Inner Circle Trader (ICT) strategies, developed by Michael J. Huddleston, provide traders with a comprehensive approach to understanding how financial markets operate from the perspective of smart money (institutional traders).

ICT strategies focus on key concepts such as liquidity, market manipulation, order flow, and price action.

These strategies are designed to help traders identify high-probability trade setups by analyzing the behavior of institutional traders who dominate the markets.

The core philosophy behind ICT strategies is that markets are manipulated by large financial institutions, and retail traders often fall victim to this manipulation.

ICT strategies teach traders how to identify institutional trading patterns, predict price movements, and capitalize on these opportunities.

Below is a detailed explanation of the most important ICT strategies, with examples.

1. Market Structure in ICT

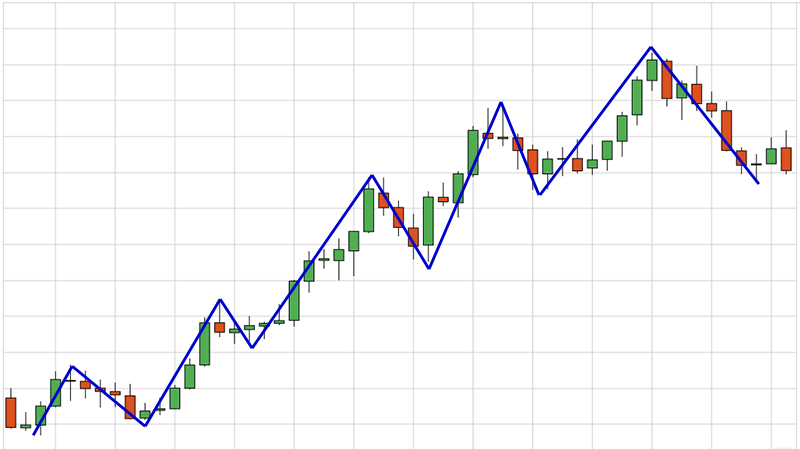

Market structure is the foundation of ICT strategies.

It involves understanding the natural flow of price action through higher highs, higher lows in uptrends, and lower highs, lower lows in downtrends.

Identifying changes in market structure helps traders determine when a market is trending or reversing.

Example:

Imagine the EUR/USD is in an uptrend, forming higher highs and higher lows.

A shift in market structure occurs when the price breaks below a significant swing low, signaling a potential reversal.

ICT traders would look for signs that institutional traders are entering short positions at this point, such as the formation of an order block.

2. Liquidity Pools and Stop Hunts in ICT

Liquidity pools are areas in the market where a large number of stop-loss orders or pending orders accumulate.

Smart money traders often manipulate the market to trigger these stop-losses in a process known as a stop hunt.

By doing this, they create the liquidity needed to enter or exit large positions without disrupting the market too much.

Example:

If Bitcoin is rising and many retail traders have placed their stop-losses just below the most recent swing low, institutional traders may push the price down to this level to trigger these stop-losses (a liquidity grab) before pushing the price higher.

ICT traders can take advantage of this by entering long positions after the stop hunt.

3. Order Blocks in ICT

Order blocks are zones on a price chart where institutional traders have placed large buy or sell orders.

These areas serve as key support or resistance levels, and price often returns to these areas for institutional traders to defend their positions.

Order blocks are essential to ICT strategies because they offer clues about where large institutions are accumulating or distributing their positions, providing traders with high-probability entry points.

Example:

In a downtrend, a bearish order block may form when institutions place large sell orders, causing the price to drop. When the price retraces to this order block, ICT traders expect the institutions to defend their sell positions, creating an opportunity to enter a short trade.

