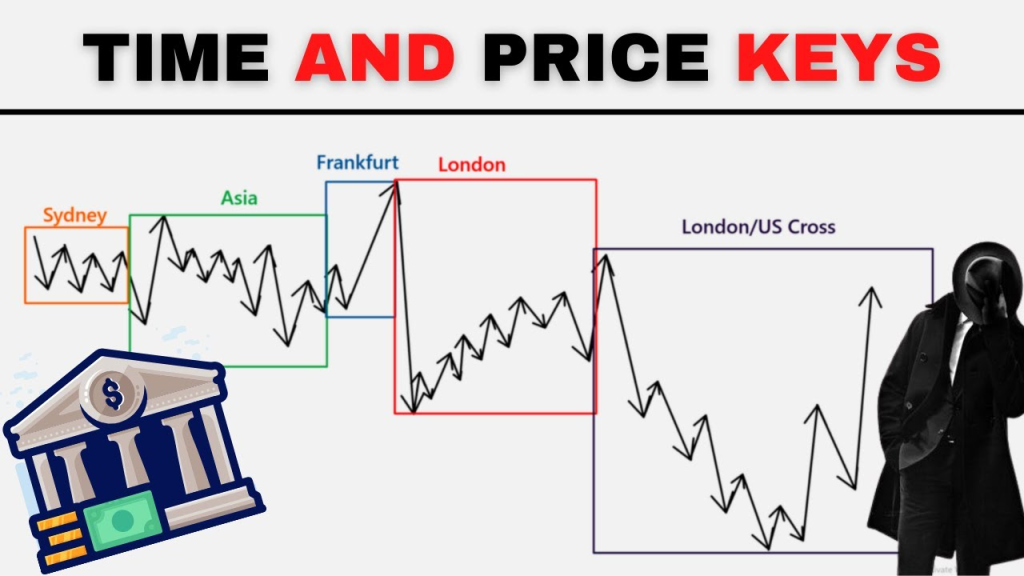

In the Inner Circle Trader (ICT) methodology, time plays a crucial role in determining the most favorable market conditions to trade.

By aligning price action with key time zones, such as the London Open, New York Open, and other significant trading sessions, traders can better predict institutional behavior and take advantage of high-probability setups.

This guide explains how to align price action with these time zones using the ICT framework, supported by examples.

1. Understanding Key Trading Time Zones in ICT

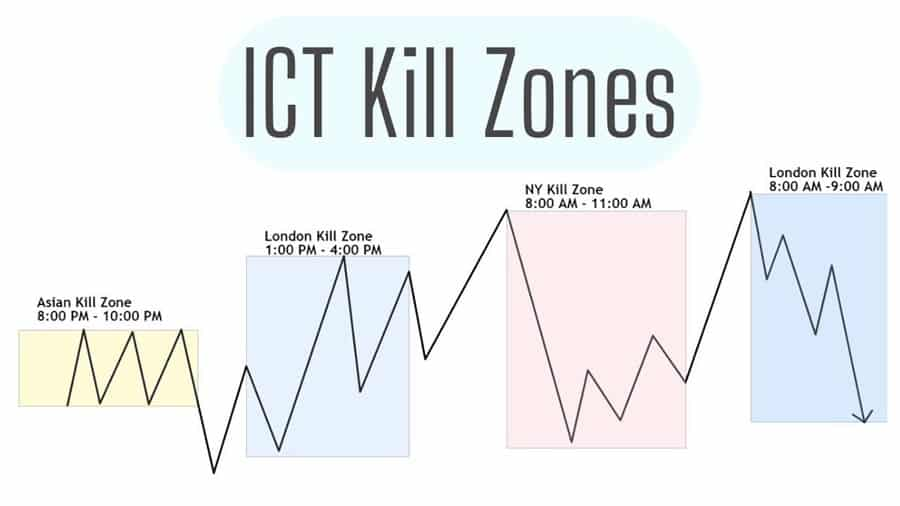

ICT identifies specific time periods during the trading day when market liquidity is highest, and institutional traders are most active.

These periods often see price volatility and movements that offer excellent trading opportunities.

The three main time zones ICT traders focus on are:

- London Open (7:00 AM – 9:00 AM UK time)

- New York Open (8:30 AM – 10:30 AM EST)

- Asian Session Close / London Pre-Market (3:00 AM – 5:00 AM UK time)

These sessions are critical because they coincide with institutional trading desks being active, meaning larger orders and volatility can impact price action significantly.

2. Why Time Zones Matter in ICT Trading

Institutions tend to place their largest trades during these high-liquidity time zones.

Price manipulation, liquidity sweeps, and institutional order flow are all more likely to occur in these sessions.

As a retail trader using ICT strategies, aligning your trades with these sessions allows you to “ride the coattails” of smart money.

By focusing on these time zones, traders can:

- Capture high-probability moves: Price action tends to align with institutional objectives (such as targeting liquidity pools or filling fair value gaps).

- Predict market reversals: Price reversals often occur during the opening or closing of these key sessions.

- Avoid false moves: By trading during high liquidity times, traders are less likely to be caught in low-volume market noise or false breakouts.

3. Aligning Price Action with the London Open

The London Open is one of the most important times for ICT traders.

The European session accounts for a large portion of daily trading volume, and it often sets the direction for the day.

1. How to Trade the London Open

1. Liquidity Sweeps:

Look for price to sweep key liquidity levels, such as highs and lows formed during the Asian session.

This is a common institutional tactic to capture retail stop-loss orders before the real move begins.

2. Fair Value Gaps (FVGs):

After the liquidity sweep, identify any fair value gaps (FVGs) on smaller time frames (such as the 5-minute or 15-minute chart).

