The Ultimate ICT Intraday Strategy is a trading method that helps you find high-probability trades during the same day using Smart Money Concepts.

It combines these core ICT ideas:

- Liquidity

- Market structure

- Time of day (Killzones)

- Fair Value Gaps (FVGs)

- Order Blocks

You don’t need to hold trades overnight.

You just need 1–2 good trades per day — with precision and confidence.

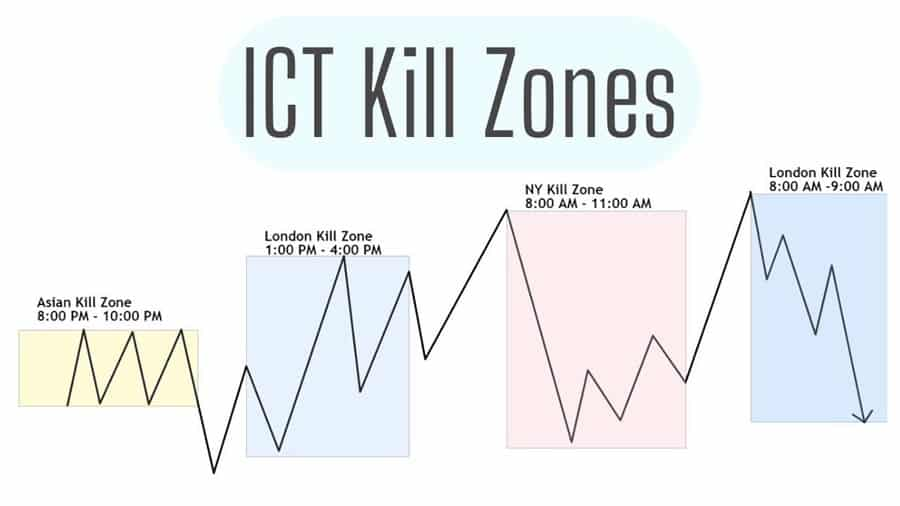

1. When Should You Trade in ICT?

ICT focuses on 3 key sessions:

- London Killzone (2:00 AM – 5:00 AM EST)

- New York Killzone (7:00 AM – 10:00 AM EST)

- Lunch (11:30 AM – 1:00 PM EST) – avoid trading here

The New York session is ideal for most intraday traders.

