1. Understanding Lower Highs and Lower Lows in ICT Trading

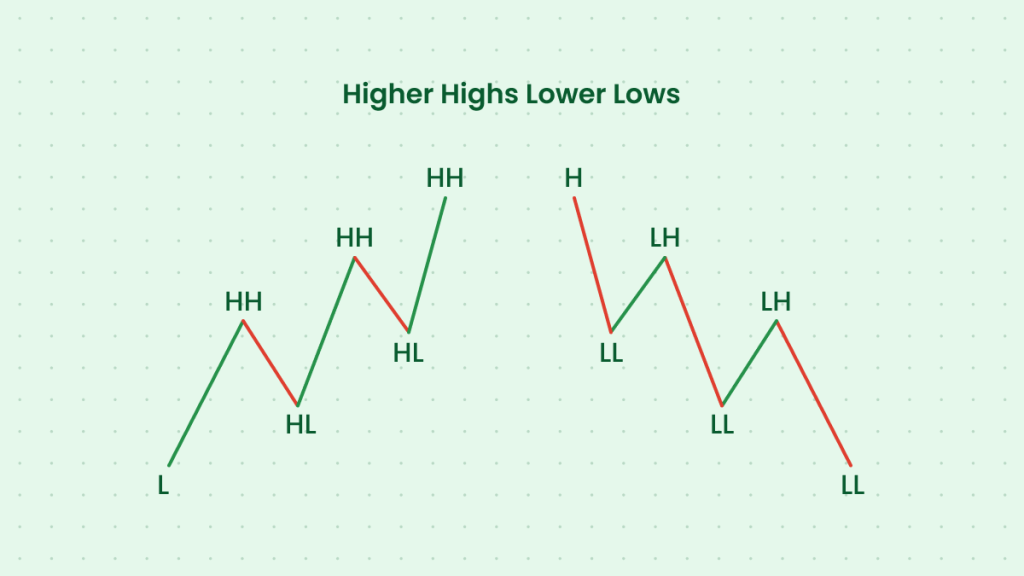

In ICT (Inner Circle Trader) methodology, a bearish trend is characterized by a series of lower highs (LH) and lower lows (LL), showing institutional distribution and smart money manipulation.

Key Concepts in a Bearish Trend:

- Lower High (LH): A price peak that is lower than the previous high, indicating weak bullish momentum.

- Lower Low (LL): A price bottom that is lower than the previous low, confirming bearish market structure.

Institutions create these formations to trap retail traders and hunt liquidity before continuing the downward movement.

2. Step-by-Step Guide to Identifying Lower Highs and Lower Lows in ICT

1. Identify Market Structure Breakdown (MSB)

- Look for a break in bullish structure where price fails to make higher highs.

- The first lower low (LL) forms when price breaks below a previous low.

Example:

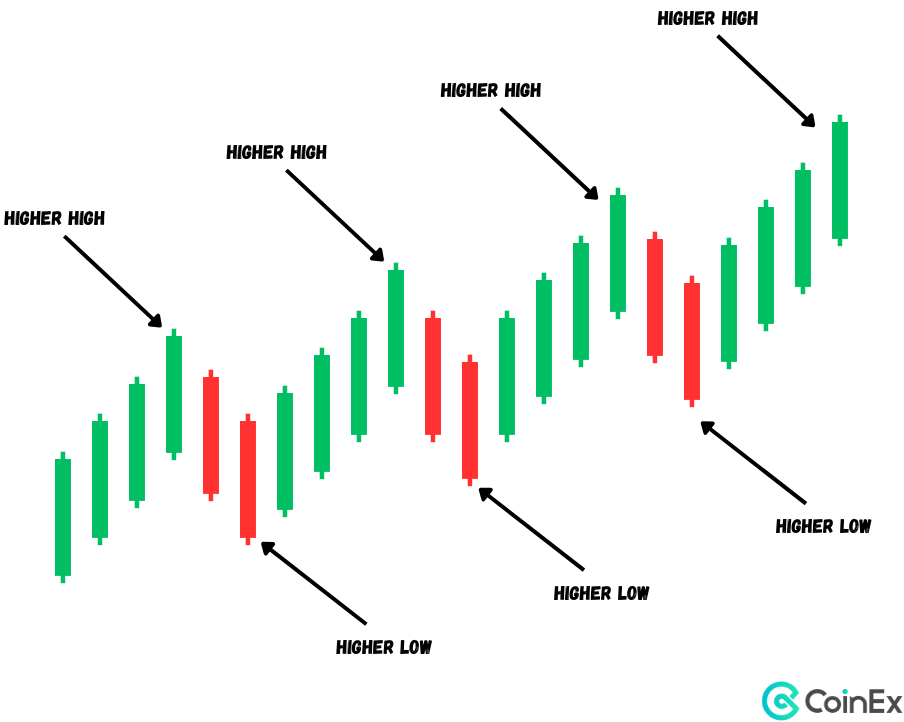

- Price is making higher highs (HH) and higher lows (HL) in an uptrend.

- Suddenly, price fails to break a key high and instead drops below the previous HL.

- This breaks market structure (BMS), signaling bearish order flow.

2. Confirm Lower Low (LL) Formation

- A valid LL occurs when price closes below the previous swing low.

- Institutional traders trigger this by sweeping liquidity below equal lows before pushing price lower.

Example in EUR/USD:

- Previous swing low: 1.0800

- Price breaks below it and closes at 1.0780 → New Lower Low (LL)

3. Identify the Lower High (LH) as Price Retraces

- After the LL, price retraces to mitigate an order block (OB) or fair value gap (FVG).

- This forms a Lower High (LH), indicating weak buying pressure.

- Institutions use this retracement to trap retail buyers before the next drop.

Example in GBP/USD:

- New LL at 1.2200

- Price retraces to 1.2250 (order block) → Lower High (LH)

- Market resumes the bearish trend by making another LL at 1.2150

4. Repeat the Pattern for a Strong Bearish Trend

- Multiple Lower Highs and Lower Lows confirm institutional selling.

- Look for ICT concepts like Fair Value Gaps, Order Blocks, and Liquidity Grabs.

Example in USD/JPY:

- Lower High at 145.80

- Lower Low at 145.00

- Retracement to 145.50 (Bearish Order Block)

- Another LL at 144.20, continuing the bearish structure

3. ICT Tools to Confirm Lower Highs and Lower Lows

- Break in Market Structure (BMS): Price breaking a key low confirms LL formation.

- Fair Value Gaps (FVGs): Price fills an imbalance before forming a Lower High.

- Order Blocks (OBs): Price retraces to mitigate orders before continuing the bearish trend.

- Liquidity Grabs: Smart money hunts stop-losses above swing highs before dropping price.

4. Example: Identifying Lower Highs and Lower Lows in NASDAQ (NAS100)

- Market shifts from bullish to bearish as price breaks below 15600 (LL).

- Price retraces to 15800 (bearish order block), forming LH.

- Another LL forms at 15450, confirming bearish order flow.

- Traders enter shorts at 15750 (mitigation level), targeting 15200 liquidity pool.

5. How to Trade Lower Highs and Lower Lows in a Bearish Trend

1. Entry Strategy: Short at a Lower High (LH)

- Wait for price to retrace to a Bearish Order Block (OB) or FVG.

- Enter a short position at the LH.

📌 Example:

- LL at 1.0800, retracement to OB at 1.0850 → Enter Short.

2. Stop-Loss Placement

- Place SL above the previous high to avoid stop hunts.

📌 Example:

- LH at 1.0850, stop-loss at 1.0880.

3. Targeting Lower Lows

- Take profit at the next sell-side liquidity zone (SSL).

📌 Example:

- Short at 1.0850, TP at 1.0750 (next LL).

6. Conclusion: Mastering Lower Highs and Lower Lows in ICT Trading

✔ Bearish Trends Follow a Clear Structure: LH → LL → LH → LL.

✔ Use ICT Tools to Confirm Entries: BMS, OBs, FVGs, and Liquidity Grabs.

✔ Wait for Smart Money Manipulation Before Entering Trades.

✔ Short at LH, Take Profit at LL, and Use Institutional Concepts to Manage Risk.

By applying ICT techniques, traders can accurately identify and trade bearish market order flow, avoiding retail traps and aligning with institutional movements.

Leave a Reply