These imbalances often get filled during the London Open, offering a great entry point.

3. Market Structure Shift (MSS):

Once price sweeps liquidity and shifts market structure (e.g., from a downtrend to an uptrend), look for a retracement into the FVG for an entry.

4. Example:

Let’s say EUR/USD is in a range during the Asian session. As the London Open approaches, price sweeps below the Asian session low, triggering sell stops.

Institutions step in and reverse the price, creating an FVG on the 5-minute chart.

The price retraces into the FVG, providing a high-probability long entry.

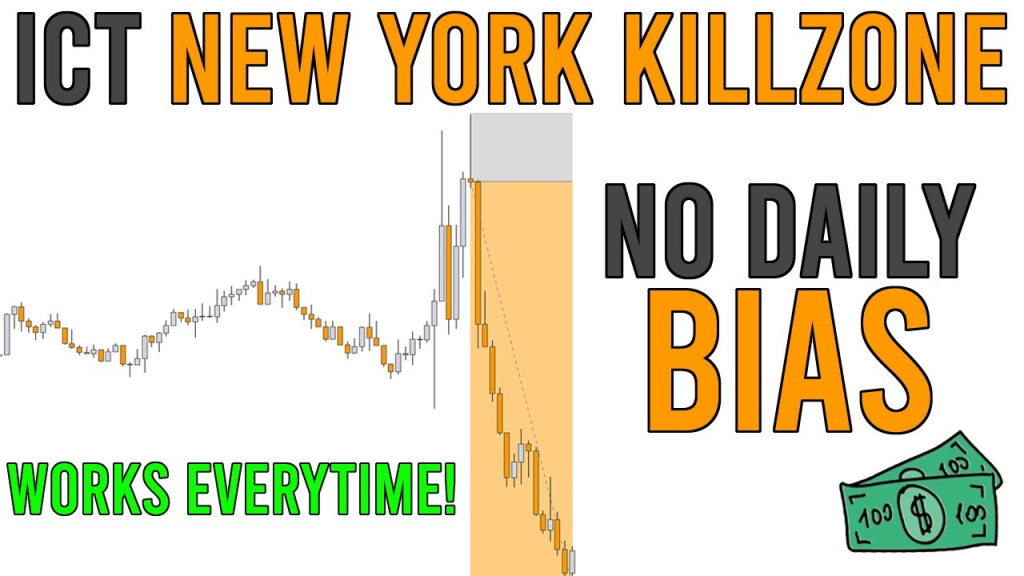

4. Trading the New York Open

The New York Open coincides with the overlap between the London and New York sessions, which adds even more liquidity and volatility to the market.

Institutional traders in both financial hubs are active, making it a prime time for ICT traders to execute trades.

1. How to Trade the New York Open

1. Liquidity Runs:

Similar to the London Open, look for price to run liquidity levels (e.g., swing highs or lows) from the London session.

This is often followed by a reversal or continuation move, depending on the overall trend.

2. Order Blocks:

After a liquidity run, identify an order block (a zone where institutions have previously entered or exited large positions).

If price revisits this order block during the New York Open, it often signals a potential entry point for a trade.

3. Optimal Trade Entry:

The most favorable setups often occur around 9:30 AM EST, coinciding with the stock market open in the U.S. Liquidity is highest at this time, and it is common to see large moves.

4. Example:

Let’s say GBP/USD was in a strong uptrend during the London Session. As the New York Open approaches, price briefly runs below a key swing low from earlier in the session, triggering stop-losses.

An order block forms near 1.3700, and price reverses into this zone, providing a high-probability buy setup.

5. The Asian Session Close / London Pre-Market

Although the Asian session typically has lower liquidity than the London and New York sessions, the Asian Close and London Pre-Market period (around 3:00 AM – 5:00 AM UK time) can still offer valuable setups.

1. How to Trade the Asian Close

1. Price Reversals:

Look for price reversals at the end of the Asian session as the London market prepares to open.

Institutions often use this time to reposition themselves for the upcoming volatility.

2. Liquidity Pools:

Key levels established during the Asian session (such as session highs or lows) often get swept during this period, creating an opportunity for trades aligned with the upcoming London Open.

3. Example:

USD/JPY is trading within a tight range during the Asian Session.

As the session comes to a close, price runs above the Asian session high, triggering buy stops.

Shortly after, price reverses and begins moving lower as the London Pre-Market traders step in.

This liquidity sweep provides a shorting opportunity before the London Open volatility.

6. Combining Key Time Zones with Price Action for ICT Success

The key to mastering ICT strategies is combining time zones with price action setups, such as:

- Liquidity sweeps

- Fair value gaps (FVGs)

- Order blocks

- Market structure shifts (MSS)

1. Example of a Full Day’s Trade:

1. London Open:

EUR/USD sweeps the Asian session lows, triggering sell stops. Price reverses and forms an FVG, where you place a long trade.

2. New York Open:

During the overlap of London and New York sessions, price runs the highs from earlier in the London session, creating a sell opportunity into an order block.

3. Close:

As the New York session closes, price consolidates, giving you time to exit trades or prepare for the next trading day.

By focusing on high-probability times like the London Open and New York Open, you can align your trades with institutional activity and increase your chances of success.

7. Conclusion

Aligning price action with key time zones such as the London Open, New York Open, and Asian Session Close is essential for executing high-probability trades in the ICT methodology.

These periods represent times of institutional activity, liquidity hunts, and significant price movement, which ICT traders can capitalize on using liquidity sweeps, fair value gaps, and order blocks.

By mastering the interaction between time and price action, you’ll be able to refine your trades and improve your overall trading results.

Leave a Reply