2. Timeframes to Use in the Ultimate ICT Intraday Trading Strategy

- Daily: to understand overall bias

- 1H / 15M: to mark structure, liquidity, FVGs

- 5M / 1M: to enter with sniper precision

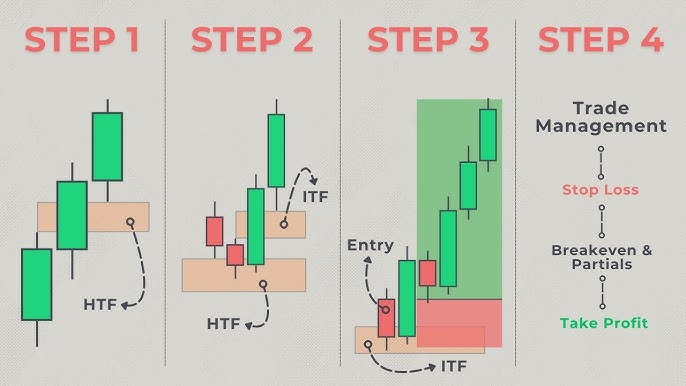

3. Step-by-Step: Ultimate ICT Intraday Trading Strategy

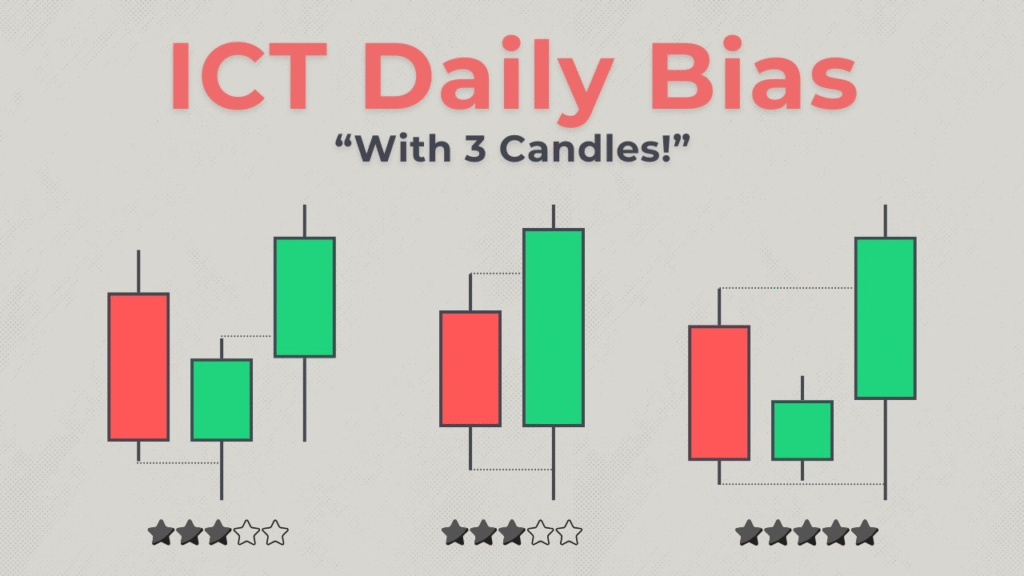

Step 1: Start with a Daily Bias

Look at the previous day’s high and low.

- Is price close to previous day’s high?

- Is it moving toward a liquidity pool?

- Is it likely to hunt stops above or below?

Let’s say price is moving up toward yesterday’s high — that’s buy-side liquidity. So you’ll look for a reversal near that point.

Step 2: Mark Key Liquidity Levels

Mark:

- Daily high and low

- Asian session high/low

- Previous day’s FVGs

- Internal liquidity (equal highs/lows)

Example:

- Asian High = 1.2630

- Previous Day’s High = 1.2655

- Your eyes should be on 1.2630 to 1.2655 for a possible liquidity run.

Step 3: Wait for the Killzone

Let’s assume you are trading the New York Killzone (7:00 AM – 10:00 AM EST).

This is when:

