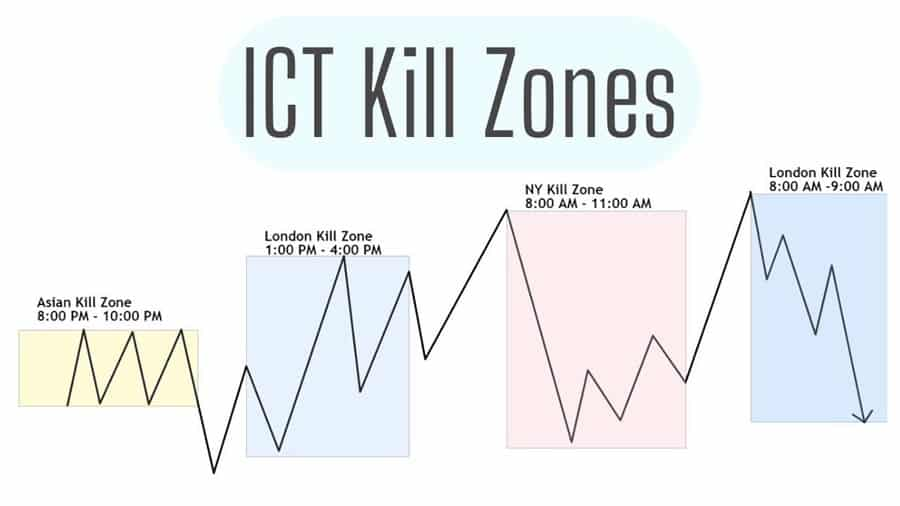

In ICT (Inner Circle Trader) trading, killzones are crucial because they align with high-volume periods when institutional activity and liquidity are at their peaks.

These specific times provide clearer, more predictable market movements and create trading opportunities aligned with institutional order flow.

Killzones include the London Open, New York Open, and London Close—the three sessions where price action is most active, often generating substantial directional movement.

1. Why Killzones Are Crucial in ICT

1. Institutional Participation:

Killzones coincide with periods when institutional traders, banks, and hedge funds are most active.

This activity leads to higher volume and sharper price movements, which ICT traders aim to capitalize on.

2. Liquidity Concentration:

Killzones see increased trading volume, which means liquidity is concentrated, making it easier to identify large players’ moves.

This concentration often results in setups like liquidity sweeps, order blocks, and fair value gaps, which align with ICT trading strategies.

3. Predictable Volatility:

These times consistently show more volatility, as sessions overlap or open and close.

This volatility creates larger price swings and more distinct setups, which are essential for ICT traders looking to enter trades with a higher probability of success.

2. Breakdown of Each Killzone in ICT

1. London Open Killzone

Time Frame: 2:00 AM – 5:00 AM EST

Significance: London is one of the largest forex trading hubs, and this killzone often experiences a surge in volume as European banks open.

It also overlaps slightly with the end of the Asian session, creating a transition that can lead to strong price movements.

ICT Strategy: During this period, ICT traders look for liquidity sweeps on either side of the Asian session range.

Often, price will “fake out” in one direction, sweep liquidity, then reverse in the opposite direction as institutional traders take positions.

Example:

Suppose the GBP/USD pair traded in a narrow range during the Asian session.

As the London Open approaches, it may briefly spike downward, sweeping liquidity below the Asian session low.

An ICT trader would identify this sweep and potentially enter a long trade when price reverses back above the Asian session low, anticipating that institutions are pushing price upward for the London session.

2. New York Open Killzone

Time Frame: 7:00 AM – 10:00 AM EST

Significance: The New York Open overlaps with the London session and is characterized by heightened volatility as U.S. traders start placing their orders.

This period is especially crucial for ICT traders as it often leads to trend continuation or strong reversals depending on the previous London session’s trend.

ICT Strategy: Traders may look for order blocks and fair value gaps from the London session that can serve as entry points during the New York Open.

Reversals and continuations from London session moves are common.

Example:

Let’s say EUR/USD rallied strongly during the London session and reached a resistance level.

As the New York Open approaches, ICT traders monitor for signs of a reversal, such as a break of structure (BOS) or liquidity sweep above the resistance level.

If a reversal setup appears, traders might enter a short trade, aiming to catch the downward move as U.S. institutions adjust positions.

3. London Close Killzone

Time Frame: 10:00 AM – 12:00 PM EST

Significance: This period marks the end of the London session, and traders often adjust or close positions, creating reversals or slowing momentum.

The London Close is a time when trends established earlier in the day may shift.

ICT Strategy: ICT traders look for trend exhaustion or consolidation, anticipating a reversal as London-based institutional traders finish their trading day.

Example:

If USD/JPY had been in an uptrend from the London session into the New York session, it might begin to pull back around the London Close.

An ICT trader could look for signs of a sell-off, such as a Shooting Star or bearish candlestick pattern, and enter a short position, expecting a retracement as volume decreases with London’s exit.

3. Benefits of Trading in Killzones with ICT Concepts

1. Higher Probability Setups:

Killzones offer trade setups with higher accuracy since they align with times when institutions make moves.

2. Increased Liquidity:

The concentration of liquidity during killzones helps in identifying areas where smart money may sweep liquidity and take the price in the intended direction.

3. Aligned with Institutional Activity:

Since institutions trade in these zones, ICT traders can take advantage of predictable price movements, using concepts like liquidity pools and displacement moves.

4. Summary Table of Killzones in ICT

| Killzone | Time (EST) | Key Price Action | Typical ICT Strategy |

|---|---|---|---|

| London Open | 2:00 AM – 5:00 AM | Liquidity sweeps, breakouts | Trade liquidity sweeps on either side of Asian session range |

| New York Open | 7:00 AM – 10:00 AM | Trend continuation or reversal | Enter based on order blocks and fair value gaps |

| London Close | 10:00 AM – 12:00 PM | Trend reversal, profit-taking | Look for exhaustion or reversals |

5. Conclusion

Killzones are pivotal to ICT trading as they offer structured, reliable trading windows.

By understanding these high-activity periods, ICT traders can time entries based on institutional order flow, capturing moves that align with institutional liquidity strategies.

Trading within these windows provides a clearer perspective on price action and increases the likelihood of catching high-probability trades.

Leave a Reply