Aligning trades with ICT Killzones is a crucial aspect of ICT trading as it helps optimize entries and exits based on high-activity periods in the market.

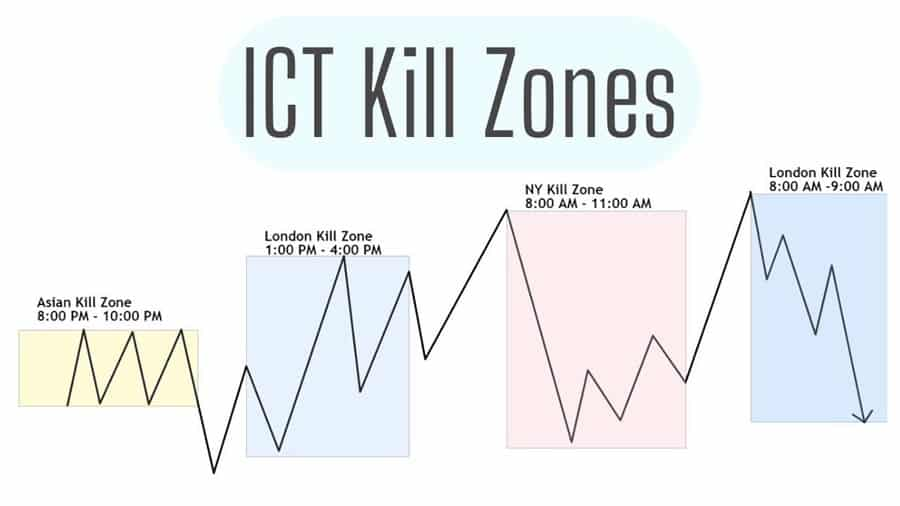

The concept of Killzones in ICT revolves around specific trading windows, particularly the London Open, New York Open, and New York Close, where liquidity and volume typically surge.

Aligning trades within these windows increases the probability of capturing significant price movements as institutional traders and high-volume players are more active.

1. Overview of Key Killzones in ICT

ICT defines several key killzones, each with unique characteristics:

1. London Open Killzone (2:00 AM to 5:00 AM EST):

- High volume as the London session begins, often setting the initial direction for the day.

- Known for initial moves that sometimes result in stop hunts before establishing a strong trend.

2. New York Open Killzone (7:00 AM to 10:00 AM EST):

- Increased volume as both London and New York sessions overlap, amplifying volatility.

- Often presents reversals or continuations of the London session’s trends.

3. New York Close Killzone (2:00 PM to 5:00 PM EST):

- Characterized by end-of-day rebalancing, where institutions adjust positions for the next trading day.

- Lower volume than the open killzones but useful for exits or capturing final trends.

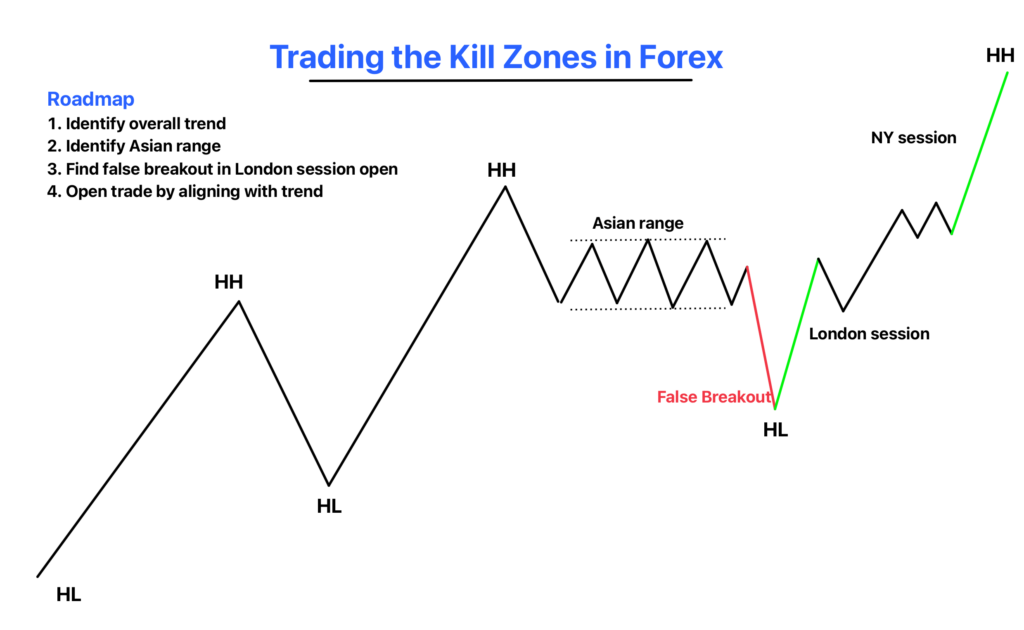

2. How to Align Trades with Killzones in ICT

To align trades with these killzones, focus on identifying patterns and setups within these windows, particularly for entry, exit, and stop-loss placement.