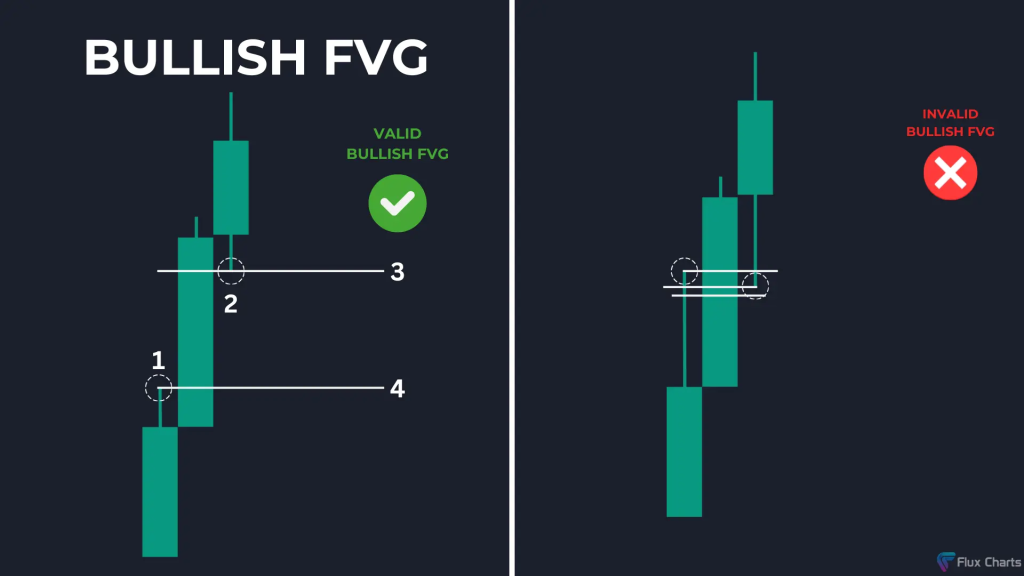

4. Fair Value Gaps (FVG) in ICT

A Fair Value Gap (FVG) occurs when there is a price imbalance—an area where the market has moved too quickly in one direction, leaving a gap in the price action.

According to ICT theory, price tends to revisit these gaps to “rebalance” the market before continuing in its original direction.

ICT traders look for these gaps as retracement points, where they can enter trades in line with the overall trend.

Example:

Suppose the S&P 500 experiences a rapid move from 4400 to 4450, leaving a gap between 4415 and 4420.

An ICT trader would anticipate a retracement to this Fair Value Gap before the market resumes its upward trend, offering a good buying opportunity.

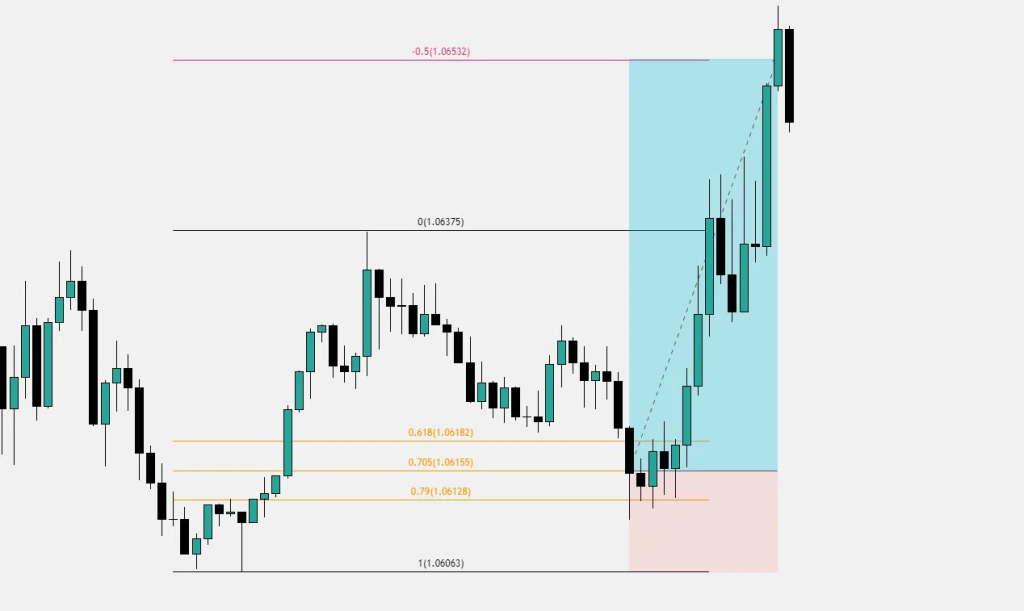

5. Optimal Trade Entry (OTE) in ICT

Optimal Trade Entry (OTE) is a key concept in ICT strategies that combines market structure and Fibonacci retracements to identify the most favorable point to enter a trade.

The OTE typically occurs between the 61.8% and 79% Fibonacci retracement levels during a pullback in the trend.

The OTE concept is used to get better risk-reward ratios, allowing traders to enter with precision while minimizing risk.

Example:

Let’s say crude oil is trending upward and reaches a high of $80, then retraces to $75.

ICT traders would use the Fibonacci retracement tool to measure the pullback.

If the retracement falls within the 61.8% to 79% range, this is considered the optimal trade entry point for a long position, anticipating a continuation of the uptrend.

6. Killzones in ICT

Killzones are specific times during the trading day when institutional traders are most active, and the market is likely to exhibit higher volatility.

ICT emphasizes trading during the London Open, New York Open, and London Close, as these periods offer the best opportunities to catch significant price movements.

By aligning trades with these key time windows, ICT traders increase their chances of entering during periods of institutional activity, which tends to create more reliable setups.

