The Shooting Star candlestick is a bearish reversal pattern commonly recognized in ICT trading for identifying potential trend reversals.

It typically forms at the top of an uptrend, indicating that the upward momentum may be weakening.

Recognizing and trading this pattern can help ICT traders catch potential reversals or pullbacks before a downward move.

1. What is a Shooting Star Candlestick in ICT?

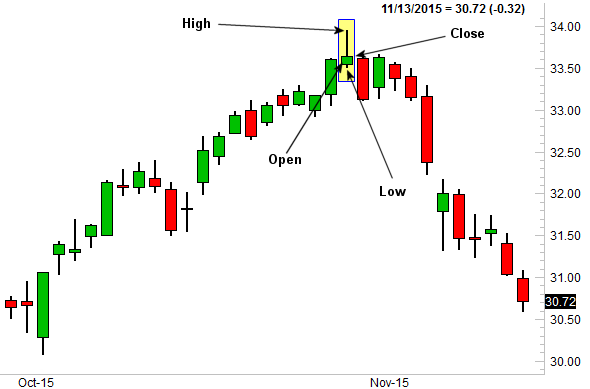

1. Structure:

- Long Upper Wick: The candlestick has a long upper shadow, at least twice the length of the real body.

- Small Real Body: The small real body (either bullish or bearish) forms near the candle’s low, signaling rejection of higher prices.

- Minimal Lower Wick: It has little or no lower shadow, reflecting a lack of buyer support at the close.

2. Interpretation:

When a Shooting Star appears in an uptrend, it signifies that while buyers initially drove the price higher, sellers overpowered them, pushing the price back down near the open.

This creates a potential reversal signal.

2. How to Identify a Shooting Star in ICT

1. Location in Trend:

Look for a Shooting Star after a sustained upward trend or near a resistance level where buyers are losing momentum.

2. Volume Confirmation:

Higher volume during the formation of the Shooting Star strengthens the validity of the reversal, as it signals increased selling pressure.

3. Price Action Context:

In ICT, a Shooting Star near liquidity zones, such as key supply levels, order blocks, or resistance, may signal the exhaustion of buyers and readiness for a reversal.

3. Trading the Shooting Star in ICT

1. Entry Strategy

- Wait for confirmation: A conservative approach is to wait for a bearish candle following the Shooting Star to confirm the reversal.

- Entry Point: Enter a short trade below the low of the Shooting Star. This suggests a break in the structure, and sellers have taken control.

Example:

Suppose GBP/USD has been in an uptrend and forms a Shooting Star at 1.3200, a significant resistance level.

After this, a bearish candle closes below the Shooting Star’s low, confirming the reversal.

An ICT trader would enter a short trade slightly below 1.3180, the low of the Shooting Star, anticipating a downward move.

4. Stop Loss and Take Profit Placement in ICT

- Stop Loss: Place a stop loss just above the high of the Shooting Star to protect against invalidation of the reversal.

- Take Profit: Set the target at key support levels, such as previous lows, or areas where liquidity pools might exist.

5. Confluence with ICT Concepts

- Order Blocks: If the Shooting Star forms near an order block, it strengthens the bearish reversal signal.

- Fair Value Gaps (FVG): Look for Shooting Stars forming in a fair value gap, where price may seek to fill the imbalance downward.

6. Example of Shooting Star in Action in ICT

Let’s say EUR/USD has risen for several days and forms a Shooting Star at 1.1800, a level previously known for strong resistance.

After the Shooting Star forms, the next candle closes lower, confirming the reversal.

You could enter a short trade just below the Shooting Star’s low, place a stop loss above its high, and target a recent support level.

7. Summary of Key Steps to Trade the Shooting Star Candlestick

| Step | Action |

|---|---|

| Identify Trend | Look for Shooting Star at the top of an uptrend. |

| Check Volume | High volume strengthens the reversal signal. |

| Confirmation Candle | Wait for a bearish candle after the Shooting Star for entry confirmation. |

| Set Stop Loss | Place above the Shooting Star’s high. |

| Target Profits | Aim for nearby support or liquidity zones. |

8. Conclusion

In ICT trading, the Shooting Star candlestick serves as a powerful reversal indicator, especially when it aligns with key price zones and liquidity considerations.

By carefully timing entries and setting stop losses and profit targets with ICT principles, traders can use the Shooting Star candlestick pattern to identify and capitalize on bearish reversals effectively.

Leave a Reply