Step 1: Set up Killzone Alerts

Define the killzone times in your trading platform so you’re aware when each killzone starts.

Many ICT traders set alerts, especially for the London and New York Opens, to monitor for potential setups as liquidity increases.

Step 2: Identify Market Bias Before Entering Killzones

Before entering a killzone, establish a daily market bias based on factors like:

- Previous day’s high and low,

- Key support and resistance levels,

- Order blocks or fair value gaps on higher timeframes.

For example, if the daily bias is bearish, look for short setups during the New York Open rather than buying opportunities.

Step 3: Observe Initial Moves (Stop Hunts or Liquidity Sweeps)

Often, killzones begin with liquidity sweeps or stop hunts as institutional traders target areas of retail stop orders before initiating the real move.

Watch for sharp moves that grab liquidity above or below recent highs or lows, then monitor for a reversal or continuation.

Example:

During the London Open, if GBP/USD spikes above a previous high and then quickly drops, this could indicate a stop hunt to target liquidity above the high.

Once the liquidity is captured, the price may reverse in line with the bearish daily bias.

Step 4: Use ICT Patterns for Entry within Killzones

Aligning entries with specific ICT setups can help secure high-probability trades. Common patterns include:

- Break of Structure (BOS) or Change of Character (CHOCH) to confirm a trend shift.

- Order blocks for key entry levels.

- Fair Value Gaps (FVGs) for potential support or resistance zones.

Example:

During the New York Open, if a bullish order block forms after a BOS on EUR/USD, this setup could signal an ideal entry point for a long position, especially if the daily bias is bullish.

Placing an entry near the order block and a stop-loss just below it leverages the killzone’s volume surge for a quick move.

Step 5: Exit and Take Profits Using Later Killzones

Use subsequent killzones for strategic exits:

If you enter during the London Open, consider taking partial profits during the New York Open, especially if the price has reached a key resistance level or if there is a high-impact news event approaching.

The New York Close can also serve as an exit point for day trades, as liquidity reduces after this window.

Example:

Suppose you enter a long trade during the London Open on GBP/USD. The price rises throughout the day, reaching a significant resistance level near the New York Close.

Taking profits here aligns with the reduced liquidity phase, where larger players start to exit, and reversals are common.

3. Examples of Killzone-Aligned Trades in ICT

Example 1: Bullish Trade in the London Open

- Pre-Killzone Bias: Daily bias is bullish on EUR/USD.

- Initial Move: At the London Open, price drops briefly to a recent low, triggering retail stop losses.

- Entry Setup: A bullish order block forms, and the price breaks above it, indicating a potential entry.

- Entry and Stop: Enter long near the order block, with a stop below the recent low.

- Exit Strategy: Take profits at the New York Open or upon reaching a higher resistance level.

Example 2: Short Trade During New York Open

- Pre-Killzone Bias: Daily bias is bearish on GBP/USD.

- Liquidity Grab: At the New York Open, GBP/USD spikes above a recent high, sweeping liquidity.

- Confirmation Pattern: A bearish FVG forms, signaling a potential reversal in line with the daily bias.

- Entry and Stop: Enter short at the FVG, with a stop above the high.

- Exit Strategy: Take profits as price reaches support near the New York Close.

4. Summary Table of Killzone Strategy in ICT

| Killzone | Characteristics | Entry Example | Exit Example |

|---|---|---|---|

| London Open | High volume; initial stop hunts. | Short after a liquidity sweep above a high. | Exit at New York Open if major resistance is met. |

| New York Open | Increased volatility from session overlap. | Long from a bullish order block if bias is bullish. | Partial exit by New York Close to lock in gains. |

| New York Close | Lower volume; final trend moves possible. | Avoid new entries; use for partial or full exits. | Full exit as price approaches support/resistance levels. |

5. Key Takeaways

- Killzones offer high-liquidity windows: Entering and exiting trades during these times maximizes potential as institutions are active.

- Combining ICT setups with killzones increases reliability: Patterns like BOS, order blocks, and FVGs offer structure when aligned with killzone moves.

- Use multiple killzones for trade management: Taking partial profits at later killzones or exiting fully at reduced-liquidity times minimizes risk and maximizes profit potential.

Killzones are critical in ICT because they sync trades with the rhythm of institutional activity, enhancing trade entry, execution, and exit points for higher consistency.

Leave a Reply