- Big market participants enter

- Liquidity runs and real moves begin

- News can act as a catalyst

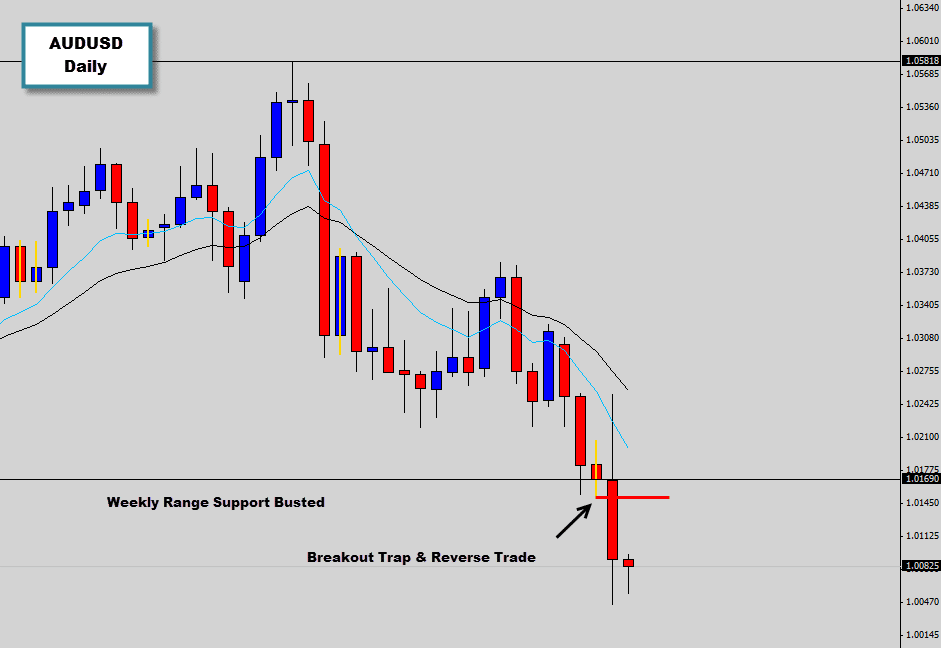

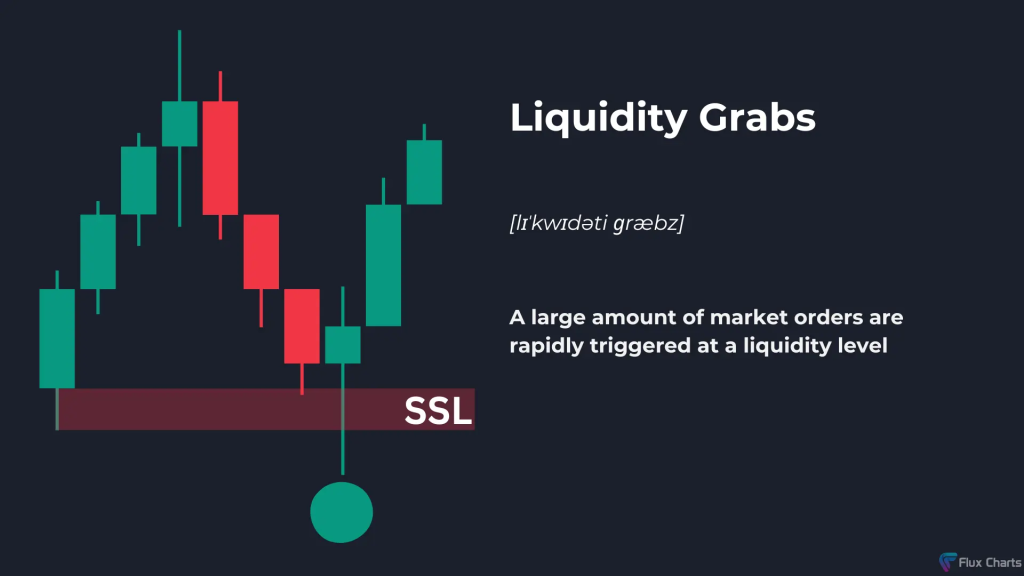

Step 4: Look for a Liquidity Grab

Price will often:

- Break above a recent high (buy-side liquidity)

- Or dip below a recent low (sell-side liquidity)

- Then reverse quickly

This is the Smart Money trap.

Example:

- Price spikes above Asian high at 1.2630

- Immediately rejects with a Change of Character (CHoCH) on 1M or 5M chart

- A small FVG forms right after that

Step 5: Confirm Reversal and Enter

This is where it gets surgical.

Look for:

- Market structure break or CHoCH

- Fair Value Gap (small imbalance)

- Order Block near the grab

Place your entry:

- Inside the FVG retracement

- Or on a refined order block

Stop-loss:

- Just above the high that took liquidity

Target:

- Internal liquidity, or

- Opposite side of the range

4. Example of the Ultimate ICT Intraday Trading Strategy – EUR/USD Short

- Daily Bias: Bearish

- Asian High: 1.0930

- NY Killzone: Price spikes to 1.0935 → breaks liquidity

- 5M BOS appears + FVG at 1.0920

- Entry: Short at 1.0920

- SL: 1.0936 (above the high)

- TP: 1.0885 (sell-side liquidity)

Risk: 16 pips | Reward: 35 pips = 2.1R

5. Bonus Tip: Use Time and Price Together in ICT

- If a liquidity grab happens during NY Killzone, it’s valid

- If it happens outside Killzones, it’s often a trap

- Combine price action with time-based expectation

6. Why This ICT Strategy Works

Uses institutional logic

Based on repeatable patterns

Gives you clear risk management

Works on all major Forex pairs, indices, and crypto

7. What to Avoid in the Ultimate ICT Intraday Trading Strategy

- Don’t trade in consolidation

- Don’t chase breakouts blindly

- Avoid midday sessions (low volume = chop)

- Don’t enter without confirmation (FVG/BOS)

8. Final Words

The Ultimate ICT Intraday Strategy is about:

- Waiting patiently

- Understanding where Smart Money wants to attack

- Using FVGs, structure breaks, and order blocks for entry

- Trading with precision and discipline

Even one good trade per day using this system can grow your account over time.

Leave a Reply