Example:

An ICT trader might observe that the EUR/USD often experiences significant movement between 8:00 AM and 10:00 AM (New York Open).

The trader will focus on trading during this time window, waiting for price action signals such as liquidity grabs or order block formations to enter trades.

7. Institutional Candlesticks in ICT

Institutional candlesticks refer to specific candlestick patterns that signal institutional activity in the market.

ICT traders learn to recognize these patterns, which often indicate the presence of smart money entering or exiting positions.

Examples include engulfing candles, pin bars, and imbalance candles that reflect the strong momentum driven by large orders.

Example:

In an uptrend, a bullish engulfing candle may signal that institutions are accumulating long positions.

ICT traders recognize this as a potential opportunity to enter long positions in line with smart money flows.

8. Liquidity Raids in ICT

Liquidity raids occur when institutional traders intentionally move the price in the opposite direction to grab liquidity.

This often happens near key levels where retail traders have placed their stop-losses or pending orders.

After grabbing liquidity, the price typically reverses in the direction of the underlying trend.

ICT traders anticipate these liquidity raids and use them to enter trades at optimal points.

Example:

Let’s say GBP/USD is trending downward, and many traders have placed buy orders just above a recent swing high, expecting a breakout.

Institutional traders might push the price higher temporarily to trigger these buy orders before reversing the price lower.

An ICT trader would wait for the liquidity grab to complete before entering a short position.

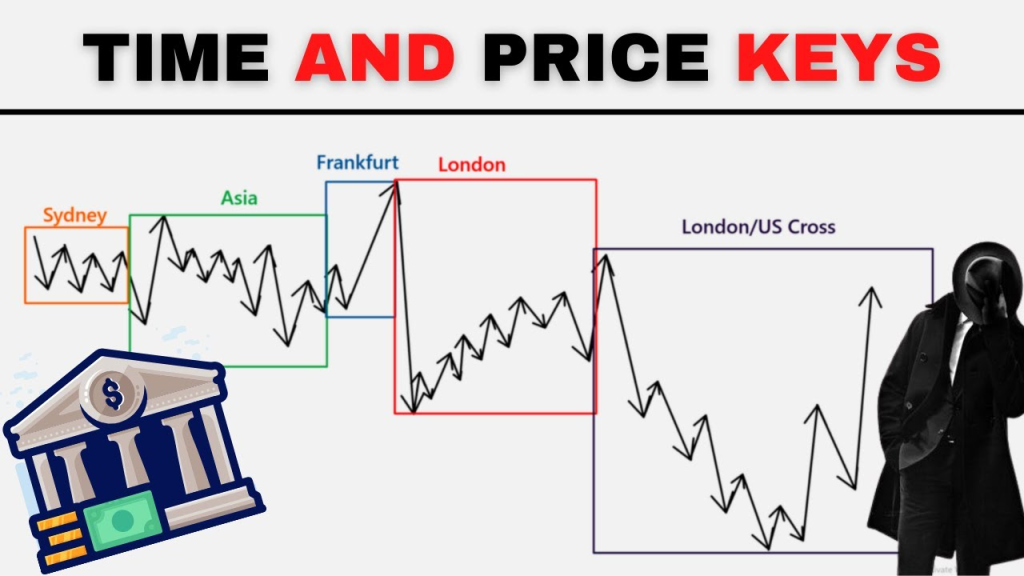

9. Time and Price Theory in ICT

ICT’s Time and Price Theory teaches that price action is not random, and it often aligns with specific times of day or key price levels.

By focusing on how institutions execute trades at these times, ICT traders can anticipate market movements with more accuracy.

This theory emphasizes the importance of waiting for the right time to enter trades, rather than chasing the market.

Example:

If gold is trading near a significant support level during the London Open, an ICT trader might wait for a liquidity grab or order block formation during this time window before entering a long trade, knowing that institutions are likely active during this period.

10. Risk Management in ICT

Risk management is an essential part of ICT strategies. While the technical setups provide high-probability entries, ICT emphasizes the importance of proper position sizing, using stop losses, and limiting exposure.

ICT traders never risk more than a small percentage of their account balance on any single trade.

Example:

An ICT trader with a $10,000 account might risk only 1% per trade, which is $100.

They would place their stop-loss strategically below an order block or after a liquidity raid, limiting potential losses while maximizing the reward if the trade moves in their favor.

Conclusion:

ICT strategies offer traders a systematic way to trade like institutional traders by focusing on liquidity, market manipulation, and price action.

By mastering concepts like order blocks, liquidity pools, optimal trade entries, and killzones, traders can significantly improve their chances of success.

These strategies help traders anticipate market movements driven by smart money, allowing them to enter and exit trades with precision and confidence.

Leave a Reply